Should You Buy JPMorgan Chase's Stock at an All-Time High?

JPMorgan Chase (NYSE: JPM) is the amalgam of two iconic names in the finance industry. The company is well respected and has been executing well. But is that enough of a reason to buy the stock?

Considering that, at the moment, the market is pricing in what seems to be a perfect performance in the future, most investors will want to think twice before jumping in. Here's a look at the problem with JPMorgan Chase's stock today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

What does JPMorgan Chase do?

JPMorgan Chase is a finance company. That's the best way to describe it because its business touches on several important segments of the industry. For example, it owns a large bank that services consumers and businesses. It also operates an investment bank, which helps companies raise capital. And it operates a wealth management business, which handles the details of personal investing for wealthy clients. That basically touches on all of the big business lines in the finance industry with the exception of insurance.

Image source: Getty Images.

The roughly $700 billion market cap financial giant has been performing pretty well of late. For example, in the final quarter of 2024, JPMorgan Chase's revenue rose 11% year over year. It increased earnings by 58%. And return on equity rose to 17% from 12% in the prior year. There is a reason why investors have been pushing the stock price up.

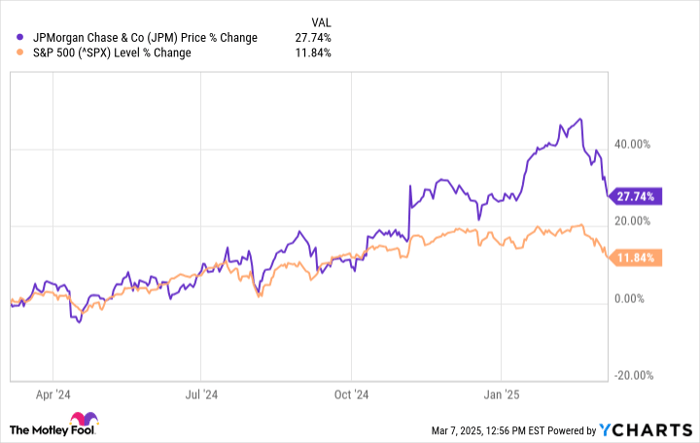

And that's where things get interesting if you are looking at JPMorgan Chase today. The stock has pulled back a little from its recent highs, but it is still up nearly 28% over the past year. That's more than twice the gain of the S&P 500 index (SNPINDEX: ^GSPC). Investors are pricing in a lot of good news.

Data by YCharts.

Just how expensive is JPMorgan Chase?

For dividend investors, it is notable that JPMorgan Chase's roughly 2% dividend yield is near the low end of its 10-year range. That suggests a premium price tag today and should give income investors pause. However, dividend yield is a less common valuation tool.

Looking at more common valuation metrics backs up the valuation concerns highlighted by the dividend yield. For example, JPMorgan Chase's price-to-sales (P/S) ratio is currently sitting at around 4.25 times versus a five-year average of around 3.3 times. The price-to-earnings (P/E) ratio is up around 12.5 times compared to a long-term average of roughly 11 times. And price-to-book value (P/B) is a bit above 2.1 times right now versus a five-year average of about 1.6 times.

The P/E ratio gap is the smallest of this group of valuation tools, suggesting only modest overvaluation. But the P/S and P/B ratios are both materially above their longer-term averages. And then you have to consider that the actual stock price is within 10% of its all-time highs at the time of this writing. This is most definitely not a stock that is on sale.

Not a big enough pullback to buy JPMorgan Chase

JPMorgan Chase's stock has pulled back some along with the broader market on economic concerns. But that drop isn't nearly enough to make the stock cheap if you look at traditional valuation tools or less traditional ones, like dividend yield. That doesn't mean JPMorgan Chase is a bad company, but even a good company can be a bad investment if you pay too much for it.

Should you invest $1,000 in JPMorgan Chase right now?

Before you buy stock in JPMorgan Chase, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Chase wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $690,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.