[IN-DEPTH ANALYSIS] Walmart (WMT): When a Strong Business Model Faces Economic Challenges

Source: TradingView

Key Points

- Walmart is the largest operator of supermarkets in the states and the biggest company in the world by revenue

- The company stock has had a great rally in the last two years, supported by strong consumer sentiment and expanding e-commerce business

- Currently, Walmart is facing deceleration on the top line, as well as several margin-related headwinds due to economic slowdown, overseas expansion, looming tariffs and increased inventory

- Valuation-wise, the earnings growth prospects do not support the current high price

Company Overview

Walmart is the largest operator of supermarkets, hypermarkets, department stores and grocery stores. They are the largest company in the world in terms of revenue. They are the leading supermarket in the United States with roughly 24% market share and the second largest e-commerce player in the country with around 6% market share (just behind Amazon with 38%).

In the past year Walmart stock went up almost 50% and this rally is quite impressive, to say the least. Not only the stock outperformed its major supermarket peers like Costco, Kroger and Target, but also outperformed its main competitor in the ecommerce space – Amazon.

Despite the modest top-line growth of just 5-7% and the low operating margins of 4% (due to the business nature), Walmart is still quite beloved by investors, due to a number of factors:

Market leadership and brand value: As a global market leader, Walmart takes advantage of its economies of scale in order to provide products that can be very price competitive. What’s more, is that the brand has already evolved as they not only cater for price-conscious customers, but we also see an increasing popularity among high-income earners. Thus, with its rich assortment and competitive prices, Walmart wins the hearts and minds of both the rich and the poor.

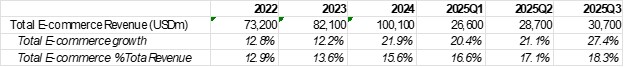

Great execution on the e-commerce front: Walmart successfully transitioned from an old-school brick-and-mortar chain to a growing e-commerce powerhouse. In the full 2024 fiscal year, they recorded $100 billion of e-commerce revenue. With 20% this is currently the main driver of the business, as the portion of the total revenue increased significantly from 13% in 2022 to 18% in 2025Q3. For reference, Amazon is currently growing at around 10%. A significant advantage of Walmart against Amazon is the already established physical presence of the former with stores all over the country. This allowed them to establish a reliable delivery infrastructure that could reach the end customer within a short period of time.

Source: SEC Filings, TradingKey

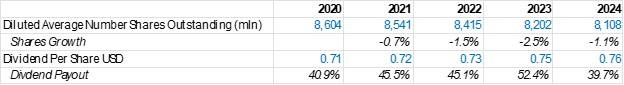

Generous capital return policy: With a generous 40% dividend payout and constant share buybacks, WMT appeals to income investors.

Source: SEC Filings, TradingKey

Company Segments

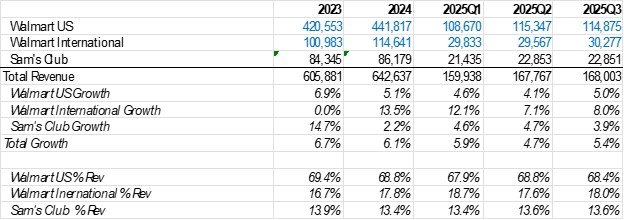

Source: SEC Filings, TradingKey

Walmart recognizes revenue in one of its three operating segments:

Walmart U.S.: Operating all stores in the United States and Puerto Rico under the “Walmart” brand. It represents nearly 68% of the corporation’s sales, summing up physical and e-commerce stores.

Walmart International: Operating all stores overseas under the “Walmart” brand. This generates around 18% of net sales.

Sam’s Club: Sam’s Club is a membership-only warehouse. It represents about 14% of net sales. Sam’s Club offers groceries and consumables, home and apparel, technology and electronics, often in bulk at discounted prices.

Source: SEC Filings, TradingKey

In terms of growth, International is the fastest-growing segment due to the early stage of the company’s global penetration. In terms of profitability, the US operations are more profitable due to the mature stage and high purchasing power of the American consumer base. As a wholesale-style, discounted goods seller, Sam’s Club has the lowest margins.

Source: SEC Filings, TradingKey

Product Mix and Margin Comparison

As a supermarket chain, Walmart’s main competitors are Costco and Target. Despite the similar business model, there are certain differences that explain the difference in their margins. Historically, Walmart’s margins have been slightly lower than the other two players.

In terms of product mix, Walmart has more exposure to grocery items which are generally low-margin, representing 60% of the revenue. That differs from players like Target and Costco which have 20% and 50% grocery exposure, respectively. Instead, they have more exposure to apparel, appliances and beauty-related products.

Another important differentiator is private-label products. Private label products are manufactured by one company but sold under the brand name of another (in our case, the supermarket brand). Private label products generally have a higher margin due to direct sourcing and a lack of need for marketing spending. All three supermarket chains rely on private label products but the revenue exposure towards this category of items is more obvious for Costco and Target than Walmart, further explaining why the former ones have higher profitability.

Is the valuation justified?

Despite the positive developments for Walmart in the past few years, questions remain about the future prospects of the company in terms of growth and profitability.

Revenue growth in the recent quarters has been around 5% vs 6-7% in 2023 and 2024. The slowdown mainly comes from the US operations – the most mature market for Walmart. We do observe significantly higher growth in overseas markets, but the international operations are still 3-4 times smaller than the American ones, making the international growth not that strong of a tailwind.

.jpg)

Source: SEC Filings, TradingKey

However, considering that the majority of the products are groceries, and groceries are usually quite resilient during an economic downturn, we expect a downside limit to the overall growth.

Projecting the profitability is a more complex task as there are a combination of headwinds and tailwinds to the margins.

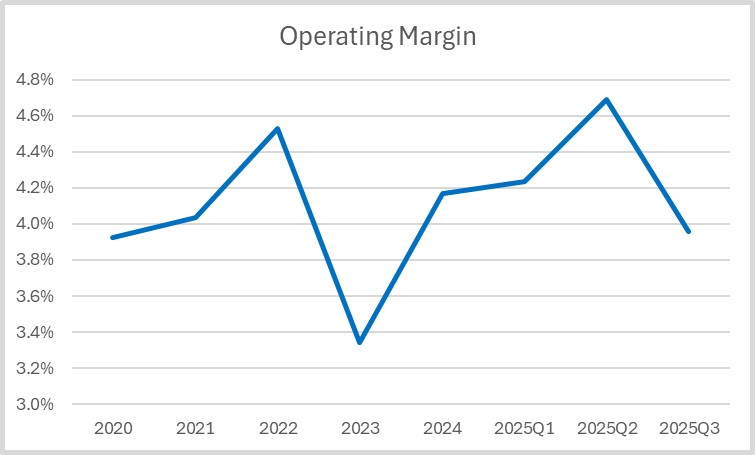

The biggest tailwind is supposed to be the growth of e-commerce. As we saw in the previous graph, e-commerce is becoming an increasingly significant portion of the total revenue, this also comes with the closures of physical stores which will be beneficial when it comes to cost reduction. However, the reality paints a different picture, as so far we haven’t observed a massive improvement in operating margin despite the growth in e-commerce. This can be explained by the establishment of a more robust e-commerce infrastructure (logistics, fulfillment centers, etc..)

Source: SEC Filings, TradingKey

Apart from e-commerce, some factors can affect the margins negatively:

- International Revenue: Some of the biggest overseas markets of Walmart are Latin America and China, consumers there have lower purchasing power than domestically, thus margins there are lower. With the faster growth of international revenue, we will observe margin dilution.

- Economic Slowdown: Potential economic slowdown would also mean that consumers will spend less on high-margin products, further putting pressure on the OPM

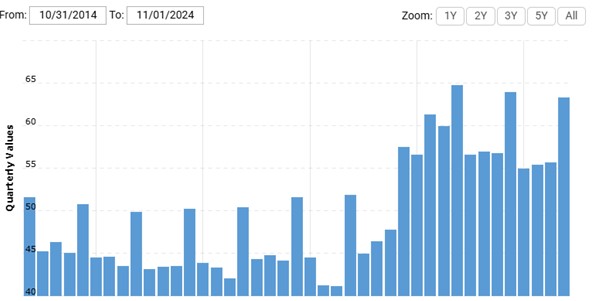

- Inventory Issues: The current level of inventory stands at $63 billion; this is 40% higher than what we saw in 2021. During the same period, the revenue has grown 20% only. High inventory levels may put a certain pressure on Walmart to clear the inventory by cutting prices, therefore lowering the margins.

- Tariffs threat: As the biggest supermarket chain in the world, it is very understandable that Walmart has one of the most elaborate supply chain networks across the world. Walmart is in a complex situation when it comes to the new higher tariff environment. A huge portion of Walmart supplies come from China, Canada and Mexico, the main targets of the ongoing tariff policies. This means Walmart most likely have to import goods at a higher cost, which will negatively affect the gross margin. A potential remedy for this is for Walmart to try re-negotiate the original sourcing cost for products but that could backfire, as recently we saw Walmart trying to put some pressure on the Chinese suppliers, but the reaction from the government was not very positive as the Chinese authorities stood in support of the local suppliers as their profit is already quite thin.

Source: Macrotrends

AI Initiatives

As we can see from the successful development of its e-commerce business, Walmart takes its technological ambitions quite seriously. The company has a division called Walmart Global Tech (previously known as Walmart Labs) which is primarily engaged in the development of the company’s capabilities in AI, machine learning, robotics, data science and cybersecurity.

When it comes to AI, Walmart will probably follow the steps of Amazon in broadly incorporating AI tools into its daily business. There are several innovative fronts where Walmart is putting efforts and investments: AI-powered search for shopping, voice shopping, warehouse automation and robotics and AI chatbots (including an AI agent that can negotiate with suppliers).

Currently, Walmart does not disclose a specific amount of R&D expenses, however in the last fiscal year the company spent nearly $24 billion on capital expenditure, which is a significant ramp-up from four years ago when the number was just $10 billion.

Valuation

With only one quarter left till the end of the fiscal year, Walmart will most probably finish the year with $2.70-$2.80 EPS. This implies a current valuation of 30-31x PE.

On one side, Walmart is not just an average retailer, as they are a market leader and a growing e-commerce factor, thus explaining this rich valuation. However, with growth further moderating and too many headwinds hitting the margins we would likely see stagnant to negative growth in earnings, which makes the current share price of $85.00 less attractive.