Will Lower Rates Turn AGNC Investment Into a Great Income Stock?

AGNC Investment (NASDAQ: AGNC) looks like an income stock, but it doesn't actually behave like one. Or at least not one that most dividend-focused investors will want to own.

And while falling interest rates will likely be a net benefit to the business, the improving environment won't be enough to turn this roughly 14% ultra-high-yield stock into one that a dividend investor will want to buy. Here's what you need to know before you let a big yield suck you into an investment mistake.

What does AGNC Investment do?

AGNC Investment is a mortgage real estate investment trust (REIT). Its structure was designed to give small investors access to institutional-level real estate investments, with the idea that they would be able to benefit from the cash flows such assets can produce.

In fact, one of the keys to being classified as a REIT is that a company must pay out at least 90% of taxable income as dividends. That allows REITs to avoid corporate-level taxation, though it's important to note that their dividends are taxed at an investor's normal income tax rate. (Uncle Sam still wants his cut.)

Image source: Getty Images.

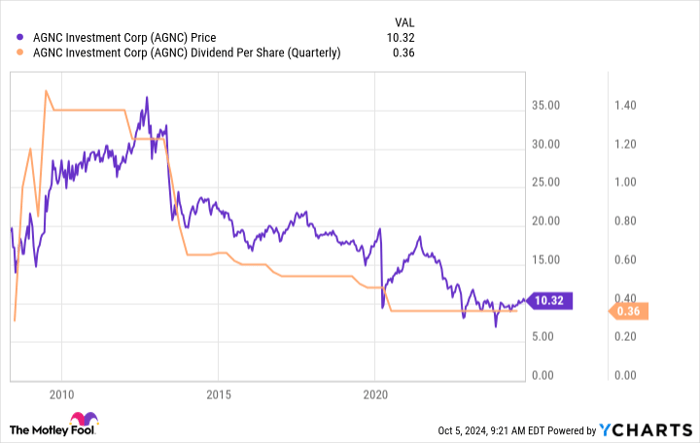

From this big-picture perspective, AGNC sounds like an income stock, particularly when you add in the huge dividend yield. But there's a problem here when you look at the stock graph and overlay the dividend history on that graph. Notice how the purple line, the stock price, spiked higher initially and then headed steadily lower. That's the same trend that the orange line, the quarterly dividend payment, follows.

AGNC data by YCharts.

Think about that for a second. If you were a dividend investor trying to live off the income your portfolio generates, would you want to own a stock that has a high yield but a price that keeps falling and a dividend payment that does the same? At the end of the day, you would have less income and less capital, which is just about the worst possible outcome based on your investment goals.

Lower rates will be good for AGNC Investment

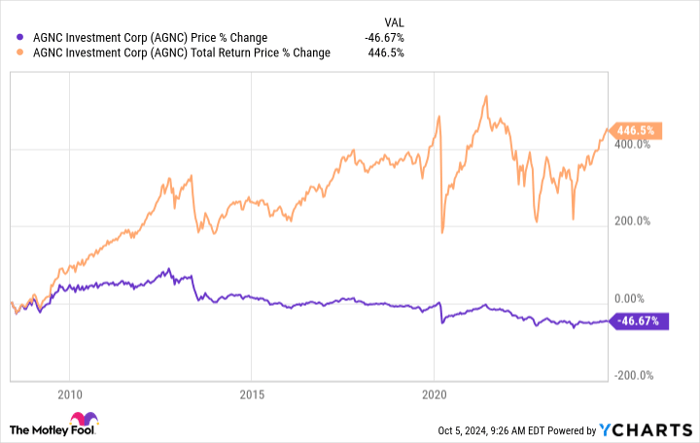

Here's where the important wrinkle comes in. AGNC is a total-return investment, which assumes the reinvestment of dividends. When you do that, the performance story changes dramatically.

In this graph below, the orange line is the total return, and it is strongly positive compared to the steadily declining purple line, which is still the stock price. The dividend the REIT pays is so large that if you buy more shares of AGNC, the payment more than makes up for the price declines in the stock.

AGNC data by YCharts.

This isn't how income-focused investors do things. It is how institutional investors, like pension funds, do it, normally using an asset allocation model. If that's what you are doing, go ahead and buy AGNC Investment and reinvest the dividends.

If you are a dividend investor, AGNC just isn't made for you. And now is the time when you might need to steel your resolve on this point.

As a mortgage REIT, AGNC Investment buys mortgages that have been pooled together into bond-like securities. These assets trade all day long and are affected by a lot of unique factors.

But one of the most important is interest rates. Rising rates tend to depress bond prices, and falling rates tend to support bond prices. As rates fall, AGNC Investment's business is likely to perk up and so, too, could its stock price.

If competition in the mortgage space heats up, perhaps because more banks get into the business again (after avoiding it following the Great Recession), there could be even more benefit to AGNC Investment's portfolio of mortgage bonds if the prices of these securities get bid up.

The outlook for mortgage REITs like AGNC Investment is improving considerably. But the improvement isn't permanent: it's subject to the whims of the Federal Reserve and the broader mortgage market.

From a total-return perspective, AGNC might be readying for a period of strong performance. Who knows, it might even hike its dividend. But none of that will change the basic nature of the REIT, which will still be focused on total return.

Be careful what you buy if you are looking to live off your dividends

Just having a big dividend yield isn't enough to make a stock a compelling addition to a dividend-focused portfolio. If you need the dividends to pay for your living expenses, perhaps as a supplement to your Social Security check, you need to own companies that are reliable payers.

History is very clear: Mortgage REITs like AGNC Investment are not reliable dividend payers. A huge yield and an improving business outlook, thanks to interest rates, won't change that fact.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.