Should You Buy Apple Stock Now or Wait for a Dip?

Apple (NASDAQ: AAPL) is the most valuable stock in the world again, with a market cap of $3.4 trillion. Even though its growth rate isn't exactly scorching hot these days, investors remain bullish on its long-term prospects. The launch of the new iPhone along with Apple Intelligence have given investors multiple reasons to remain optimistic that there's still much more revenue growth coming down the pike for the business.

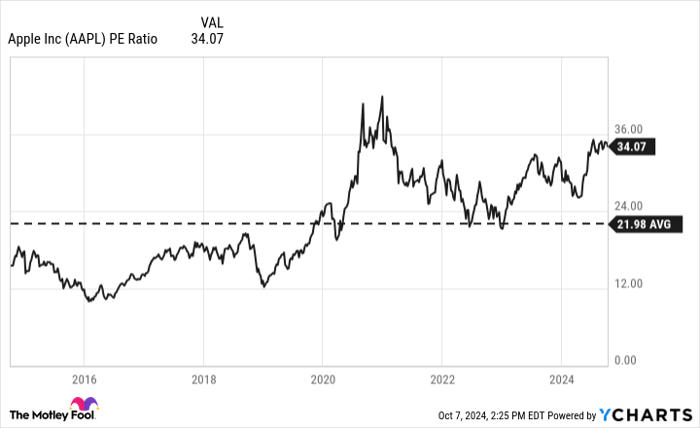

But with the stock trading at a high and a fairly expensive 34 times its trailing earnings, should you hold off on buying Apple stock until it dips in value, or are you better off adding it to your portfolio anyway?

The case for buying Apple's stock right now

Apple's business has multiple catalysts in the wings that should drive sales higher. Many consumers have held off on upgrading their phones, but with the latest iPhone, there could be an incentive to finally upgrade now that new artificial intelligence (AI) capabilities will be available with the device. And although the phone itself may not have been all that exciting, early sales numbers indicate that demand could be strong out of the gate.

Many of the company's new Apple Intelligence features may also not come out until next year and while that might seem like a negative, it could put the iPhone back into the spotlight in 2025 and help remind consumers who didn't upgrade why they should. Some AI features may also require a subscription, which could lead to yet another new element in Apple's growing ecosystem and bolster its service revenue.

For investors who are willing to buy for the long term, it's not hard to see why these opportunities in AI could be a big win for the company. Apple has proven over the years it doesn't need some groundbreaking new feature to entice consumers to buy new phones. And the promise of new AI features can provide it with enough of a carrot to get consumers to buy the iPhone 16. Strong sales and profits from that could quickly bring down its earnings multiple. Buying before that happens could ensure investors profit from a good return from the stock.

The case for waiting

Apple is trading at a historically high P/E multiple, which implies that investors are already pricing in a lot of the growth. You wouldn't normally expect to be paying 34 times earnings for a company that is growing at a rate of just 5% -- but that's what investors are getting with Apple today. The premium suggests that investors are expecting much more growth in the near term. That means the boost from AI and new iPhone sales may already be priced into the valuation.

AAPL PE Ratio data by YCharts

The risk for investors is that while the early sales numbers and preorders for iPhone 16 may be strong, these are still fairly primitive estimates. The prudent thing may be for investors to wait until at least after the company's next earnings report to get more insight into how well the phone is selling before making assumptions as to whether it will lead to stronger growth down the road. Hype leading up to the new iPhone was strong and consumers may have wanted to jump the line, buying even before seeing how revolutionary it was, for the sake of securing it.

As great of a company as Apple is, even it isn't immune to the effects of a downturn in the economy. And should a recession take place, consumers may have an incentive to hold off just a little bit longer in upgrading their phones, especially if the new iPhone and its AI features isn't all that consumers were expecting it to be. If sales don't align with expectations, a sell-off could be inevitable for Apple's stock.

Should you buy Apple's stock?

Apple is a great stock to own but I wouldn't buy it today. My concern is that with such a high valuation, expectations are going to be a bit high for the company's upcoming results, and the risk of a correction looks high. If you invest in it for several years, it can still be a great investment. But at the same time, there are many more attractively priced growth stocks that can make for better buys than Apple right now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.