Facing a Trumpcession: What Options Remain for Stock Investors?

TradingKey - Concerns about a potential recession in the U.S. economy continue to loom, with U.S. stocks declining on Monday. The Wall Street Journal reported that recession trades have once again returned to Wall Street.

As mentioned in previous articles, the Atlanta Federal Reserve has projected a 2.8% contraction in GDP for the first quarter.

While most stocks typically drop during economic recessions and there are really no true “safe havens.” There are still some low-risk stocks that could actually perform well in a downturn.

Chinese Stocks May Show Short-Term Upside

An equal-weighted index of seven major Chinese tech companies, including Alibaba Group Holding Ltd. and Tencent Holdings Ltd.—dubbed the “7 titans” by Société Générale—has surged over 40% year-to-date, driven by shocks in the Heng Seng market. Chinese tech stocks listed in the U.S. have also demonstrated strong performance this year.

Although the recently released CPI indicated that China is facing deflationary pressures, China's “Two Sessions” outlined expected key economic and policy goals for 2025, including a GDP growth target of around 5% and a fiscal deficit ratio to GDP of 4%, setting a historical high.

While there are no major surprises in policy, signals of tech development and regulatory easing are crucial for the growth of high-tech industries. Additionally, the increased focus on consumption in the reports appears to be beneficial for corporate profitability.

.png)

Source: TradingKey

The launch of DeepSeek has challenged three common beliefs: (1) that China's technology can be restricted; (2) that China's AI development cannot advance without the most powerful Western AI chips; and (3) that large tech companies can create technological monopolies through massive investment. DeepSeek has instilled confidence in the market that, even under deflationary pressures, China can maintain competitiveness in the global tech race and enhance corporate profitability and ROE.

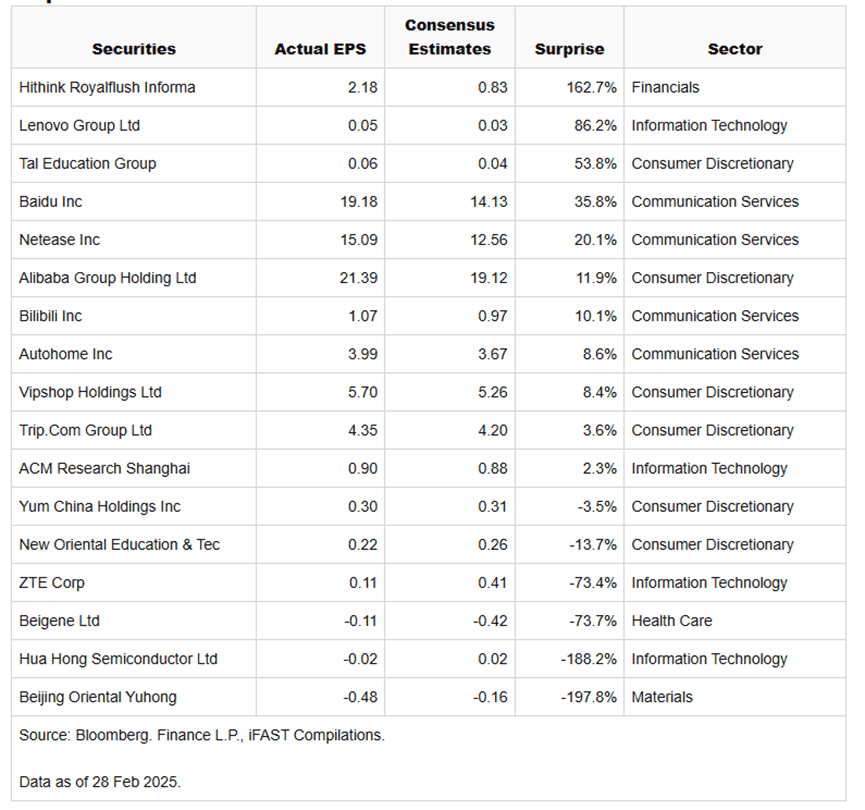

The Latest earnings are indicating a positive turnaround. According to the Q4 2024 financial data, MSCI China companies have shown significant increases in both revenue and EPS. Tech companies have markedly outperformed expectations in these metrics.

Source: iFAST

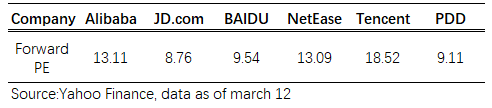

A favorable macro narrative and improving corporate ROE, combined with China's unique AI ecosystem, seem to provide opportunities for long-underestimated Chinese tech stocks. The average PE ratio of the S&P 500 is 27.311, while all Chinese tech stocks fall below 20, with some even under 10.

Source: TradingKey

“The success of DeepSeek, along with a series of AI models from China, has reminded the world that China’s innovation capabilities should not be underestimated, despite ongoing chip export restrictions from the U.S.,” said Charu Chanana, Chief Investment Strategist at Saxo Markets. “The momentum in China’s AI sector has room to run, given the valuation discount.”

Defensive Stocks May Outperform in Economic Slowdowns

The key reason for investing defensive stocks during a recession is that basic consumer needs typically remain unchanged, even in economic downturns. Defensive sectors, which include consumer staples (e.g., food and beverages, household and personal products, even alcohol and tobacco) ,utility and healthcare, are generally less affected by economic fluctuations.

Defensive stocks are often measured by beta coefficients, which are typically much lower than 1, according to data from NYU Stern School of Business. The beta coefficient for the utilities sector is just 0.39.

Another advantage of defensive stocks is that they often come with high dividend yields, which can help offset market volatility. Notably, Novo Nordisk and Eli Lilly, two of the largest healthcare companies, have achieved a compound annual growth rate of over 15% in dividends over one and five years.

Almost all utility stocks have announced dividend hikes for 2025. Morningstar's energy and utilities strategist expects a median dividend growth rate of 5% across the industry for 2025.

In bull markets, consumer staples stocks typically lag behind, but they can catch up during economic slowdowns. This sector performed well during the market sell-off in 2022, although it underperformed when the soft landing narrative took hold in the second half of 2023.

U.S. Long-Term Bonds: An Attractive Option

With recession fears looming, the bond market showed a divergence from the U.S. stock market on Monday.

As concerns about a potential long-term economic slowdown mount, expectations for interest rate cuts by the Federal Reserve are rising, with the earliest cut anticipated as soon as May. Short term Treasury bonds, which are more sensitive to interest rate changes, may experience greater price increases, while five-year bonds appear more attractive compared to two-year bonds, having declined approximately 40 basis points since the end of last year.

The market's volatility is partly due to President Trump's remarks that it's normal for the U.S. economy to undergo transitions, heightening recession speculation. However, the market will likely need to wait for clearer signs of recession. This month's labor market may continue to weaken, which could affect the 10-year Treasury yield approaching 4%.

A report from Bank of America Chief Investment Strategist Michael Hartnett last Friday stated that 30-year Treasuries are viewed as a safe haven during a recession. After five years of fiscal stimulus from the U.S. government, a contraction in fiscal policy will lead to a loss of a key growth engine for the economy. Labor data is also weak, with U.S. payrolls dropping from 85% a year ago to 70% as of January 2025, with layoffs by DOGE being a major contributing factor. Over the long term, these two factors could lead U.S. households to prioritize savings over consumption.

Moreover, to steer clear of "political malpractice," the Trump administration might struggle to implement significant tariff hikes, potentially revealing deeper economic vulnerabilities. If the yield on 30-year bonds drops below 4%, it could draw in a considerable amount of defensive capital, leading to a positive feedback loop. This scenario offers a strong appeal for investors.