Here's Why Rivian Stock Is a Buy Before Nov. 5

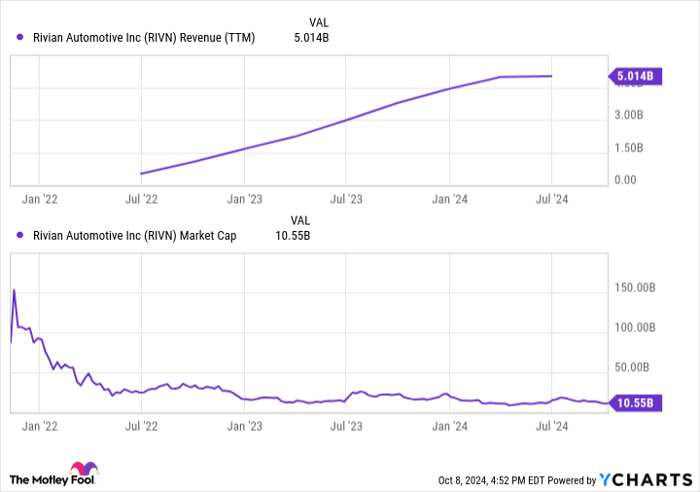

Since going public in 2021, Rivian Automotive (NASDAQ: RIVN) has seen its sales zoom from the millions to the billions. Today, the company is generating more than $5 billion in annual sales. Yet over the same time period, the company's market capitalization has tanked from above $100 billon to just $10 billion. So far, patient investors have been burned.

But there's reason to believe that much better days may be ahead, especially given some major news that could be unveiled Nov. 5 during Rivian's next quarterly conference call.

Next month could be a game-changer for Rivian

Rivian's sales base has exploded in recent years. And its electric vehicles have earned high praise from the market. Consumer Reports recently conducted a survey asking vehicle owners whether they would buy the same brand that they purchased last time. This survey included nearly every major auto manufacturer, including both EV producers and conventional fossil fuel models. The No. 1 brand was none other than Rivian.

Rivian likely benefited from its small size and niche category in the study. But the takeaway should be clear: Rivian's management team is clearly capable of producing cars that people want and love -- so much so that they'll be looking to the company again for their next car purchase.

This fact is particularly exciting considering Rivian is set to launch three new vehicles beginning in 2026: the R2, R3, and R3X. All three are expected to debut under $50,000. This will allow Rivian to target mass-market sales like never before. When Tesla launched its mass-market vehicles -- the Model 3 and Model Y -- sales grew by more than 500% in the years that followed.

If all of this is true, then why is Rivian stock priced near an all-time low, with a market cap of only $10 billion? First, the general EV market is struggling this year due to lower-than-expected sales growth. Even Tesla experienced some declines in its revenue base in early 2024. The long-term demand forecast for EVs remains robust, but short-term headwinds have affected nearly every EV stock.

The second issue is that the EV space is full of big promises that fail to be fulfilled. A major reason for this is that the vehicles are incredibly capital-intensive to produce. Companies need consistent access to billions of dollars to design, produce, and market a portfolio of cars. Many EV start-ups have gone bankrupt due to a lack of fresh capital.

All of this is what makes Nov. 5 -- the date of Rivian's next earnings release -- so exciting. In a few weeks, everything could change for the company from a capital standpoint.

RIVN Revenue (TTM) data by YCharts

Will Rivian shares soar on this financial milestone?

Despite Rivian's sales success, and the promise of its upcoming vehicle pipeline, the company is still losing around $32,000 for every vehicle it makes. That's a $6,000 improvement from last quarter, but still a major headwind for the stock given the financial uncertainty. Rivian not only needs billions in additional capital to finance the production of its mass-market vehicles, but it also needs billions of additional dollars to keep producing its existing lineup -- at least if nothing seismic changes. Yet we may be about to receive some seismic news on that front.

Earlier this year, Rivian's CEO promised that the company will achieve positive gross margins by the end of the year. That means the $32,000 gross loss on each vehicle would be erased completely. This would be an absolute game-changer for the company, given the line of sight to producing its mass-market vehicles would strengthen considerably. We know Rivian can make great cars, and that it has an opportunity to ramp sales up considerably with its new models. And a flip to gross profits would likely give the market the confidence it needs to keep funding Rivian through these milestone events.

To be clear, achieving positive gross profits would likely have a strong positive effect on the stock price because it's a hard feat to accomplish. While Rivian has been improving its gross margins most quarters, a $32,000 gulf remains. And it should be noted that this upcoming quarter is only Q3 for Rivian's fiscal calendar, so it may not report positive gross margins in November.

But with the new models several years out, this is the biggest potential catalyst for Rivian today. And we'll learn a lot more in a few weeks.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.