Think Micron Technology Stock Is Expensive? This Chart Might Change Your Mind.

Some investors think Micron Technology (NASDAQ: MU) stock is incredibly expensive. In a certain slant of light, they're not wrong.

The memory-chip maker's shares trade at -- make sure you have a seat -- 151 times trailing earnings and 932 times free cash flow today. That's a lofty valuation by anybody's standards.

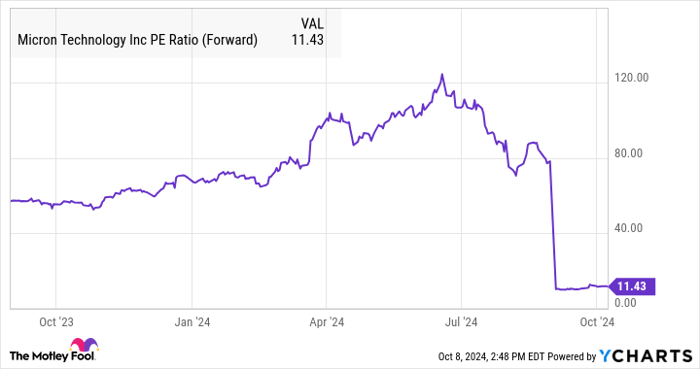

But there are other ways to assess Micron's market value. The company is in a position to turn a corner and deliver stellar earnings growth in the next few quarters. As a result, Micron's stock looks downright cheap when its share price is measured against forward-looking earnings estimates:

MU Price-to-Earnings Ratio (P/E) (Forward) data by YCharts.

Micron reported its full-year 2024 results last week. Full-year sales surged 62% higher year over year. The unadjusted bottom line swung from a net loss of $5.34 per share to a profit of $0.70 per share.

This company's management isn't in the habit of offering full-year financial forecasts, but the midpoint of Micron's guidance for the next quarter points to an accelerated 84% revenue jump and a net profit of roughly $1.54 per share. That's more than double the total profit of the full fiscal-year 2024 in a single quarter.

Micron's competitive advantages

The financials are soaring for good reason. The cyclical memory-chip industry was due for an upswing, anyway, and that positive trend was accelerated by the artificial intelligence (AI) boom. From engine-training systems to consumer-facing services, the computers involved in AI require a ton of high-speed memory.

Micron is not only a leading provider of these chips, but also boasts an in-house network of advanced manufacturing facilities. The company is also building more factories at the moment while boasting technological advantages over high-end memory makers.

Micron's stock doesn't strike me as expensive at all. The memory giant has plenty of growth-boosting balls in the air, and its earnings are about to make a major breakthrough.

It's an affordable stock in every sense that matters. Yesterday's results can't create investor value tomorrow.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Anders Bylund has positions in Micron Technology. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.