1 Reason to Keep an Eye on The Trade Desk Stock in 2025 Along With 2 Other Stocks

Human beings are complex creatures. And many media pundits don't seem to understand a basic truth: How a person feels doesn't need to make sense.

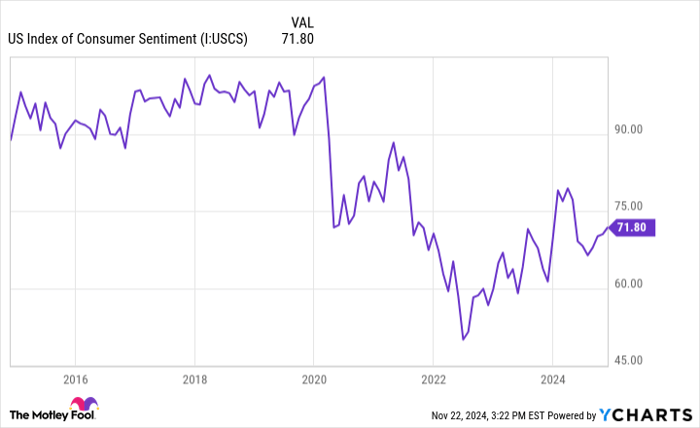

I'm not here to plant my flag in the debate regarding the current direction of the U.S. economy. But I'll concede that various statistics seem to indicate that the U.S. economy is quite strong. But whether the economy is actually strong or struggling right now isn't what's important. What's important is that consumer sentiment is objectively low.

The University of Michigan tracks this with the US Index of Consumer Sentiment. As the 10-year chart below shows, sentiment dropped at the onset of the COVID-19 pandemic and it still hasn't come close to recovering.

US Index of Consumer Sentiment data by YCharts

Some might think that consumers aren't being rational here. But that's irrelevant -- to reiterate, how a person feels doesn't need to make sense. Consumers can feel optimistic in both strong and weak economies. Likewise, they can feel pessimistic during periods of economic expansion and also during economic decline.

Investors need to pay attention to how consumers really feel more than they need to determine whether it makes sense. Here's why: Consumer sentiment is strongly correlated with consumer behavior. And behavior is what ultimately drives the economy.

Morgan Housel, author of The Psychology of Money, said it this way: "Stories are, by far, the most powerful force in the economy. They are the fuel that can let the tangible parts of the economy work, or the brake that holds our capabilities back."

Here's where things get interesting. Since Donald Trump became the president-elect, consumer sentiment is on the rise. Granted, three weeks is a small sample size. But for now, this seems to be reality. Consumers are starting to feel more optimistic about the direction of the economy.

This improvement in sentiment could be a big deal for advertising stocks The Trade Desk (NASDAQ: TTD), Roku (NASDAQ: ROKU), and PubMatic (NASDAQ: PUBM) in 2025. Here's why.

Why advertising stocks could be big winners in 2025

Advertisers keep close tabs on how consumers feel. If consumers are feeling pessimistic, they're less likely to spend money. So advertising spend can pull back. It doesn't go away completely but it might not be as high as it would be if consumer sentiment was more upbeat.

For its part, The Trade Desk is a digital advertising platform that helps advertisers get their ads placed in the right channels and in front of the right consumers. And an increasingly large part of its business is with streaming video on connected-TV (CTV).

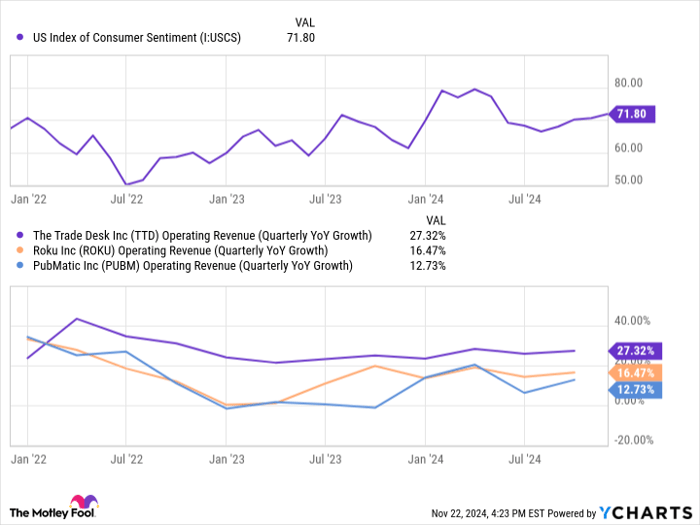

The Trade Desk's software powers CTV advertising in over 90 million U.S. households as of the third quarter of 2024, and CTV is the fastest-growing part of the business. In short, the company is extremely important to the CTV ecosystem and its growth rate has consequently held up better than the growth rates for Roku or PubMatic.

That said, The Trade Desk's growth rate had slowed. But growth recently picked back up -- Q3 revenue was up 27% year over year compared to 25% growth in the prior-year period and 26% growth in the second quarter. And an acceleration of growth was noted with other companies as well.

For those unaware, Roku provides a CTV operating system and is used by nearly 86 million households. For its part, PubMatic's reach is much smaller. But its software is used by 70% of the top streaming channels, making it a meaningful player in the space as well.

Similar to The Trade Desk's improvement, Roku's third-quarter revenue jumped 16% year over year compared with just 14% growth in the prior quarter. And PubMatic's third-quarter revenue grew by 13% compared with 6% growth in the second quarter.

Investors might need to squint to see the trend in the chart below. But growth rates for The Trade Desk, Roku, and PubMatic have started to tick higher, corresponding with recent gains in consumer sentiment.

US Index of Consumer Sentiment data by YCharts

Simply put, there seemed to be a nascent trend of improving consumer sentiment and that trend might have received a boost from the U.S. presidential election. And if sentiment is truly on the rise, advertisers should respond by spending more on top platforms, which includes CTV. Therefore, as top players in the space, The Trade Desk, Roku, and PubMatic should all be major beneficiaries of this recent development.

In my opinion, all three of these companies are set up for strong returns in 2025 as this trend plays out. But Roku and PubMatic may be particularly well-poised for gains. They both trade at about 3 times sales compared to 28 times sales for The Trade Desk stock.

With such low valuations, it doesn't seem like investors expect much from Roku or PubMatic in the near future. And that's why these two stocks could particularly surprise investors, leading to larger gains.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $352,678!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,102!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $466,805!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Jon Quast has positions in PubMatic and Roku. The Motley Fool has positions in and recommends PubMatic, Roku, and The Trade Desk. The Motley Fool has a disclosure policy.