CrowdStrike Stock Is Back Above $300 Per Share. Is It Going Back to Its All-Time High?

CrowdStrike (NASDAQ: CRWD) stock investors likely want to put 2024 behind them. After its shares briefly rose above $390 per share in July, a massive IT outage caused by a CrowdStrike glitch caused widespread turmoil across the economy. Investors quickly turned on CrowdStrike, and the stock lost as much as half of its value on an intraday basis.

After an intraday low of just under $201 per share in August, it has since recovered to be above the $300 per share price. Does this mean the stock is headed for a quick return to its all-time high, or should investors turn cautious?

What to make of CrowdStrike stock

Despite the considerable magnitude of the outage, CrowdStrike investors have good reason not to lose all optimism. Just three months after the outage, CrowdStrike stock has recovered more than half of the value lost since the incident.

The company's response to the outage likely helped. Although the update only affected software running on Microsoft's operating system, CrowdStrike quickly claimed responsibility for the incident and issued a fix quickly. While the effects of the outage still reverberated for days, the fact that it got on top of the problem quickly showed the company cared more about protecting the reputation of its software than the short-term fallout related to the outage.

Moreover, CrowdStrike partners with insurers to help protect its customers from such incidents through cyber risk and cyber liability insurance. For this reason, some of the costs will likely fall on cyber insurers like Berkshire Hathaway.

Furthermore, most of its customers appear to have stayed with CrowdStrike. This indicates it has done what it needed to do to reaffirm confidence in the company and its product.

Analysts also appear confident in the stock. They project that for fiscal 2025 (ending Jan. 31, 2025), revenue will grow by 28% and an additional 22% in the following fiscal year. This indicates that the outage is not going to derail the CrowdStrike growth story.

Reasons to doubt the recovery

However, not all of its customers have forgotten about the outage. One of the more profoundly affected companies was Delta Air Lines. Delta claims the outage resulted in a $0.45 per-share hit to its earnings in the third quarter of 2024. To that end, it has threatened to sue CrowdStrike and Microsoft, Delta's software provider, over the outage.

Also, even though most of CrowdStrike's customers likely protected themselves with the aforementioned insurance products, one has to assume CrowdStrike is still going to bear considerable costs, and the threats from Delta show the extent of those costs are not yet clear.

Competitors such as Palo Alto Networks, SentinelOne, and Zscaler also provide comparable cybersecurity software. The recent outage could induce new customers to choose a different provider, so the pressure is on CrowdStrike to not make this same mistake again. Fortunately for the company, changing cybersecurity providers can be a disruptive process, a factor that should mitigate concerns about the company losing business.

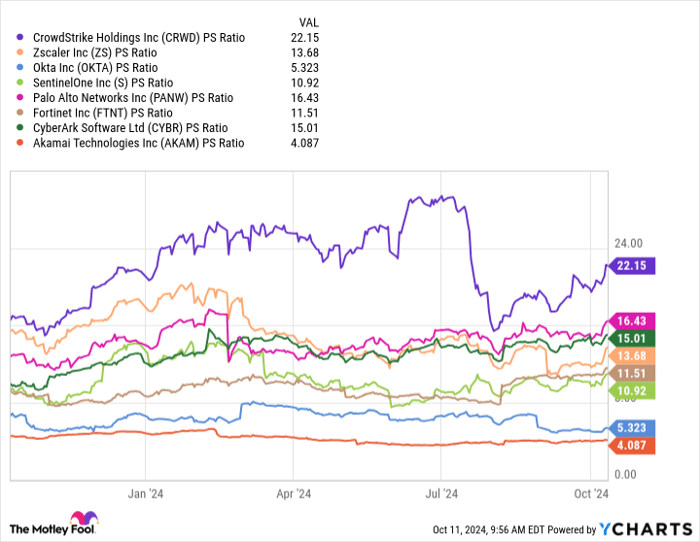

Nonetheless, that may only help shareholders up to a point. With the share price above $300 per share, its price-to-sales (P/S) ratio exceeds 22, making it the most expensive cybersecurity stock measured by revenue. Although this indicates that CrowdStrike stock has weathered the outage, such a valuation could preclude investors from bidding the stock higher.

CRWD PS Ratio data by YCharts

Stand pat with CrowdStrike stock

Considering the state of CrowdStrike and its industry, the company's shares are likely to eventually return to their all-time high.

However, eventually is the key word. At 22 times sales, it remains an expensive stock, which could limit its near-term growth. Moreover, Delta's continued focus on the effects of the outage indicates that it is going to affect CrowdStrike for some time to come.

CrowdStrike was forthcoming with the public in terms of claiming responsibility, and such a move bolsters confidence in the company and its cybersecurity products. Still, given its business conditions and competition, investors should be careful with CrowdStrike stock while it trades at such a high premium.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Will Healy has positions in Berkshire Hathaway, CrowdStrike, and Zscaler. The Motley Fool has positions in and recommends Berkshire Hathaway, CrowdStrike, Fortinet, Microsoft, Okta, Palo Alto Networks, and Zscaler. The Motley Fool recommends Delta Air Lines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.