Here's Why 2 Artificial Intelligence (AI) Stocks Slumped Recently. Time to Buy the Dip?

The market, measured by the S&P 500 (SNPINDEX: ^GSPC), has recently notched new all-time highs. However, not every stock in that index participated in the rally. Two that are still down from their all-time highs and haven't shown much life recently are Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

These two companies are often seen as front-runners in the artificial intelligence (AI) arms race, so why are their stocks slumping?)

Neither stock is near all-time highs

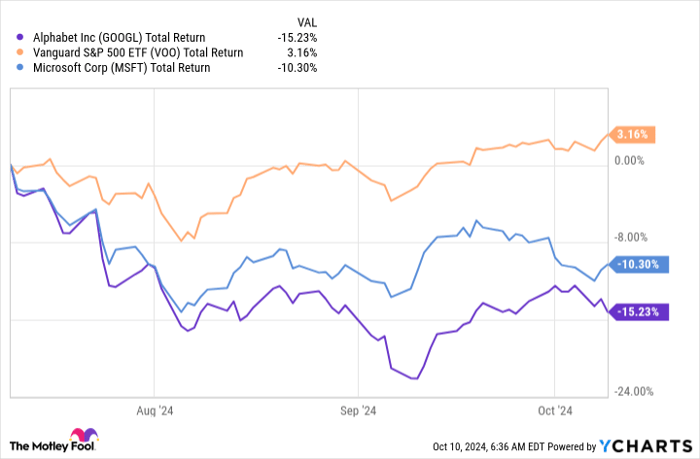

These two stocks haven't quite kept up with the S&P 500's latest rally, as both stocks are down around 10% or more since the last time the S&P 500 notched a new all-time high in mid-July.

GOOGL Total Return Level data by YCharts

Additionally, both companies posted strong Q2 results in that time frame, with Microsoft delivering 15% year-over-year revenue growth and earnings per share (EPS) growth of 10% (these results were for Microsoft's Q4 FY 2024, which ended June 30). Alphabet's revenue rose 14%, and EPS rose 31% in that same time frame.

Clearly, neither business is doing horribly from an operating standpoint, so why have these two failed to participate in the rally that others have benefited from?

Each stock has its own reasons.

Microsoft

Microsoft emerged as one of the top AI companies because of its strong partnership with OpenAI, the maker of ChatGPT. The company also integrated ChatGPT into Copilot -- Microsoft's take on a generative AI assistant. This fueled massive hype behind Microsoft and quickly helped it shoot up to a premium price tag.

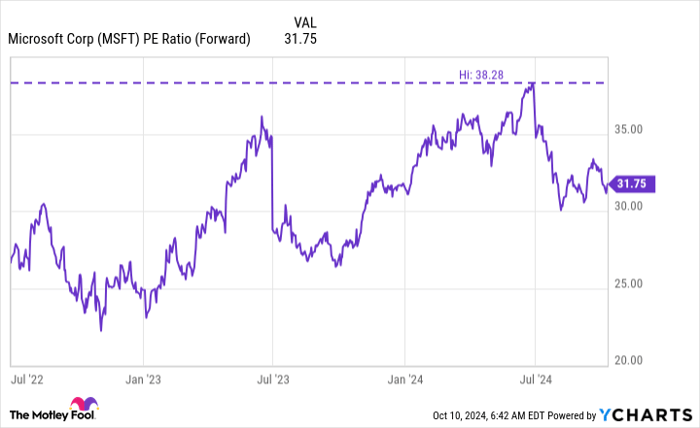

MSFT PE Ratio (Forward) data by YCharts

At the end of June, Microsoft traded for an expensive 38 times forward earnings, and that price tag has come down quite a bit to the current 32 times forward earnings. Considering that the S&P 500 trades for 23.5 times forward earnings and that Wall Street expects Microsoft to grow EPS by 11% in FY 2025, the stock is still expensive.

This is likely why Microsoft hasn't participated in the latest rally, as it already has fairly high expectations baked into the stock price. Microsoft's premium valuation could continue to evaporate if the company continues to post mundane quarters of market-matching growth.

Still, Microsoft stock is at a hefty premium to the market despite delivering average growth. As a result, I'll probably stay away from the stock until its growth can increase or its premium comes down.

Alphabet

Alphabet's stock trades for about 21.1 times forward earnings, which is less than the S&P 500's valuation. So the valuation argument that was valid for Microsoft is completely irrelevant for Alphabet.

That doesn't mean the market has Alphabet wrong, as Alphabet has some other problems under the hood.

Investors' chief concern is whether Alphabet will exist in its current state five years from now. Multiple lawsuits have been filed against Alphabet for anticompetitive practices, and the DOJ is considering breaking up Alphabet into various pieces as a result. This makes analyzing the company difficult, as investors are unsure how it will look years down the road.

Furthermore, most of Alphabet's revenue comes from advertising. Advertising can be a fickle industry that declines when businesses sense a recession could be coming. So, just because Alphabet is doing well right now doesn't mean it will maintain that success one or two years from now.

However, with Alphabet trading at a lower price than the market despite strong growth, I think it can be bought now. A DOJ breakup would likely be years away, as Alphabet would fight it in court, which would likely end up all the way in the Supreme Court after multiple appeals.

The recession risk is there for the advertising business, but that risk is present for all companies, so this isn't a unique issue for Alphabet.

Alphabet stock has value, and I wouldn't be surprised if it sees a run-up in the near future as it reverts to at least market-average pricing.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,122!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,756!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $384,515!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Microsoft, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.