Could This Bull Market Buy Help You Become a Millionaire?

Investors are in a buying mood with regard to Coca-Cola (NYSE: KO), sending the shares higher by around 30% over the past year. That's right in line with the S&P 500 index (SNPINDEX: ^GSPC), as a bull market pushed the market higher. Can Coca-Cola help you become a millionaire? Sure can! But there's a caveat you need to remember right now.

What does Coca-Cola do?

The foundation of any millionaire-making investment is a good business. Coca-Cola definitely has a good business. It is the dominant non-alcoholic beverage company across the globe, with iconic brands like Coke, Costa Coffee, Fanta, and Minute Maid, among many, many others. Its brands are sold in over 200 countries and territories.

Image source: Getty Images.

With a market cap of around $300 billion, this giant company has the financial strength and brand strength to support a massive distribution network, product innovation, and marketing apparatus that few other companies can match. It can also expand its portfolio by acquiring smaller companies, allowing them to benefit from its distribution and marketing strengths.

The best evidence for Coca-Cola's success is probably its dividend, which has been increased every single year for 62 consecutive years. That makes Coca-Cola a Dividend King. You don't build a record like that by accident -- it takes consistent strong performance, operationally and financially.

There's a reason why Coca-Cola has resided in Warren Buffett's stock portfolio at Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) for so long. Even the Oracle of Omaha loves Coke! (To own and to drink, as it were.) But there's a wrinkle here you need to understand before you run out and add Coca-Cola to your portfolio.

Buffett buys stocks when they are on sale

Buffett's investment approach is telling here. To simplify, he likes to buy well-run companies when they are on sale. And then he likes to hold them for the long term to benefit from their business growth over time. He didn't just add Coca-Cola to his portfolio; it's been in there for decades. You, however, are considering Coca-Cola's stock right now. And that's a problem on the valuation front.

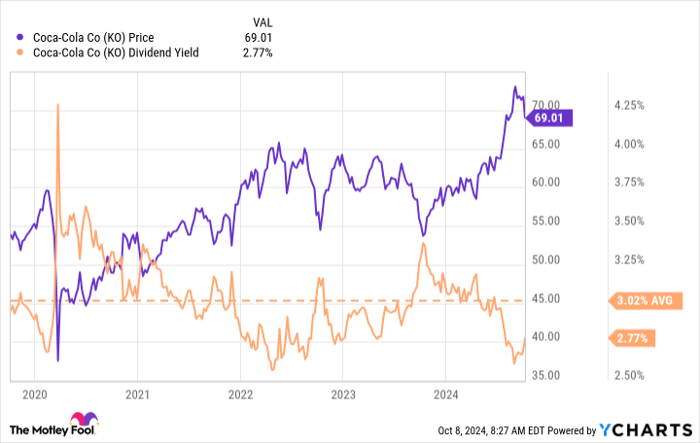

Traditional valuation metrics point to a stock that is currently a bit expensive. The price-to-sales ratio is sitting around 6.4 times compared to a five-year average of 6.2 times. The price-to-earnings ratio is roughly 28 times versus a long-term average of 26 times. The price-to-book value ratio is about 11.5 times, while the five-year average is closer to 11 times. The dividend yield, a less traditional valuation tool, is at 2.8% compared to a five-year average of 3%. Across the board, Coca-Cola looks like it is a bit pricey right now.

KO data by YCharts

That doesn't mean Coca-Cola isn't performing well. Quite the contrary. Over the past five years, revenue has grown at an annual rate of around 7.5%, with earnings rising 10% or so each year over that span. There's a reason why investors are buying this stock as the bull market continues to run. But that doesn't mean that you should follow along with the pack. Coca-Cola is probably best left on your wishlist right now, waiting for a market decline that brings its valuation back down to a more attractive level.

Good company. Not so good price.

Coca-Cola will very likely help investors build seven-figure nest eggs over the long term. But if you overpay for it, you'll hamper its ability to do that, possibly setting yourself back, at least temporarily, on your quest for financial independence. That said, you'll want to make a plan right now to buy Coca-Cola if you like it as a company. When the time is right to buy this well-run beverage giant, you will need the fortitude to go against the crowd, which will probably be selling it as the market craters. A plan will help you do that. And if you are patient and focus on buying Coca-Cola when it is cheap, you'll materially increase your chances of achieving millionaire status.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.