Where Will Deckers Outdoor Stock Be in 1 Year?

Deckers Outdoor (NYSE: DECK) has emerged as one of the hottest consumer goods companies in the stock market with shares up 95% this year.

The footwear maker benefits from the breakout phenomenon of its HOKA high-performance running and hiking shoe brand crossing into the lifestyle segment. The company's latest-earnings report was highlighted by strong growth and accelerating profitability.

The outlook is positive, but are the trends good enough to keep the rally in shares of Deckers Outdoor going? Here's what you need to know.

Strong fundamentals into 2025

Deckers Outdoor, long recognized for its iconic UGG brand of sheepskin boots, also owns a variety of smaller footwear labels like Teva. Maybe the most important piece of that portfolio is Hoka, acquired in 2012 for a reported $1.1 million when the brand only generated around $3 million in annual sales.

The deal has been a smashing success. Hoka is on track to generate more than $2 billion in sales this year. It's a large part of why Deckers Outdoor stock has returned a massive 584% over the past five years. Hoka stands out through its unique functional design and approach to cushioning. Hoka's curved "rocker" outsole has been described as enhancing comfort and improving performance in endorsements by professional runners.

Image source: Getty Images.

In the latest-reported period -- its fiscal 2025's first quarter (ended June 30) -- Deckers Outdoor's revenue climbed by 22%, led by an even stronger 30% increase from the Hoka brand.

First-quarter earnings per share (EPS) of $4.52 were up 88% driven by a sharply higher gross margin, reflecting the ongoing sales-mix shift in the premium pricing of Hoka shoes. At the same time, the UGG brand has also performed well as sales climbed by 14% year over year, balancing more volatile trends in the smaller Teva and Sanuk segments.

For the full year, Deckers expects net sales to reach $4.7 billion, an increase of 10% from last year. The company is forecasting 2025 EPS growth between 2% and 5%, which factors in a ramp-up in capital expenditures toward its supply chain and warehouse capacity.

Fundamentals are supported by a rock-solid balance sheet with $1.4 billion in the company's cash position against zero-financial debt. The company has been actively repurchasing shares, buying back $152 million in Q1 with $790 million under the remaining authorization.

Room to stay bullish on Deckers' stock

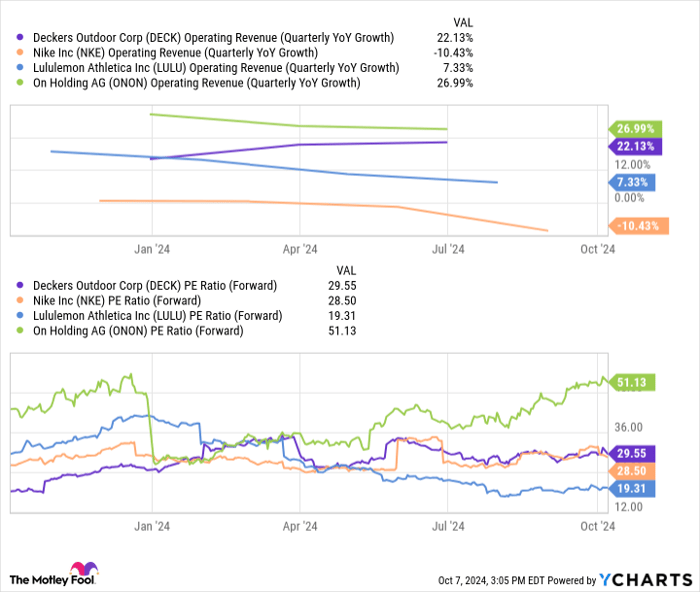

Recent results from Deckers Outdoor are particularly impressive at a time when other footwear and apparel-industry leaders are citing sluggish consumer demand. That includes Nike and even Lululemon Athletica, which have experienced a sales slowdown, making room for Deckers to capture market share.

The company sees an opportunity to continue expanding internationally while entering new product categories, including apparel, to leverage its brand momentum and loyal customer following.

In many ways, the attraction of Deckers as an investment is that layer of diversification where, beyond the Hoka brand, UGG remains a separate growth driver with room to build out its new concept brands like Koolaburra or Ahnu, which could one day evolve into the next Hoka. Expectations are for the company to gradually transform from its focus on footwear toward more of a lifestyle portfolio over time, which should be positive for earnings as a catalyst for the stock.

The shares trade at a forward price-to-earnings (P/E) multiple of 30 based on a full-year consensus EPS estimate. While this earnings multiple represents a premium to industry peers like Nike at a forward P/E of 29 or even Lululemon at 19, I believe Decker's valuation is justified given its financial strength. The company's trajectory draws parallels to high-growth On Holding with its ON brand of performance running shoes as a close competitor to Hoka. In this case, Deckers' stock seems like a bargain compared to On Holding trading at a forward P/E of 51.

DECK Operating Revenue (Quarterly YoY Growth) data by YCharts.

The big picture

There's a lot to like about Deckers Outdoor, with the stock deserving of a buy rating in my opinion. It likely won't be a straight line upward from here, but there's a good chance the share price will be higher by this time next year. As long as macroeconomic conditions remain resilient, the company is well- positioned to deliver positive-shareholder returns over the long run and can work for investors within a diversified portfolio.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,423!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $392,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.