1 High-Yielding Vanguard ETF That Has Trounced the Market This Year

Investing in exchange-traded funds (ETFs) can give you exposure to many different areas of the economy. They're not just a way to mirror the overall markets. ETFs can also allow you to tap into different growth opportunities and take advantage of sectors of the market which may be poised to do better than the S&P 500.

Vanguard funds are popular options with investors for their strong track records, diversification, and low fees. And one fund, which focuses on utility stocks, has been soundly outperforming the markets this year.

A market-beating investment in 2024

A top-performing fund this year has been the Vanguard Utilities Index Fund ETF (NYSEMKT: VPU). It is up 25% since January, which is better than the S&P 500's gains of less than 20% over the same time frame. It may seem odd that a fund focusing on utilities has been doing so well, but there are many reasons why this performance makes sense, and why the fund may still climb higher.

Utility businesses can make for safe investments to hold during economic uncertainty as their operations are fairly stable and predictable from one year to the next; they can make for safe havens to invest in. Plus, many of them also offer attractive yields, which can give investors an extra reason to invest in these types of stocks. The Vanguard fund yields 2.9%, which is more than double the S&P 500 average of 1.3%.

It also charges a fairly low expense ratio of 0.10%. There are many top utility stocks in the ETF, including Duke Energy, NextEra Energy, and Southern, which can provide investors with a great deal of long-term stability.

Historically, investors have been better off with the S&P 500

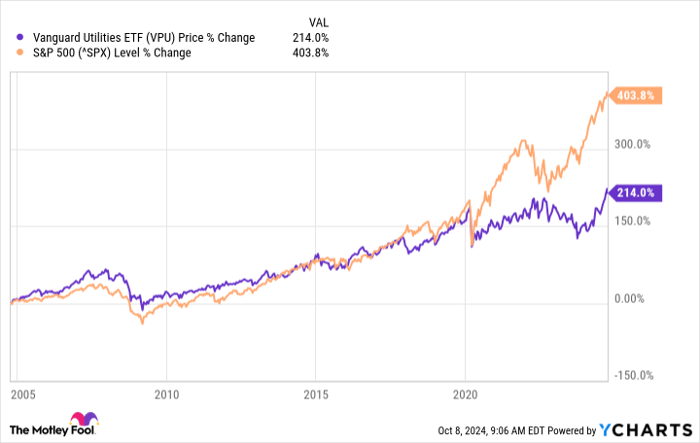

While the Vanguard Utilities Index has been performing well this year, that hasn't always been the case. When investing for the long haul, it's still hard to argue against going with the broader index. You get more diversification and it's a way to gain exposure to the best of all stocks; long-term investors of the S&P 500 have achieved better gains than they would have with the Vanguard fund.

VPU data by YCharts

There are other Vanguard funds you can choose to help diversify your portfolio or if you want to focus on higher-growth sectors of the market. But in some cases, just mirroring the S&P 500 can be the safest and best option for most investors. There is, however, a new reason to consider that could make utility stocks more attractive buys for the long haul.

AI could create a lot of demand for utilities

There's a new reason to invest in utilities, and that has to do with artificial intelligence (AI). It isn't just chipmakers and big tech companies that can benefit from the emergence of chatbots and next-gen technologies; it's utility companies, as well. And that's because the energy needs for AI are massive. Some analysts project that by 2030, data centers could be using up as much as 21% of the world's entire supply of electricity.

In the long run, there could still be a reason to remain invested in utility stocks; this may not be just a short-term trend for investors to focus on. While the Vanguard fund has underperformed the markets in recent years, that may not necessarily be the case in the future as AI plays a larger role in all sectors of the economy.

Is the Vanguard Utilities Fund a good investment today?

If you're concerned about the safety of the overall markets and don't want to just mirror the S&P 500, then going with the Vanguard Utilities Index Fund can be a good option to consider today. Between the safety, yield, and opportunities in AI, it can make for an underrated investment to hold in your portfolio, giving you many reasons to hang on to it for years. Although it hasn't always generated great returns, it can make for a good investment to buy and hold for the long haul.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends Duke Energy. The Motley Fool has a disclosure policy.