If You Bought 1 Share of Nike at Its IPO, Here's How Many Shares You Would Own Now

Athletic apparel and shoe giant Nike (NYSE: NKE) has been around for a while. The company was founded 60 years ago, and Nike's stock entered the public markets in December 1980.

The stock has also experienced seven 2-for-1 stock splits over the years. If you had bought a single Nike stub in 1980 and held on to it until October 2024, you'd have 128 shares in your pocket.

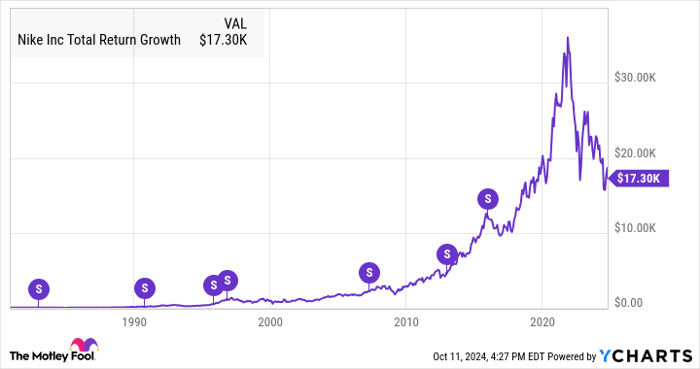

The stock price was about $23 per share on Nike's first market day. That works out to $0.18 per share on a split-adjusted basis. That single share of 1980 Nike stock is now worth about $17,300, assuming you reinvested Nike's dividends in more stock along the way:

NKE Total Return Level data by YCharts.

Simply holding on to Nike's stock for 44 years would give you 128 stubs today. But with reinvested dividends, you'd have more than 456 Nike shares. Those handy-dandy dividend reinvestment plans (DRIPs) can make a big difference in the long run.

Will Nike split its stock again?

Nike's latest stock split was performed just before the holidays of 2015. The stock has underperformed the S&P 500 market index since then, making Nike an unlikely candidate for more stock splits anytime soon.

The company is attempting a turnaround, driven by a back-to-basics approach under former Air Jordan CEO Elliott Hill. Nike might split its stock again if Hill's management style turns out to be just what the company needed. But he has been on the job for less than a month, so the jury is still out on that idea.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool has a disclosure policy.