The Smartest Growth Stock to Buy With $500 Right Now

One of the market's fastest-growing growth stocks has very little name recognition. There's a good chance this will be the first time you'll have heard of this business. Yet it could soon be worth hundreds of billions of dollars. If you need any more convincing, know that shares happen to be owned by one of the most famous investors of all time.

This ancient market was ready to skyrocket

In decades past, the Latin American banking market was behind the times. The industry, controlled by a handful of powerful incumbents, charged the 650 million people in Latin America high fees for simple services. But because these banks had the resources to run thousands of physical branches, they were able to keep a stranglehold on consumers.

But then Nu Holdings (NYSE: NU) came along in 2013. At the time, only a few banks dominated 90% of Brazil's banking sector. A little over a decade later, more than half of all Brazilian adults have become Nu customers. Taking over a market this quickly with such dominance is a rare event. How exactly did Nu accomplish this feat?

Whereas incumbent banks were focused on maintaining costly physical branches, Nu opted to go straight to the consumer, providing them access to financial services directly through their smartphones. While this may seem commonplace today, it wasn't in 2013, especially in Latin America. Because Nu had little physical infrastructure, its costs were lower, and thus it was able to offer better terms at a lower price for customers versus the competition.

The company was also able to innovate faster. When Nu launched its crypto-trading platform in 2022, for instance, it registered more than 1 million users in its first month of service.

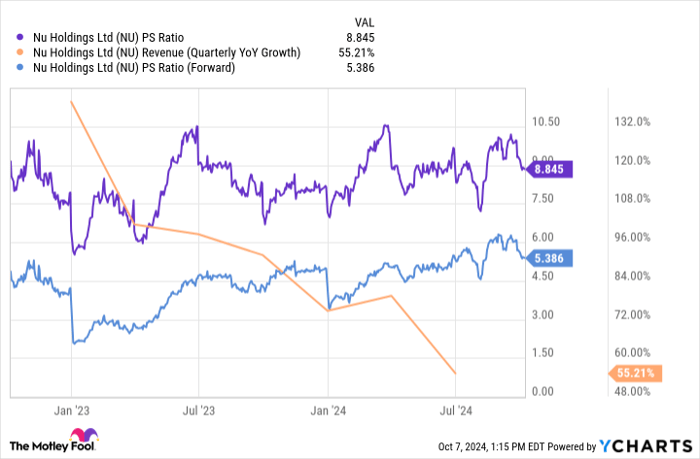

In recent years, Nu has replicated its recipe for success in adjacent markets, including Mexico and Colombia. And while growth rates are slowing over time, sales are still growing by more than 50% per year -- an incredible feat for a $60 billion bank that few people outside Latin America have ever heard of yet. Shares trade at a lofty 8.8 times sales. But given the fast growth rates, that multiple will quickly become reasonable. Based on next year's sales projections, for example, shares trade at just 5.4 times forward revenue.

NU PS Ratio data by YCharts.

This famous investor is betting on Nu stock

Need more evidence that Nu is a promising growth stock? Look no further than Warren Buffett's portfolio. His holding company Berkshire Hathaway owns more than $1 billion in shares. The position was first disclosed in 2021 when Nu held its initial public offering (IPO). And since that time, Berkshire hasn't registered a single sale despite heavy gyrations in Nu's stock price.

It's not hard to see what Buffett loves about the company. It has a proven, innovative strategy for growing a highly profitable business with potentially decades of runway to go. And yet, the shares remain reasonably priced at just 42 times earnings. If that multiple sounds high, just know that shares trade at just 31 times forward earnings. Note that the S&P 500 as a whole now trades at around 30 times earnings.

So in a few years, there's a chance that Nu stock trades at a discount to the market based on today's valuation. That's a quick payoff for a company that should outgrow the market for many years to come.

Looking ahead, analysts now expect the company to grow earnings by at least 50% per annum through 2029. If that's achieved, the current share price is undoubtedly a strong buy at these prices.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.