There Are Only 28 S&P 500 Companies Warren Buffett Can't Buy Outright. Here's the Best of the Bunch for Income Investors.

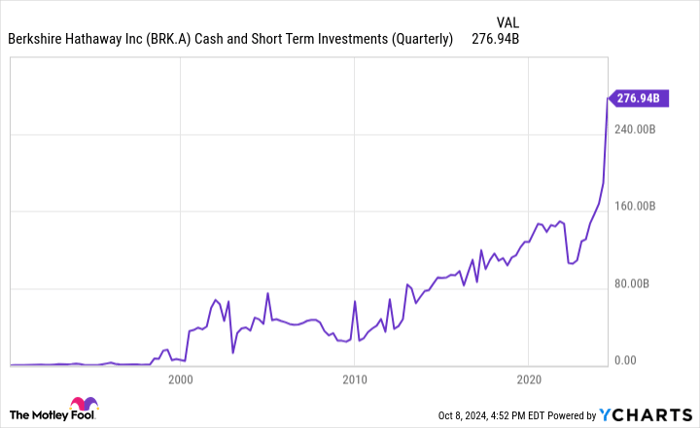

Warren Buffett wrote in his latest letter to Berkshire Hathaway shareholders, "Your company also holds a cash and U.S. Treasury bill position far in excess of what conventional wisdom deems necessary." That's an understatement.

As of June 30, Berkshire's cash position stood at almost $277 billion. That's by far more cash than the conglomerate has ever had.

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts

What could Buffett do with Berkshire's boatload of cash?

Buffett has mentioned that he doesn't prefer to sit on a huge cash stockpile. He would much rather be fully invested in equities -- either buying businesses outright or buying stocks. However, Buffett only makes a move when the price is right. That's not the case for him now, with valuations at historically high levels.

But it's fun to imagine what Buffett could do with Berkshire's boatload of cash. Nearly $277 billion goes a long way.

As of this writing, only 28 members of the S&P 500 have market caps larger than Berkshire's cash position. In theory, Buffett could gobble up any of the remaining 472 S&P 500 companies if he wanted to do so. (I qualified that statement because if he actually tried to buy the companies, their price tags would almost certainly increase above current levels.)

Still, there's a select group of U.S. companies that Buffett couldn't buy outright with Berkshire's cash. They're the biggest (and arguably the best) businesses around.

Several good picks for income investors

As you might expect, this elite list of "Buffett-proof" stocks includes quite a few that choose to pay dividends. Most income investors would turn up their noses at some of them, though. For example, Nvidia's market cap tops $3.2 trillion, but its forward dividend yield is a paltry 0.03%.

However, income investors will probably like several of the stocks Buffett can't buy outright. ExxonMobil is a good case in point. The oil and gas giant's market cap is $542 billion, well above Berkshire's cash position. Its forward dividend yield is 3.11%. ExxonMobil has increased its dividend for 41 consecutive years.

If you really want impressive dividend track records, though, some Dividend Kings are in the group of stocks beyond Buffett's reach. Johnson & Johnson has increased its dividend for 62 consecutive years. Procter & Gamble has a staggering 68 years in a row of dividend hikes to its credit.

But I don't think ExxonMobil, Johnson & Johnson, or Procter & Gamble are the best picks for income investors among the 28 S&P 500 companies Buffett couldn't fully acquire. There's another Dividend King that deserves the honor, in my opinion.

The best of the bunch

My choice for the best of the bunch is... AbbVie (NYSE: ABBV). With a market cap of around $340 billion, there's no way Buffett could buy the big drugmaker with Berkshire's current cash stockpile. AbbVie is an income investor's dream stock, with a forward dividend yield of 3.2%. The company has increased its dividend for 52 consecutive years (including the period when it was part of Abbott Labs ).

Probably the best thing about AbbVie, however, is its resilience. When the company separated from Abbott in 2013, the blockbuster autoimmune disease drug Humira generated over 50% of total revenue. Ten years later, Humira lost U.S. patent exclusivity, and its sales began to plunge.

AbbVie had prepared well for this scenario, though. The company invested heavily in research and development. It made key acquisitions. The result is that AbbVie is now in a strong position to transition to a post-Humira environment. As new CEO Robert Michael said in the company's second-quarter earnings call, "As we begin this new chapter, nearly every aspect of AbbVie's business is performing at or above expectations."

To add icing to the cake, AbbVie is attractively valued. Its price-to-earnings-to-growth (PEG) ratio is a super-low 0.46, according to financial data reporting company LSEG.

Buffett can't use Berkshire's cash to buy AbbVie outright. However, income investors might want to use some of their cash to scoop up shares of this big pharmaceutical company.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Keith Speights has positions in AbbVie, Berkshire Hathaway, and ExxonMobil. The Motley Fool has positions in and recommends AbbVie, Abbott Laboratories, Berkshire Hathaway, and Nvidia. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.