Interest Rates Just Did Something They Haven't Done Since March 2020, and It Could Foreshadow a Big Move in the Stock Market

The Federal Reserve has two objectives, as mandated by law. First, it aims to keep the Consumer Price Index (CPI) measure of inflation increasing by around 2% per year. Second, it tries to maintain full employment in the U.S. economy, although it doesn't have a specific target for the unemployment rate.

The CPI soared to a 40-year high of 8% in 2022, triggering one of the most aggressive campaigns to hike interest rates in the Fed's history. Thankfully, it has cooled significantly since then, which allowed the Fed to reduce the federal funds rate in September, for the first time since March 2020.

The central bank's projections point to even more cuts on the horizon, and history suggests a big move in the S&P 500 (SNPINDEX: ^GSPC) stock market index could follow -- but not in the direction you might expect.

Interest rates could fall further in 2024, 2025, and 2026

A cocktail of inflationary pressures resulting from the pandemic triggered the surge in the CPI during 2022:

- The government spent trillions of dollars to counteract the economic impacts of COVID-19 during 2020 and 2021, which included cash payments to citizens in the form of stimulus checks.

- The Fed lowered interest rates to a historic low of 0.13%, and it also injected trillions of dollars into the financial system using quantitative easing.

- Factories periodically shut down all over the world to stop the spread of COVID-19, which led to shortages of everything from computers to televisions to cars. That drove prices higher.

The Fed started increasing the federal funds rate in March 2022, and by the last hike in August 2023, it was at a two-decade high of 5.33%. The goal was to cool the economy down after the highly stimulative pandemic-era policies, in order to reduce inflation.

It appears to have worked. The CPI ended 2023 at 4.1%, and it came in at an annualized rate of just 2.5% in August 2024, which is the most recent reading. That means it's a stone's throw away from the Fed's 2% target.

That's why the Federal Open Market Committee (FOMC) chose to slash the federal funds rate by 50 basis points at the Fed's September meeting. According to the FOMC's own projections, more cuts are on the way, including:

- 50 basis points of further cuts by the end of 2024

- 125 basis points of cuts in 2025

- 25 basis points of cuts in 2026

That will place the federal funds rate at 2.8% in 2026 -- down by almost half from its recent peak. Those projections are a good indication of what the Fed thinks right now, but they could change as new economic data comes in.

The stock market doesn't always like rate cuts in the short term

Falling interest rates can be great for the stock market. It increases the borrowing power of corporations, which can help fuel their growth, and it reduces their interest costs, which can be a tailwind for their earnings. Plus, the yield on risk-free assets like cash or Treasury bonds often falls in lockstep with interest rates, which pushes investors into growth assets like stocks instead.

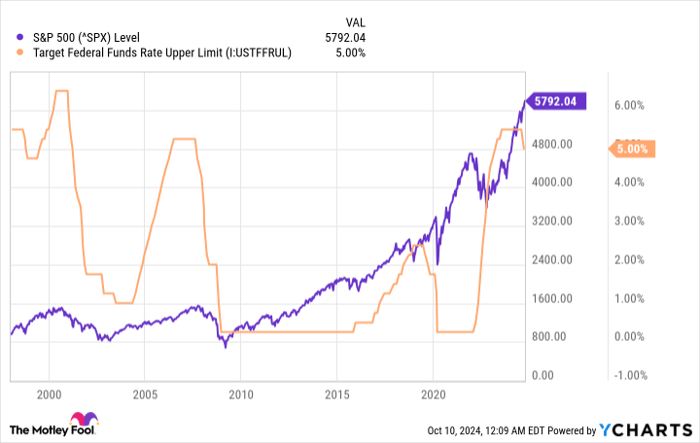

However, the below chart tells a different story. It overlays the federal funds rate with the S&P 500 index going all the way back to the year 2000, and it shows that falling interest rates often foreshadow a temporary decline in the stock market:

^SPX data by YCharts.

However, the S&P 500 always trends higher over time, so investors shouldn't be discouraged by the potential for short-term weakness. The Fed usually starts cutting interest rates when the economy slows down or suffers an unexpected shock, which is probably the true reason for the temporary stock market declines in the chart (rather than the rate cuts themselves).

During the early 2000s, the Fed slashed rates because the dot-com tech bubble burst, which plunged the economy into a recession. Then, in 2008, the Fed was cutting because of the global financial crisis. Finally, the cuts in 2020 were triggered by the pandemic.

In other words, since there is no immediate sign of an economic crisis right now, the Fed's recent rate cut could actually be a tailwind for the S&P 500. In fact, the index set a new record high a few days ago.

But there are some signs of economic weakness

The unemployment rate was at 3.7% at the start of 2024, but it has steadily climbed throughout the year with the most recent reading (September) coming in at 4.1%. If the jobs market deteriorates further, it could trigger a slowdown in consumer spending, which would have negative consequences for the broader economy.

In that scenario, Wall Street analysts would likely reduce their future earnings forecasts for corporate America, which would almost certainly lead to a decline in the S&P 500 -- especially since the index is trading at a historically expensive valuation right now. That means the stock market would be falling at the same time the Fed is cutting interest rates once again.

But that isn't a reason for investors to sell stocks. In fact, if the S&P 500 does fall in the near future, it's probably a great buying opportunity based on its long-term upward trend.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.