Every SoundHound AI Investor Should Keep an Eye on This Number

Artificial intelligence (AI) expert SoundHound AI (NASDAQ: SOUN) has about two decades of operating history and technology development under its belt. At the same time, it's a young company on the stock market. SoundHound AI entered the public stock market by merging with a special purpose acquisition company (SPAC) in the spring of 2022.

Ten earnings reports later, the maker of AI-powered voice control systems boosted its trailing-12-month revenue from $21.8 million to $55.5 million while lowering its net loss by 70%. SoundHound AI is expanding service offerings into new target markets and stretching its customer list.

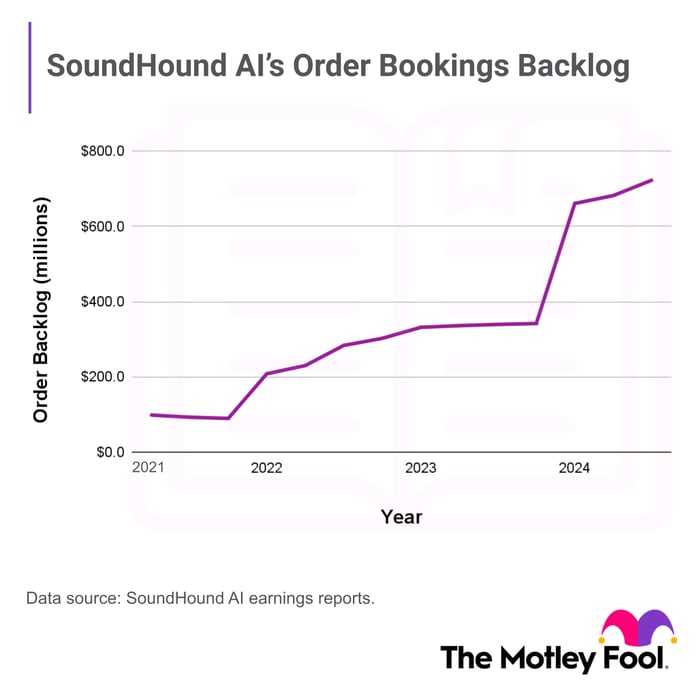

That brings me to the most important number in SoundHound AI's financial results. The company has reported its backlog of order bookings from the start. Shareholders and potential investors should watch this unusual metric closely, as it provides insight into SoundHound AI's future revenue collections.

As you can see in the chart above, the backlog is soaring. SoundHound AI had $98.2 million of unfilled order bookings in Q1 2021. The balance more than tripled in two years.

The large jump in the first quarter of 2024 is not quite as impressive as it looks here -- SoundHound AI changed the underlying metric at this point, including future revenue collections linked to long-term service contracts.

Still, the revamped metric showed a 3% and 6% sequential increase in the next two quarters. And don't forget that each backlog update excludes the latest quarter's contract-based revenue collections -- which also are surging. SoundHound AI's backlog growth is the real deal.

Future growth prospects

Meanwhile, the average length of the underlying contract terms keeps expanding. The first report showed an average contract term of roughly four years. Now, it stands just below seven years.

This massive and growing order backlog speaks volumes about SoundHound AI's upcoming revenue growth. This little company is finding household-name clients across many target markets, from automakers and restaurants to call centers and healthcare providers.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Anders Bylund has positions in SoundHound AI. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.