Want Decades of Passive Income? Buy This Index Fund and Hold It Forever

While some investors enjoy the process of investing in individual stocks, it's not for everyone. You may not have time to research each company or can't stand the potential volatility.

However, investing is still one of the best ways to accumulate wealth. Luckily, there are many ways to invest, some of which require very little work while generating passive income. If a preselected basket of stable dividend stocks is more in line with your investing style and risk tolerance, consider buying and holding this index fund long term.

Low risk, high yield

Investors can find a high dividend yield with relatively low risk in the Invesco S&P 500 High Dividend Low Volatility ETF (NYSEMKT: SPHD). This exchange-traded fund is composed of at least 90% stocks from the S&P 500 Low Volatility High Dividend index. The index itself contains 50 stocks from the S&P 500, specifically those with a history of attractive dividend yields and low volatility. Unlike most dividend stocks, SPHD pays a monthly dividend.

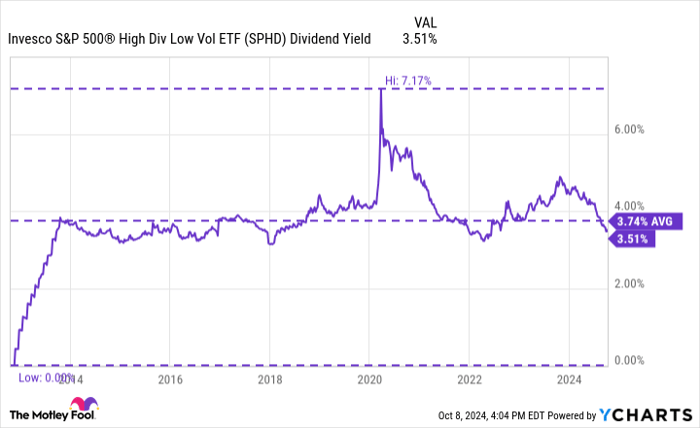

Data by YCharts.

Due to the make-up of the underlying index, SPHD constituents often come with strong balance sheets and a lower beta (a measurement of volatility) than the broad market. The S&P 500 has a beta of 1, so securities with a beta above 1 are more volatile than the broad market, while those with a beta below 1 are less volatile.

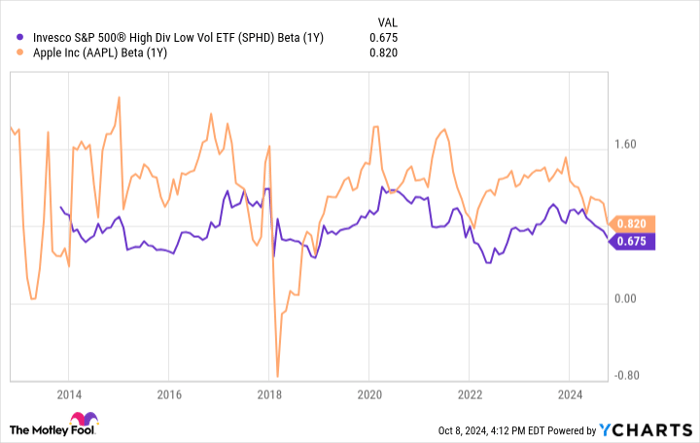

Data by YCharts.

As you can see above, SPHD has a beta of 0.68 as of this writing. That's even lower than Apple, the tech giant with the largest weighting in the S&P 500.

You can set this one and forget it

When it comes to investing, there is no one size fits all approach. Everyone is investing with different goals and timelines. There are retail investors trying to save for retirement, hedge fund managers trying to beat the market every year, and a broad spectrum of people between them.

Since its inception, the ETF has delivered a compound annual total return of 10.0%, according to YCharts data. While that may lag the 14.3% annual total return of the S&P 500 over the same period, consider what your priorities are. If steady dividends and the peach of mind that comes from owning a basket of lower-risk stocks are important to you, the SPHD stands out as an attractive option. The ETF enables its shareholders to collect year after year of passive income with a true set it and forget it option.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.