2 Monster Stocks That Are Crushing the S&P 500 This Year

Investing in the S&P 500 via an exchange-traded fund (ETF) that tracks it is an excellent idea for long-term investors. The index has generally delivered solid returns. We have every reason to believe that will continue for a while.

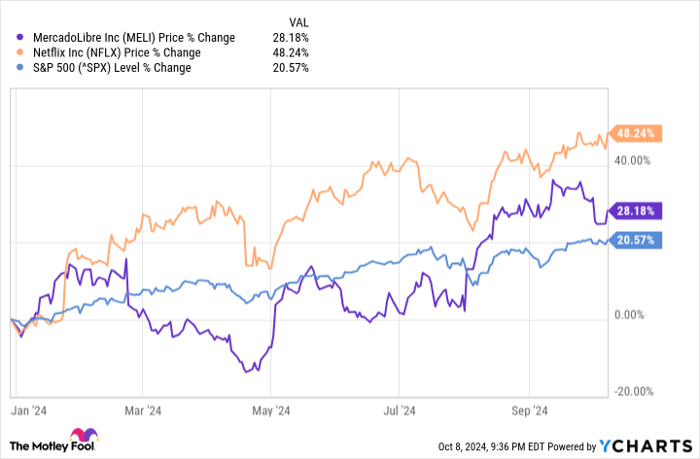

But what about investing in equities that can perform even better? That's what MercadoLibre (NASDAQ: MELI) and Netflix (NASDAQ: NFLX) have done this year. Of course, that's no guarantee they will do so moving forward, but we also have good reasons to expect they will.

Let's discuss some of those reasons.

MELI data by YCharts.

1. MercadoLibre

MercadoLibre, the largest e-commerce player in Latin America, has the makings of a long-term winner. The company's position is so strong that even Amazon hasn't been able to compete. Any time a company can dominate a market, especially in the broad e-commerce category, while going up against Amazon, that company is probably doing something right.

However, it's worth pointing out that MercadoLibre isn't just an Amazon copycat. The company's business has multiple segments, including fintech, logistics, and a service that allows merchants to open online storefronts. That brings us to another important point: MercadoLibre's comprehensive and complimentary suite of services grants it a solid competitive advantage.

The company arguably benefits from the network effect -- the value of its e-commerce platform increases with use -- and switching costs, since merchants within its ecosystem could suffer business disruptions if they decide to jump ship. A strong moat is essential for a company to deliver above-average returns over long periods. MercadoLibre isn't lacking in this category.

Furthermore, the company is delivering profitable growth. Consider MercadoLibre's second-quarter results. Its revenue increased 42% year over year to $5.1 billion. The company's net income of $531 million soared by almost 103% compared to the year-ago period. MercadoLibre's metrics moved in the right direction across the board. The company's strong financial results have contributed to its performance this year.

Lastly, MercadoLibre should continue benefiting from the growth of e-commerce as retail transactions switch to online channels. The incentive to do business with people and businesses worldwide -- as opposed to those constrained within a small geographic area -- is too strong. That's why e-commerce is on a long-term growth path. Few players are better positioned to benefit than MercadoLibre. It's not too late to buy the stock, despite its strong returns this year.

2. Netflix

Netflix pioneered streaming, but the company is now facing more competition than ever. There are dozens of streaming services, some trying to appeal to a broad audience and others focusing on specific categories such as sports.

Still, several players dominate the field, and unsurprisingly, Netflix is one of them. The company has found a way to perform well despite the changing dynamics. It introduced a lower-priced ad-supported subscription option, and it cracked down on password sharing by making primary account holders pay for sub-accounts owned by people outside their households.

Partly due to these changes, Netflix's financial results have rebounded from the slump they experienced two years ago. In the second quarter, Netflix's revenue increased by 17% year over year to $9.6 billion. Net income was up 44% year over year to $2.1 billion. Netflix's paid memberships were 277.65 million at the end of the period, growing 16.5% compared to the prior-year quarter.

Netflix's ecosystem grants it its competitive advantage. The company collects data on viewer habits and on what viewers like and dislike, and steers its content production efforts based on its findings. In other words, Netflix's platform benefits from the network effect. More subscribers mean more data, better content-producing decisions, more hours viewed, and, eventually, even more subscribers. That matters for the company's future.

There's still plenty of room to grow in the streaming industry. Netflix wants to replace cable, which, although it has lost market share, is far from gone. Streaming captured 41% of television viewing time in the U.S. in August. That number is likely much lower in most other places. So, Netflix still has massive opportunity ahead. The company could deliver outsized returns as it makes headway into its addressable market.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon, MercadoLibre, and Netflix. The Motley Fool has a disclosure policy.