Down 55%, This Blue Chip Stock Is a Good Buy for Long-Term Investors

Nike (NYSE: NKE) checks the boxes for being a blue chip stock. It's been an industry leader for quite some time, it's financially stable, and it has a global brand many companies could only dream of matching. Unfortunately, being a blue chip stock doesn't make you immune from down periods, and that's exactly what Nike has gone through these past few years.

Since hitting an all-time high in Nov. 2021, Nike stock is now down close to 55%. It's fallen 24% in 2024 alone. Needless to say, it's been a rough ride for Nike and its shareholders lately.

On one hand, no investor wants to see their investment's value drop by more than half (or at all). On the other hand, Nike's current trading levels present a good buying opportunity for long-term investors who are willing to have some patience.

A changing of the guard could breathe new life into Nike

Nike recently announced it would replace CEO John Donahoe with incoming CEO Elliott Hill, effective Oct. 14.

Donahoe has been Nike's CEO since Jan. 2020, and it has been a tale of two halves. The first half of his tenure saw Nike stock receive a COVID-19-fueled boost (like many other high-profile stocks), but it's been downhill for the latter half of his stint as CEO.

Some people have pointed out that one of Donahoe's biggest weaknesses was his lack of experience in the creative and design-focused side of the apparel industry. Having previously served as eBay's CEO, Donahoe's strength was e-commerce, and the company's decision to focus so much on its direct-to-consumer strategy proved to be one of the major reasons for its recent struggles.

Incoming CEO Hill has decades of experience at Nike. Having someone familiar with Nike's culture and what it took to become the powerhouse it currently is could help the company return to the path of innovation that has fueled its brand through the years.

A fair price for a great company

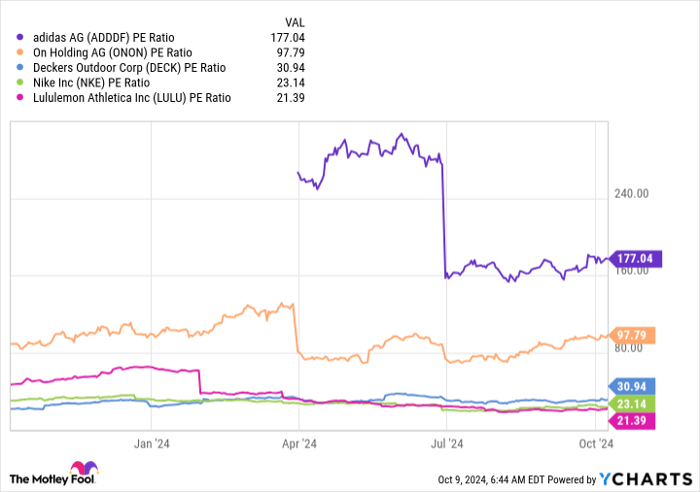

Nike's price-to-earnings (P/E) ratio is just over 23.1 as of this writing, a far cry from the 84 it hit in late 2021. That alone doesn't make the stock a bargain, but it appears fairly priced compared to many of its direct competitors like Adidas, On Holding (owner of On shoes), Deckers Outdoor (owners of Ugg and Hoka), and Lululemon.

Data by YCharts.

To be fair, the other companies have been growing revenue and earnings at a much higher rate than Nike recently. However, few of them can match Nike's brand power, and that's a competitive advantage that's hard to put a price on.

In this situation, consider Warren Buffett's quote: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." That's not an insult to the other companies -- Nike is just the indisputable leader in athletic shoes and apparel.

Nike's recent missteps should end up being a brief stumble in its long history of success.

Nike has been spending billions on stock buybacks

Management has taken advantage of the stock's decline by increasing its stock buybacks, including nearly $1.2 billion of repurchases in the latest quarter.

| Month | Shares Repurchased | Average Price Paid Per Share | Total Spent |

|---|---|---|---|

| June | 3.26 million | $94.11 | $307 million |

| July | 6.16 million | $74.19 | $457 million |

| August | 5.39 million | $79.76 | $430 million |

Data source: Nike. Total spent rounded to the nearest hundred million.

The biggest benefit for investors is a smaller number of outstanding shares, which increases earnings per share. That and dividends are two key ways to return capital to shareholders beyond stock price appreciation.

Increased buyback activity can also serve as a signal of management's belief that the stock is a bargain in the lead-up to its turnaround, especially given how steep its decline has been this year.

Nike's recovery won't happen overnight, but if you invest with a long-term mindset, now is the time to scoop up shares while the company is beginning its transition.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.