1 Under-the-Radar Artificial Intelligence (AI) Stock That Cathie Wood Keeps Buying Hand Over Fist

Cathie Wood is the CEO and chief investment officer of Ark Invest. Over the last several years, she has earned a reputation for making overly bullish calls on companies that may typically lack the full attention of the rest of Wall Street.

Another aspect of Wood's investment prowess that is quite uncommon is that she has Ark publish its trading activity on a daily basis. With this in mind, it's never a question of what stocks Wood is buying or selling, but why she may be doing so.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Toward the end of last year, I started noticing some frequent purchases of GitLab (NASDAQ: GTLB) from Ark's daily trading reports. If you're unaware of GitLab, fear not!

Below, I'm going to break down Wood's trading activity in GitLab stock and make the case for why this under-the-radar artificial intelligence (AI) player is worth keeping on your radar.

Cathie Wood can't get enough of GitLab

In the table below, I've outlined Ark's buying activity in GitLab over the past several weeks:

| Date | Shares Purchased |

|---|---|

| Dec. 23 | 78,185 |

| Dec. 24 | 269,976 |

| Dec. 31 | 245,243 |

| Jan. 6 | 290,710 |

| Jan. 7 | 162,121 |

Data source: Ark Invest.

Since the end of December, Wood has purchased slightly more than 1 million shares of GitLab and spread the position across two of Ark's exchange-traded funds (ETFs): ARK Innovation ETF and ARK Next Generation Internet ETF.

Image source: Getty Images.

Why GitLab could be a great AI opportunity

GitLab is a software platform that helps developers code, identify security vulnerabilities, and automate testing all in one platform.

Image source: GitLab.

The company's AI platform, GitLab Duo, is integrated with Amazon Q -- an agentic AI chatbot. During GitLab's third-quarter earnings call in early December, management noted that "the next evolution in AI will be agentic" and "agentic AI is the foundation of GitLab Duo workflow."

I do not see the collaboration with Amazon as coincidental. Microsoft's CoPilot is one of the largest agentic AI systems available right now, and a big part of its success can be traced back to GitHub. Remember, GitHub is perhaps the most direct competitor to GitLab, and became a part of Microsoft's ecosystem after it was acquired for more than $7 billion back in 2018.

Should you follow Wood's lead and buy GitLab stock right now?

In 2024, shares of GitLab declined by roughly 10%. Considering AI fueled the S&P 500 and Nasdaq Composite to new highs on numerous occasions last year, it's actually surprising to find a technology stock that underperformed the broader market.

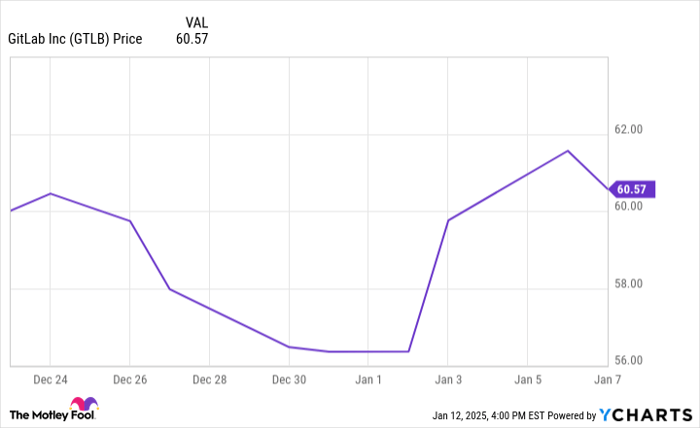

In the table below, I've illustrated GitLab's price action between the dates that coincide with Ark's purchases. Given the brief sell-off toward the end of the year, it appears that Wood took advantage of the depressed price action and bought the dip.

GTLB data by YCharts

Considering GitLab's top line is growing at more than 30% annually and the company has recently transitioned from a cash-burning operation to generating positive net income, I tend to think the underperformance in the stock boils down to a couple of factors such as competition and high expectations from investors.

While it remains much smaller than Microsoft's GitHub, I wouldn't discount GitLab's potential. Considering the company is partnering with Amazon and specifically focusing on agentic AI, I personally think GitLab is subtly positioned for much higher revenue and profit growth.

I think GitLab could be an interesting opportunity for investors looking for potentially high-growth, albeit volatile, names in the AI realm.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $345,467!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,391!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $453,161!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adam Spatacco has positions in Amazon and Microsoft. The Motley Fool has positions in and recommends Amazon, GitLab, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.