My 4 Best Stocks to Buy Right Now

Although the market is still hitting record highs, many stocks are still good buys. The key isn't to look at where the market is now; it's to look at where some stocks may be heading if they can keep up their growth trajectory.

If these four can maintain their general direction, they'll continue rising faster than the market, which makes them excellent buys now.

1. Taiwan Semiconductor Manufacturing

Regardless of where you look in the tech sector, you'll find that highly sophisticated chips are within every device. It doesn't matter if a GPU is being used for training artificial intelligence (AI) models or the latest smartphone, they all have cutting-edge chips. There's a good shot that these chips are manufactured by Taiwan Semiconductor Manufacturing (NYSE: TSM), known commonly as TSMC, as it works with nearly all of the biggest tech players to produce their chips.

This positions TSMC nicely in today's tech-heavy environment. In fact, management believes it will grow revenue at a compound annual growth rate (CAGR) between 15% and 20% over the next "several years." That's market-beating growth, making it a company that every investor should consider owning.

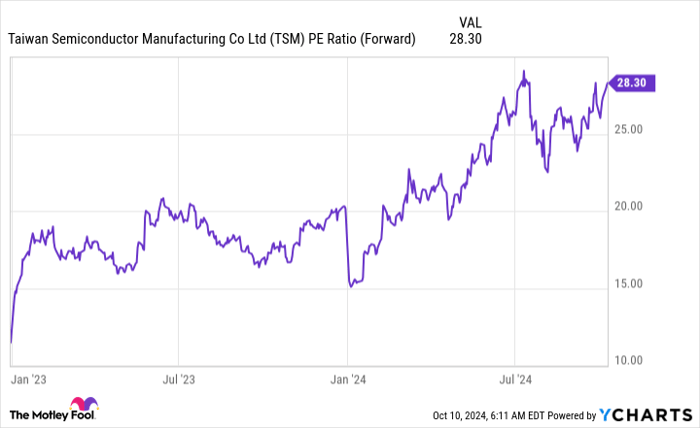

Taiwan Semi is the most expensive stock by far in this group, trading at 28 times forward earnings.

TSM PE Ratio (Forward) data by YCharts

However, with its long-term execution, market-beating growth, and industry-leading position, it has earned that premium. I think Taiwan Semi is a great buy here and will be a successful investment over the next few years.

2. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is likely better known as Google's parent company. Its dominance in the search market has resulted in a massive revenue stream, although it is a mature business and isn't growing nearly as fast as some of its peers.

However, Alphabet is also heavily invested in the generative AI tech race and has plenty of financial resources to make one of the best offerings in this space. Still, even with all of this upside from two industries that are slated to boom over the next decade, Alphabet's stock only trades for 21.2 times forward earnings. The most common index that Alphabet is compared to is the S&P 500, which trades for 23.5 times forward earnings.

That's a healthy discount to the market, even though Alphabet has consistently grown its earnings above 30% year over year for the past year. Alphabet stock has a strong value in a market full of expensive stocks, making it a great place to put cash.

3. Meta Platforms

Meta Platforms (NASDAQ: META) is similar to Alphabet, as most of its revenue comes from its social media platforms, like Facebook, Instagram, and Threads. This produces unbelievable cash flows, as its "Family of Apps" segment delivered an operating margin of 50% in Q2.

It uses a lot of that money on AI research and developing mixed-reality products, like its new Orion glasses, which are still in the works. While many investors wish it wasn't burning cash on this pursuit, Meta is still a great business, even with its Reality Labs division being a drag on margins. Plus, if Meta develops a must-have technology in this space, it will have a new revenue stream.

Meta trades for 27.6 times earnings, but it has experienced incredible growth (revenue rose 22% year over year, and earnings per share rose 73% in Q2), allowing it to earn that premium price tag.

4. PayPal

PayPal (NASDAQ: PYPL) has been in a turnaround scenario for a few years now. However, CEO Alex Chriss, who was brought on board in August 2023, has been doing a phenomenal job. Although revenue isn't growing at breakneck speed anymore (it was up 8% in Q2), Chriss has directed a lot of PayPal's cash flows to repurchase shares and launch new products.

It took a while for investors to catch on, but the stock seems to be making a pivot, as it has risen around 40% since July. The stock still only trades for 18.5 times forward earnings, so it's still a good buy at these prices.

However, if management continues innovating and repurchasing shares, forward earnings projections may increase, making the stock look even cheaper. This is just the beginning of PayPal's turnaround, and it's a great stock to get in on now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Alphabet, Meta Platforms, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.