Has Costco's Stock Finally Peaked? 1 Number Investors Should Take a Closer Look At.

Costco Wholesale (NASDAQ: COST) has been a top retail stock to own in recent years. The company has been able to generate fantastic results amid challenging economic conditions, proving to be a versatile and adaptable business. That has pushed the stock to new heights and it is valued so highly it now trades at more than 50 times its trailing earnings.

But could the stock have finally hit a peak? The company's sales have been slowing down and one number in particular may suggest that investors should be thinking twice about Costco's high valuation, and whether it's still a good buy at its current price point.

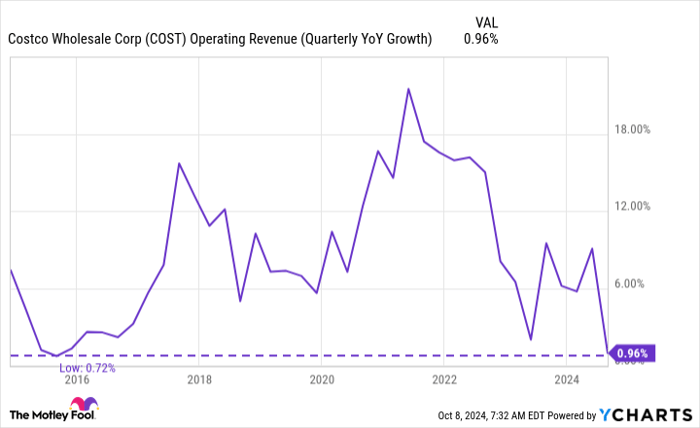

Costco's quarterly sales growth rate is the slowest it has been since 2015

Last month, Costco posted its fourth-quarter earnings numbers. Revenue for the period ended Sept. 1 totaled $79.7 billion and rose by just under 1% year over year. A combination of lower gas prices and slowing economic conditions have weighed on its results. But by Costco's standards, that's still an awful growth rate, and you have to go back to 2015 for the last time it was this low.

COST Operating Revenue (Quarterly YOY Growth) data by YCharts

Costco's growth rate is oftentimes in single digits but this is definitely a noteworthy development, especially given the high value that investors place on the retail stock. The company isn't generating the high levels of growth it was posting a few years ago and these latest numbers could serve as a reminder that investors are paying perhaps too high of a premium for the big-box retailer.

The good news for investors is that Costco recently announced increases to its membership fees, which will help give the top line a boost in the near future. Its membership fees make up the majority of its operating profit which should ensure that Costco's bottom line will rise significantly as well. But increases to its membership fees don't happen often; this is the first time Costco has announced a rate hike since 2017.

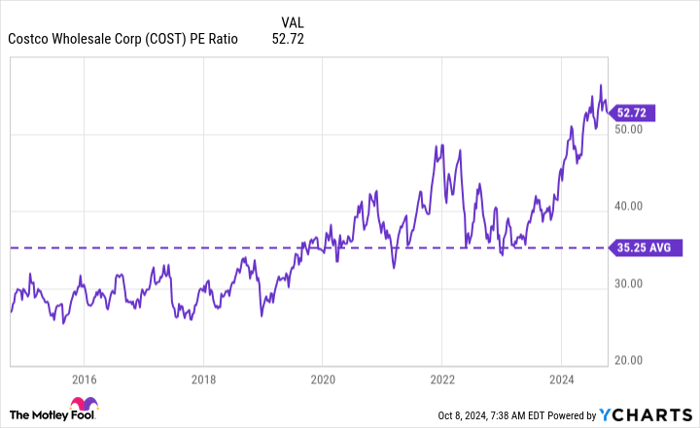

Costco's stock is trading at a much higher premium than normal

Over the past 10 years, shares of Costco have averaged a price-to-earnings (P/E) ratio of around 35 -- far lower than what investors are paying today. That can be a problem because when you're paying such a significant premium for a stock, expectations are high, and that also means a lot of future growth is already priced into the business; there isn't a big margin of safety for investors should the company struggle.

COST PE Ratio data by YCharts

Shares of Costco are at such high levels that the stock could be due for a large decline, as it may have a difficult time convincing growth investors that it's worth paying so much for the business anymore.

Should you buy Costco stock today?

Costco is a great business, but I haven't invested in it because the stock's valuation is simply too rich. While it will get a boost from raising its membership fees, the company arguably needs a bit more than just that to justify its high price. Costco's stock will still likely rise in value in the long run, but if you buy at a high valuation, it can be difficult to earn a good return on the stock. And there are many other more modestly valued stocks out there to consider instead, which can be better options for your portfolio.

Even if Costco's growth rate rebounds in the next few quarters this is still a stock I'd hold off on buying due to the high premium it trades at. It can still be a good buy for the long haul, but you should temper your expectations on the near term as this is a stock which could be overdue for a correction.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.