Should You Buy the Dip on Snowflake Stock?

Snowflake (NYSE: SNOW) used to be one of the highest flyers on Wall Street. However, after a few disappointing results and slowing growth, it lost its luster, and the stock sits around its all-time low. This has been a particularly disappointing year, as the stock has declined over 42% in 2024 alone, while the Nasdaq Composite has increased by about 20%.

With that kind of underperformance compared to a common tech stock measuring stick, Snowflake investors may be wondering if it's time to jump ship. While it has been a disappointing year, there may be a reason or two to hold on to the stock, and maybe even buy more.

Snowflake's data cloud product has seldom been more applicable

Snowflake's product centers around the data cloud. Whether it's collecting data, storing it efficiently, using that data to feed applications, or running data science on a data set, Snowflake has its customers covered. Data is incredibly important to ensure businesses are making the best possible decisions, as using old information can be a serious misstep in today's competitive environment.

However, another use for data has emerged recently. Artificial intelligence (AI) models are hungry for data and become the most useful when large data sets are fed into them during training. For companies that want to develop their own AI models internally, having a wide and diverse data set from internal data is critical. This widens the use case for Snowflake's products, which gave investors hope last year that it could capitalize on the AI race.

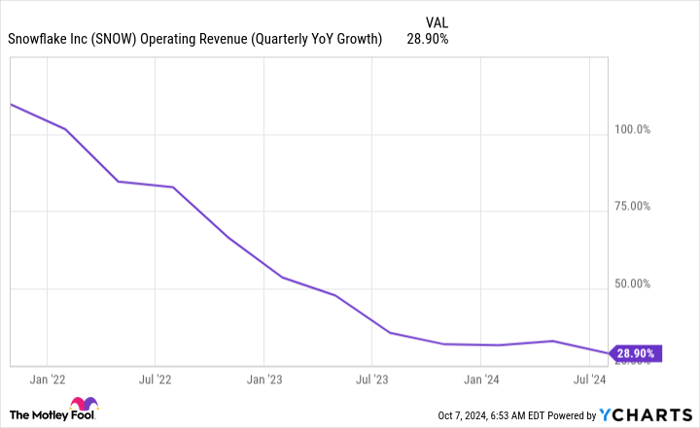

Unfortunately, Snowflake hasn't seen the benefit that investors expected. Over the past few quarters, Snowflake's year-over-year revenue growth figure decelerated.

SNOW Operating Revenue (Quarterly YoY Growth) data by YCharts.

This may lead some investors to the conclusion that Snowflake is a failed company, but I think that's far from the truth. In second-quarter fiscal year 2025 (ending July 31), Snowflake had 10,249 customers, up from 8,456 last year. That's up 21% year over year, which is less than its revenue growth. This is a very important mismatch, as it shows existing customers are still accounting for a healthy chunk of its revenue growth.

Snowflake's net revenue retention rate can quantify existing customer growth. This metric was 127% in Q2, which means that existing customers spent $127 in Q2 for every $100 they spent last year.

Clearly, Snowflake is still posting strong growth. However, because investors remember Snowflake's rapid growth a few years ago, they think Snowflake is a failing business.

But there are some real pitfalls with Snowflake, too.

Snowflake is still a long way away from turning a profit

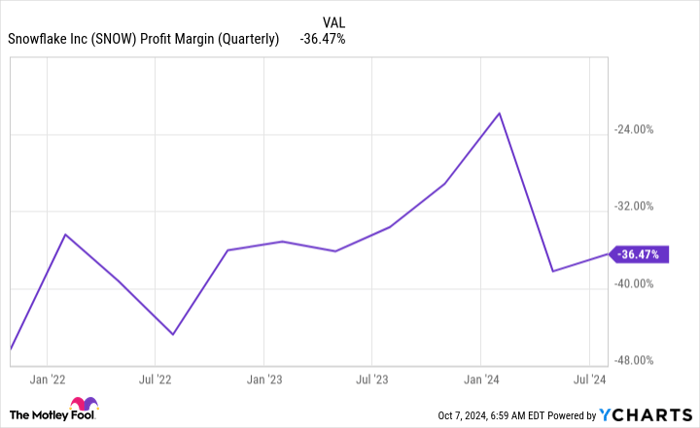

Since it debuted on the public markets, Snowflake has been horribly unprofitable, and it's not getting any better.

SNOW Profit Margin (Quarterly) data by YCharts.

With Snowflake having a long way to go to break even, investors are getting a bit nervous. Normally, companies pivot to become more efficient and focus on profits when growth slows down. Snowflake isn't doing that, and some investors are concerned that it may never break even.

However, it's worth noting that in a vacuum, Snowflake still posted a fairly high year-over-year revenue growth rate when compared to other software companies.

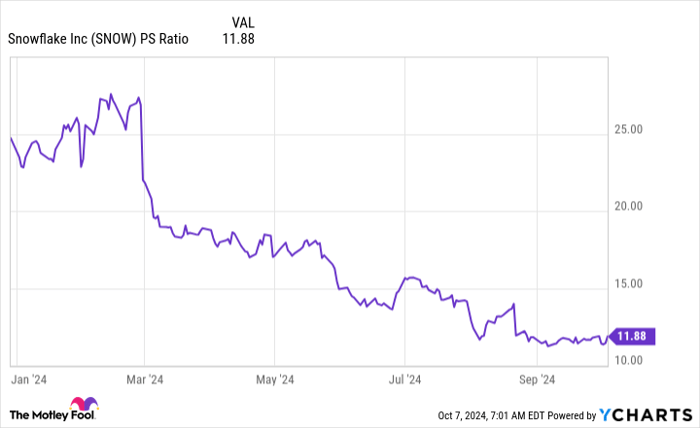

Because Snowflake isn't anywhere close to profitable, I'll use the price-to-sales (P/S) ratio to value the business. At 12 times sales, Snowflake's stock doesn't fetch much of a premium for a software stock.

SNOW P/S Ratio data by YCharts.

The biggest question is when Snowflake will make progress toward improving its bottom line. I still believe in Snowflake as a company, as its product is incredibly useful and has growing use cases. Revenue growth is still outstanding, but profits are a big problem.

Snowflake is a stock that could be bought now and likely be a successful investment, but I want to see improving margins before I dive in, as management has failed to do that despite the shifting landscape. However, if you have a greater risk tolerance, Snowflake may be a steal right here.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Keithen Drury has positions in Snowflake. The Motley Fool has positions in and recommends Snowflake. The Motley Fool has a disclosure policy.