These 3 Billionaires Have Massive Stakes in Coca-Cola Stock

I put the word "billionaire" right in the headline because I know that investors want to know what the billionaires are doing. People tend to call this the "smart money." A lot of people believe that if you know what smart, informed billionaires are investing in, you can make better investing decisions as well.

Shares of Coca-Cola (NYSE: KO) are clearly popular among billionaire investors. Sometimes the investment is direct and other times the investment is indirect through an affiliated hedge fund. But billionaires Warren Buffett, Ken Griffin, and Jeremy Grantham all have significant stakes in this beverage giant.

Buffett is in charge of Berkshire Hathaway, which is an enormous conglomerate with a large investment portfolio. In 1988, Berkshire Hathaway started buying Coca-Cola stock. And today, that position is worth nearly $28 billion, or about 9% of the value of the company's portfolio.

Griffin runs Citadel Advisors, which has a multibillion-dollar portfolio. Citadel's position in Coca-Cola isn't as large as Berkshire Hathaway's position, but at over $1 billion, Citadel's stake in the beverage giant is significant.

Finally, Grantham runs his fund, GMO. His stake in Coca-Cola is valued at approximately $750 million, making it a smaller position than what Buffett and Griffin own. That said, 2.5% of Grantham's portfolio is in Coca-Cola stock compared to only about 1% of Griffin's portfolio.

Why billionaires buy Coca-Cola stock

Everyone knows about Coca-Cola's eponymous beverage. According to Beverage Digest, Coca-Cola was the top soda brand in the U.S. again in 2023, with over 19% market share. It's enjoyed the top spot for decades and holds similarly attractive market share in other markets around the world.

However, Coca-Cola is much more than just its namesake soda. The company owns more than 200 beverage brands. Management says 64 billion beverage servings are consumed daily around the world. And its portfolio of products accounts for a whopping 2.2 billion of those.

Moreover, Coca-Cola's distribution network is absolutely massive, giving the business impressive reach. This scale is why Buffett once said, "If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done."

In short, consumers around the world purchase beverages every single day and likely will continue to do so for a long time. Coca-Cola's products address every corner of the non-alcoholic beverage market and are available everywhere. This makes Coca-Cola one of the strongest and most resilient businesses on the planet.

Should everyone own Coca-Cola stock?

I believe it's imperative to remember that every investor is in a unique financial situation. The motivations of a billionaire investor can be significantly different from the average investor. Therefore, investment decisions from billionaires shouldn't be blindly followed.

For many investors, the goal is simple: outperform the S&P 500. These investors are trying to grow their wealth and could do so by simply buying an S&P 500 index fund. However, to grow their wealth at a faster pace, they prefer to buy shares of individual companies.

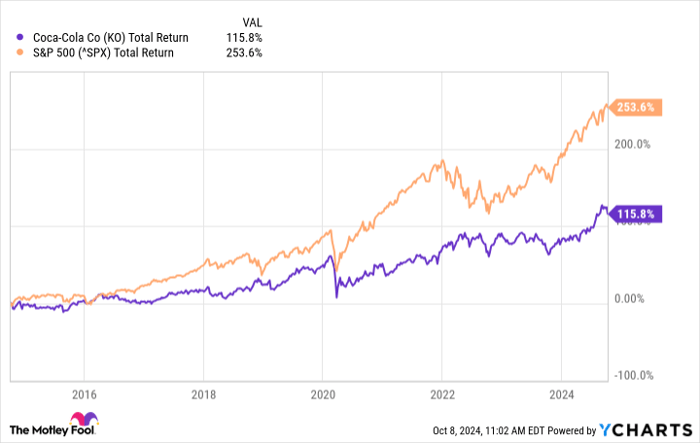

However, Coca-Cola stock has underperformed the S&P 500 over the last 10 years, even when reinvesting dividends, as seen below.

KO Total Return Level data by YCharts

Why would billionaires own a stock that underperforms the market? To reiterate, investors each have their own motivations. For Buffett, his company will receive nearly $800 million in dividend payments from Coca-Cola this year. Considering he purchased his stake in the company nearly 40 years ago, he is content to passively collect his dividends, redeploying that capital into other investment opportunities with higher upside.

For his part, Grantham is known for being regularly pessimistic regarding macroeconomic conditions. Right now, he's saying the stock market is "dangerous" and the "most vulnerable market there has ever been." Whether he's right or wrong is irrelevant to this discussion. What matters is that if an investor believes stocks are dangerous, then it makes perfect sense to mitigate downside risk by owning a large position in one of the safest stocks in the world with Coca-Cola.

In closing, Coca-Cola stock is popular among billionaire investors. But remember that their financial situation is different from most investors. Picking stocks that go up in value isn't easy and an investor could certainly do worse than buying Coca-Cola stock. But shares of this mature business routinely underperform the market average, which means that many investors should look elsewhere when trying to grow their own wealth.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.