2 Reasons to Buy Berkshire Hathaway Stock Like There's No Tomorrow

Most investors know that Berkshire Hathaway (NYSE: BRK. A)(NYSE: BRK.B) has been one of the best-performing investments of all time. Its key to success has been to invest consistently, holding for years or even decades at a time.

But Berkshire's run is far from over. And right now, there are two exciting reasons nearly every investor should consider jumping into this legendary stock.

1. Berkshire has a permanent competitive advantage

Warren Buffett acquired Berkshire Hathaway back in 1965. Over the first few decades of operation, the company soared in value. In the 1980s, for example, Berkshire stock rose in value by at least 30% most years, with annual returns reaching as high as 90%.

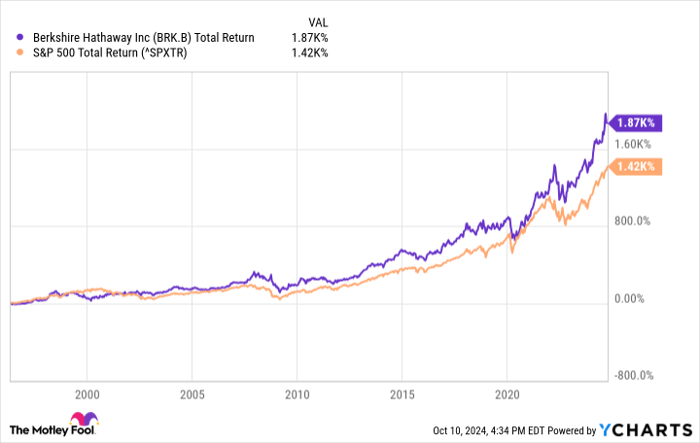

Even though Berkshire's biggest days of growth are behind it, the shares have still performed quite well over more recent decades. During the past 30 years, for instance, Berkshire's total return has greatly outperformed that of the S&P 500 index. Even over just the past three years, Berkshire stock has risen by roughly 60%, besting the S&P 500's return of just 38% over the same time period.

BRK. B Total Return Level data by YCharts

What has allowed Berkshire stock to beat the market again and again, even as its valuation has soared to nearly $1 trillion? The biggest key has been Buffett's investing prowess. Buffett and his investing team have repeatedly invested shareholder capital successfully, whether by buying shares of a publicly traded company, acquiring a private company, or simply buying back Berkshire's own stock.

But there's another advantage that Berkshire has that few other investments offer: the advantage of permanent capital. That is, Berkshire has a pool of capital that it can invest regardless of market conditions. During the 2008 financial crisis, for example, it was able to spend billions of dollars on blue chip companies at discounts simple because so many other competing pools of capital had already dried up.

This permanent capital is generated by Berkshire's insurance businesses -- an industry that doesn't necessarily see demand plummet during recessions or bear markets. While underwriting profits may not be very high during certain market cycles, insurers provide a steady stream of investable cash because premiums are paid up front while claims are paid out after the fact. Many other investment vehicles have copied this business model in recent years, but it has remained a durable competitive advantage for Berkshire, especially when paired with Buffett's investment acumen.

2. Berkshire makes saving money fun

Diverting more cash that could be used for lifestyle expenses into your investment account is not always fun, but it's a wise long-term decision. Investing in Berkshire can eliminate some of the friction involved in upping your savings rate.

First, every time you buy more Berkshire stock, you know you're betting on one of the most successful investment vehicles in history. Putting more money to work in the market is significantly more fun when you have the confidence that these investments will match or even outpace the overall market's returns.

Second, by buying shares of Berkshire, you become a partner in one of America's most iconic businesses. You quite literally become an investing partner with Buffett and the rest of this team. Whenever they make a move, so are you. Except in this case, they're doing all of the groundwork for you, while you sit back and enjoy life. If they see opportunities in a certain industry or region of the world, Buffett and company are empowered to invest your money where it has the best chance of growing. Whereas with other investments, your capital may be limited to a certain industry or geography.

In a nutshell, investing in Berkshire can be more fun than nearly any other investment vehicle. Who wouldn't want to be investment partners with Warren Buffett? And any trick you can use to up your savings rate is nearly as important as choosing the right investment. With Berkshire, you can accomplish both, making it an attractive choice for nearly every investor.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.