Small-Cap Stocks Could Rally in 2025, and These 2 ETFs Are the Best Way to Take Advantage.

Small-cap stocks may have finally turned the corner last quarter, but the rally may be just getting started.

The benchmark small-cap stock index, the Russell 2000, climbed 8.9% during the third quarter. That outpaced the large-cap S&P 500 (SNPINDEX: ^GSPC) return of 5.5%. Investors rotated into small-cap stocks in July as many expected the Federal Reserve would start cutting interest rates in the near future. Those rate cuts materialized in September with a 50-basis-point drop and the suggestion of more rate cuts to come. Small-cap stocks rallied further on the news.

That was likely just the start of the small-cap rally, and 2025 could see significant outperformance from this sector of the market.

Image source: Getty Images.

The Fed just cut rates -- here's what history says happens next

Many expected the Fed to cut interest rates in September, but after some weak jobs numbers, the FOMC decided a 50-basis-point cut instead of the usual 25-basis-point cut was in order. That could be a major catalyst for small-cap outperformance.

Smaller companies rely more on floating-rate debt than larger companies, which can issue fixed-rate bonds to investors. So when interest rates go down, it reduces the cost of debt and enables smaller businesses to borrow more, both of which can be good for overall earnings growth.

Jill Carey Hall, Bank of America's head of U.S. small- and mid-cap strategy, says history is on the side of small caps. She found that small caps outperform large caps by about a percentage point in the six months following a 50-basis-point cut. If you look out a full year, small caps outperform by an average of three percentage points.

So, even if you missed the 9% rally in small caps during the third quarter, there's still time to add some exposure to the market segment. That's especially true when you consider the Fed is expected to continue cutting rates over the next two years. Not only does that make it easier and less expensive for small businesses to borrow, but it will reduce the risk-free rate and push more capital into assets like stocks. Additionally, money supply growth is accelerating, favoring a broader swath of the market instead of the more concentrated gains investors have seen recently.

With that in mind, here are the two ETFs to take advantage of this small-cap opportunity.

The best ways to invest in small-cap stocks

The most popular way to invest in small-cap stocks is to buy a Russell 2000 index fund like the iShares Russell 2000 ETF (NYSEMKT: IWM). The index fund has a low tracking error, but its expense ratio of 0.19% could be better -- Vanguard offers a lower-cost alternative.

Both funds are great at what they do: track the Russell 2000 index. But that's not the small-cap index investors should be looking to track.

The challenge with the Russell 2000 is there's practically no quality filter. Any company that falls in the bottom two-thirds by market cap of the Russell 3000, which aims to track the total market, qualifies for the Russell 2000. And that's increasingly problematic in a day and age when many great small companies are staying private until they become much larger companies. The companies that go public when they're small just aren't as good as they used to be.

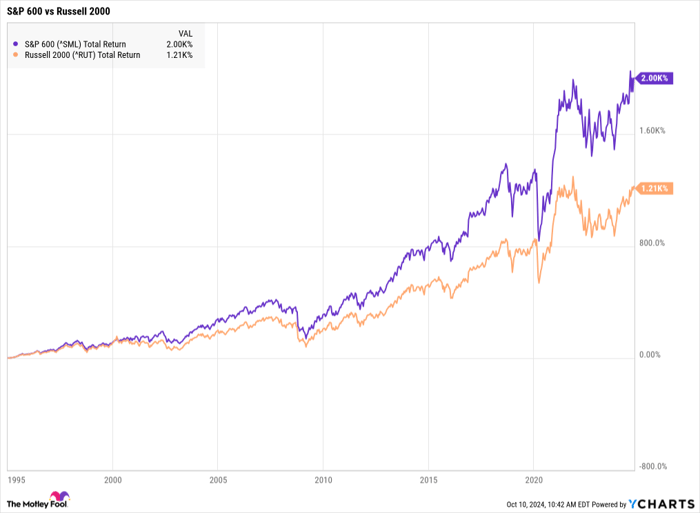

S&P Global uses a simple quality filter for its indexes: Companies must be profitable in the most recent quarter and on a trailing-12-month basis. As a result, the S&P 600 small-cap index holds higher-quality names, on average, than the Russell 2000. While it's certainly possible to find a quality business that isn't profitable, this simple filter has resulted in better results over the long run. The S&P 600 has outperformed the Russell 2000 by a wide margin over the last 30 years.

Data by YCharts.

One of the best index funds for tracking the S&P 600 is the SPDR Portfolio S&P 600 Small Cap ETF (NYSEMKT: SPSM). Its minuscule expense ratio of 0.03% is one of the best in the industry. It uses a representative sampling approach to keep costs and taxes low for investors. That does result in some tracking error, but it does a good job of keeping pace with the index overall. For investors who would rather fully replicate the index, Vanguard offers a fund with a slightly higher expense ratio.

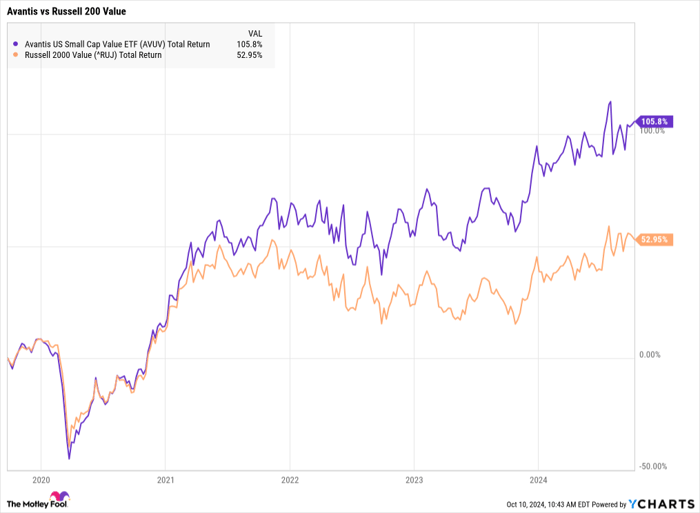

For investors who want to take the quality filter a step further, the Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV) is a great option. The fund looks at the small-cap stock universe and selects those with good price-to-book ratios and cash-based profitability. That can filter out stocks that only look like a good value based on certain accounting decisions from management, i.e., value traps. It selects the top 25% of small-cap stocks for the fund based on its criteria.

The approach has worked well historically. Avantis's team comes from Dimension, where it ran a successful small-cap value fund for years. The ETF makes the strategy accessible to anyone with a brokerage account and charges just 0.25% of assets as its expense ratio. This is a price that has been well worth it since the ETF's launch in 2019.

Data by YCharts.

The Avantis fund is technically an actively-managed fund, despite its more passive approach to implementing the portfolio. As such, it could go from outperforming its benchmark or other small-cap indices to underperforming. If you'd rather track an index, the S&P 600 index fund may be better suited for you.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in American Century ETF Trust - Avantis U.s. Small Cap Value ETF. The Motley Fool has positions in and recommends Bank of America and S&P Global. The Motley Fool has a disclosure policy.