What Is the Dividend Payout for Visa?

Visa (NYSE: V), the largest payments company in the world with a market capitalization of $564 billion, has paid a quarterly dividend since going public in 2008. Moreover, Visa management has a history of raising its dividend each year, with another increase announcement expected soon.

Visa's total return has trailed the S&P 500 index over the past five years, but research from Hartford Funds shows that companies with consistent dividend growth and low payout ratios tend to outperform the market in the long run. Let's explore these key metrics to assess Visa's potential.

Here's how Visa returns capital to shareholders

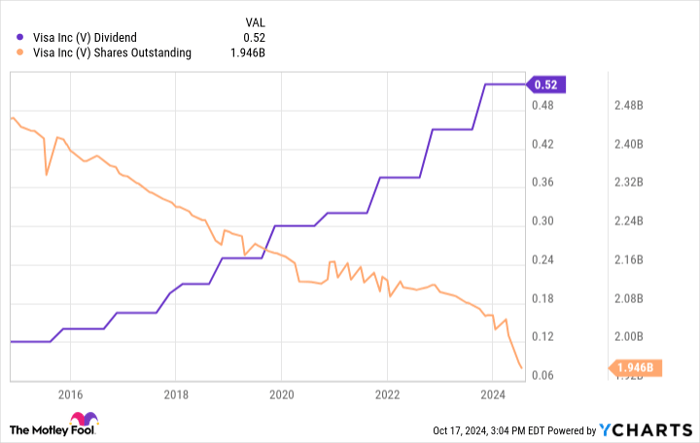

Over the past 12 months, Visa paid a quarterly dividend of $0.52 per share, equating to an annual dividend of $2.08 per share and a yield of 0.74%.

Given its history of announcing a dividend increase with its fiscal fourth-quarter earnings release, Visa investors can reasonably expect management to announce another hike when the company reports its fiscal Q4 2024 earnings on Oct. 29. Over the past decade, Visa has averaged an annual dividend growth rate of nearly 18%, offering insight into the potential size of its next increase. To add to the probability of future increases, Visa's payout ratio -- the percentage of earnings a company pays out as dividends -- is a paltry 21.5%, meaning it doesn't burden other capital allocation strategies.

In addition to paying dividends, Visa regularly repurchases its stock, a more tax-efficient way of returning capital to shareholders. Reducing the number of shares available gives each remaining share a larger ownership stake. Over the past year, Visa has been particularly active in this strategy, reducing its outstanding shares by 5.2% through aggressive buybacks. At the end of its fiscal Q3 2024, the company had $18.9 billion remaining on its share repurchase program.

V Dividend data by YCharts

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Collin Brantmeyer has positions in Visa. The Motley Fool has positions in and recommends Visa. The Motley Fool has a disclosure policy.