1 No-Brainer Marijuana Stock to Buy and Hold Forever

The cannabis industry has faced significant challenges in recent years, with most marijuana stocks losing over half their value in the past five years. This downturn can be attributed to factors such as slow progress toward U.S. federal legalization, burdensome tax regimes, and competition from the black market. Many companies have also struggled with supply/demand mismatches due to managerial missteps.

Despite these hurdles, the cannabis market's long-term potential remains substantial. Industry analysts project global cannabis sales to grow at a compound annual rate of 34% from 2023 to 2030, potentially reaching $444 billion by the decade's end. This explosive growth presents a significant opportunity for well-positioned companies.

Image source: Getty Images.

Here's a closer look at one top-tier U.S. multi-state operator (MSO) that stands out as a potential long-term winner in the cannabis industry.

Green Thumb: A cannabis powerhouse with nationwide reach

Green Thumb Industries (OTC: GTBIF) is a major player in the U.S. cannabis market. The company operates across 14 states, with 20 manufacturing facilities and 98 retail locations. Green Thumb's diverse portfolio includes popular cannabis brands such as Beboe, Dogwalkers, and RYTHM.

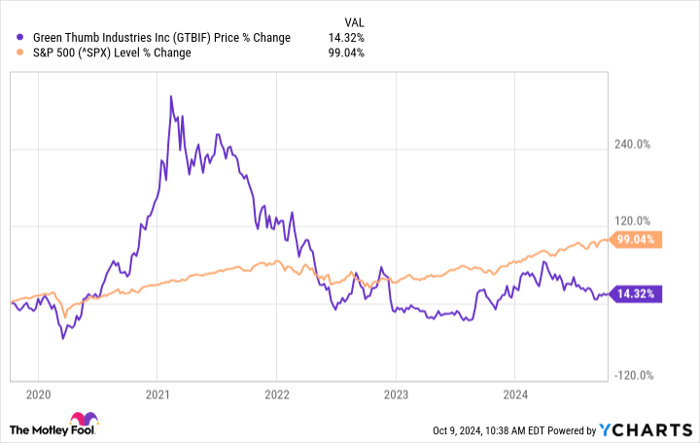

Wall Street analysts believe the stock is undervalued by 57% from current levels, reflecting its growing footprint, product portfolio, and customer base. Green Thumb's stock has shown strength in this challenging environment, delivering a positive 14.3% return over the past five years.

GTBIF data by YCharts.

While this falls well short of the S&P 500's 99% gain during the same period, it highlights Green Thumb's relative strength within the struggling cannabis industry.

Financial strength in a challenging market

Green Thumb's strong financial performance drives its relative outperformance. In the second quarter of 2024, the company reported revenue of $280 million, an 11% year-over-year increase. More notably, Green Thumb achieved a GAAP net income of $21 million and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $94 million.

The company's cash-flow generation is a key strength. Green Thumb reported $104 million in cash flow from operations for the first half of 2024.

This financial strength has allowed the company to maintain a robust balance sheet, with $196 million in cash at the end of Q2 2024. However, it's important to note that the company exited the most recent quarter with $309.7 million in outstanding debt.

Management confidence reflects a growing top line

Green Thumb's management has shown confidence through share buybacks. The board recently authorized a $50 million share-repurchase program, allowing for the buyback of up to 10,573,860 shares over the next 12 months. This follows a previous program that saw the company repurchase 6.5 million shares for $73.3 million.

Analysts project 7% top-line growth for Green Thumb in 2025. While modest, this high-single-digit growth rate reflects the company's substantial revenue base and the challenging regulatory environment.

Strategic positioning for future growth

With a market cap of approximately $2.42 billion, Green Thumb is the second-largest cannabis company in the world. The company's sizable footprint positions it to benefit from growing U.S. legal market demand. Green Thumb's focus on states with large populations and limited licenses -- including Illinois, Massachusetts, New York, Florida, and Ohio -- provides a strategic advantage.

The company's growth strategy centers on states with robust medical cannabis markets and momentum toward future recreational legalization. This approach aligns well with the projected high-teens average annual growth rate for the U.S. recreational market over the next decade. While Green Thumb currently lacks international operations due to federal illegality, this could change if U.S. laws are reformed.

Potential risks and challenges

Investors should be aware of potential challenges, including the risk of increased taxes on cannabis products and competition from the black market. Additionally, Green Thumb's current inability to cultivate internationally may limit its competitiveness in the global medical cannabis market once federal laws change.

Despite these challenges, Green Thumb's strong financial performance, strategic market positioning, and growth potential make it a compelling option for investors looking to gain exposure to the cannabis industry. As the U.S. market continues to evolve and mature, Green Thumb appears well-positioned to capitalize on the opportunities ahead.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,579!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,710!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,239!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Green Thumb Industries. The Motley Fool has a disclosure policy.