Is Deckers Outdoor a Good Stock to Buy?

"Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now." [emphasis added] -- Warren Buffett, 1996 letter to Berkshire Hathaway shareholders.

Deckers Outdoor (NYSE: DECK) is a beloved stock right now. It owns popular shoe brands such as Hoka, was included in the S&P 500 in March, and recently had a 6-for-1 stock split. But I believe it's better for investors to take interest in Deckers because it's a business that's straightforward and easy to understand -- the kind that investing great Warren Buffett said investors should look for.

Here are some important things to note with Deckers' business and some thoughts regarding its future earnings, a key aspect of Buffett's advice to investors.

What to know about Deckers

Deckers owns many shoe brands. Its four big ones are Ugg, Hoka, Teva, and Sanuk -- each brand has a slightly different target, from running shoes to sandals and more. This gives Deckers broad exposure to the shoe market, rather than just catering to one specific category.

Deckers sells its shoes through wholesale partners. It also sells directly to customers through its e-commerce portals and in its own stores (less than 200 retail locations worldwide). In its fiscal 2024 (which ended in March), 43% of sales were direct, whereas the rest came through wholesale channels.

Deckers doesn't really have control over how these sales are split. People like buying things online, but they also like trying shoes on in person. Sometimes, they'll shop online before trying them on in a store. Other times, the reverse is true.

The point is, Deckers needs its wholesale partners even though it has a strong direct-to-consumer operation. Meanwhile, competitors such as Nike leaned too hard into e-commerce in recent years, giving up shelf space. Deckers was a direct beneficiary of the misstep, gaining some market share.

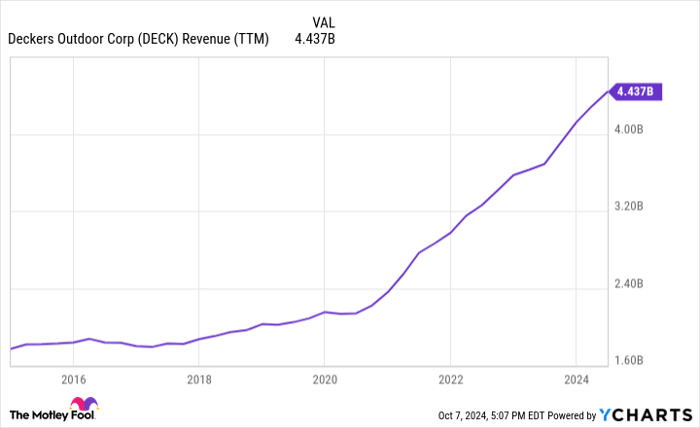

As the chart below shows, revenue for Deckers has increased at an impressive pace in recent years.

Data by YCharts.

One of the good things about this business is that shoes are universally adopted by consumers. Moreover, they regularly wear out and need to be replaced. Therefore, Deckers is in a somewhat recession-proof industry. As long as it can stay present in people's minds, it should enjoy a baseline level of demand. And if it can keep taking market share, demand will grow.

This is indeed an easy-to-understand business.

Will Deckers' future earnings be materially higher?

Buffett also recommends that investors consider whether a company's earnings will be higher in the future. When it comes to Deckers, this might be a somewhat complicated question to answer.

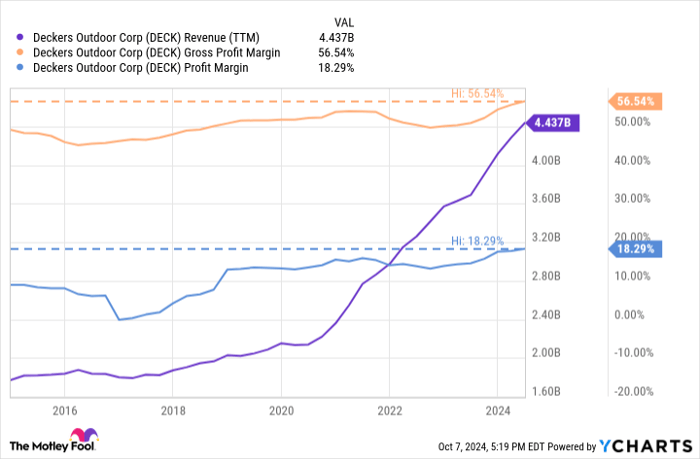

As of this writing, Deckers' revenue is soaring. This surge in sales has lifted its gross margin and its net margin to all-time highs.

Data by YCharts.

With margins at these levels, it's worth asking the question: Did Deckers make material improvements to the business, or is it simply enjoying a temporary profit boost due to the recent revenue growth?

If management improved the business, then maintaining these record-high margins should be possible, which would underscore the case for buying Deckers stock. But if cyclicality is driving demand above supply, then its profit improvement might only be temporary.

With that in mind, Deckers' profit margins will likely take a step back in coming years. The company has benefited from selling shoes at full price, and it also raised prices because of inflation. However, some inflationary pressures on the supply chain have abated.

Management also expects gross margin to pull back from nearly 56% in fiscal 2024 to 54% in the current year, so this concern with margins is already materializing. Moreover, investors should consider the economy has been relatively stable. If economic conditions worsen, then one would expect the company's growth and profitability to fall to more normalized levels.

So, could Deckers' sales be higher five years from now? Yes, that's definitely possible if it continues to take market share from competitors. Can its earnings be higher? Yes, that's also possible. But if margins contract, then earnings might not be materially higher.

This would be less of a concern if Deckers stock was trading at a bargain valuation. But at 31 times earnings, it's pricey for a shoe stock, and that valuation is near the highest level the company has seen in the last five years.

To circle back to Buffett's quote, investors can't be "virtually certain" Deckers' earnings will be materially higher in five years. As a result, its high valuation is reason for concern. To be sure, Deckers is a good business that has made strong gains in recent years, but there might be better investment options for those looking to buy a stock today.

Should you invest $1,000 in Deckers Outdoor right now?

Before you buy stock in Deckers Outdoor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Deckers Outdoor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Nike. The Motley Fool has a disclosure policy.