Why Cruise Line Stocks Carnival, Royal Caribbean, and Norwegian Rallied This Week

Shares of cruise lines stocks rallied this week, with Carnival Corp. (NYSE: CCL) (NYSE: CUK), Royal Caribbean Cruises (NYSE: RCL), and Norwegian Cruise Line (NYSE: NCLH) up 12.9%, 8.3%, and 14%, respectively, through Thursday at 1:27 p.m. ET, according to data from S&P Global Market Intelligence.

Cruise lines had been battered by the COVID-19 pandemic, but have been digging themselves out of their respective debt holes for the past two years. Fortunately, pent-up desire for travel and experiences has led to strong and resilient demand for cruising, even through high oil prices in 2022 and higher interest rates in 2022 and 2023.

With the economy remaining resilient and interest rates now coming down, cruise stocks got even more good news this week, when one Wall Street analyst upgraded the sector.

Citi upgrades the cruise lines

On Wednesday, Citigroup analyst James Hardiman upgraded the entire cruise sector, while raising the firm's price targets on all three names. The analyst raised the price target on Carnival from $25 to $28, Royal Caribbean from $204 to $253, and Norwegian from $20 to $30.

Analysts have grown more optimistic on each cruise line's ability to continue profitable growth and dig themselves further out of debt as time goes on.

For Carnival, Hardiman remained optimistic in the wake of recent third-quarter financial results reported Sept. 30. In its fiscal third quarter, Carnival's revenue grew 14% and net income surged over 60% to $1.7 billion. Management also raised its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) guidance for 2024 to $6 billion, up $200 million relative to the guidance given in June. Importantly, the company's debt was recently upgraded by ratings agencies, a point management was quick to point out.

Hardiman remains optimistic that Carnival's new private island in the Bahamas, called Celebration Key, should bring in more profitable growth ahead. The analyst also noted that Carnival's focus on moderate but highly profitable growth should enable it to pay down debt over the next few years.

Image source: Getty Images.

Hardiman also had positive things to say about Royal Caribbean and Norwegian. Royal Caribbean is the least indebted of the three, and Citi expects the company to report strong growth, with 6% capacity growth and earnings inflecting at an even faster pace in the year ahead. Citi also believes Royal Caribbean will come out with a long-term financial plan and outlook in the next couple of quarters, which could be a catalyst for the stock.

Meanwhile, Citi saved the biggest-percentage price target hike for Norwegian amid a slight shift in its business strategy. Previously, Hardiman noted, Norwegian pursued a premium experience strategy, but also spent lavishly to do so. Now, the analyst sees management focusing more on costs, which could lead to outsize bottom-line growth. "Norwegian's shift in strategy from quality at all costs to a more balanced yield/cost relationship gives us confidence that the considerable pricing power and the company's increased focus on costs 'can't help but bear fruit,'" he wrote, according to Reuters.

Cruise lines look cheap, but need the good times to continue

The cruise lines stocks, despite positive performance this year, still look cheap on a forward P/E basis, with Carnival, Royal Caribbean, and Norwegian trading at 12, 14.6, and 12.6 times forward earnings, respectively.

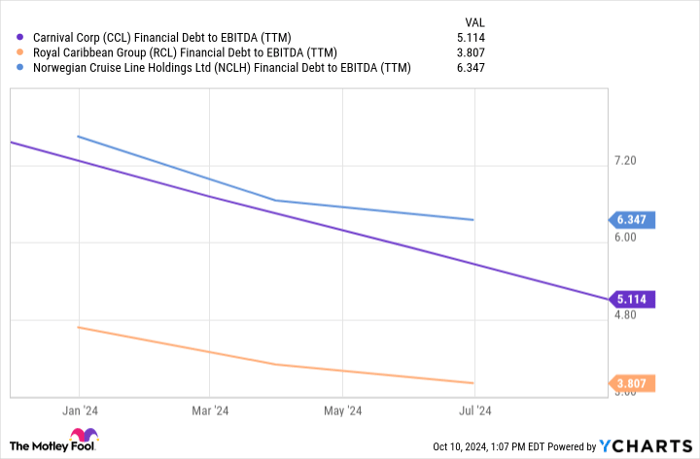

However, investors should understand that each company still has a substantial debt load in relation to its EBITDA.

CCL Financial Debt to EBITDA (TTM) data by YCharts

This means that the cruise stocks could catapult higher if results stay strong and each pays down its debt, helped along by lower interest rates. However, should the economy hit a downturn or oil prices and/or interest rates rise again, there could be significant downside.

Cruise line stocks are therefore appropriate for the higher-risk, high-upside portion of your portfolio. Fortunately for existing shareholders, this week's Citi upgrade was a positive indicator that the upside scenario looks very much intact at the moment.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Billy Duberstein has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.