This Artificial Intelligence (AI) Stock Plunged 15% in the Last Month. Here's Why I'm Not Selling.

Artificial intelligence (AI) stocks come in all shapes and sizes. Some are companies built from the ground up to use AI, while others simply adopted it to adapt to the current environment. Adobe (NASDAQ: ADBE) is one of those companies that integrated AI into its line of graphic design tools, but the stock hasn't reacted positively.

The stock fell 15% since its last earnings report was released. However, I don't think there is any reason to sell the stock here, and this could be an opportunity to buy more.

Adobe integrated generative AI into its product suite

Adobe's graphic design suite is the default product for those working in a field requiring digital media creation. This field could be disrupted by generative AI technology, as many of the top models have image-generation capabilities. However, Adobe got ahead of this and developed its own generative AI model, Firefly.

Firefly is incredibly useful. It allows its users to modify image and vector files with text input. It's also working on a version that can be used for video, which is a capability few generative AI models currently have. The use of Firefly has been incredible, with management stating that more than 12 billion images have been created by Firefly.

Adobe is a shining example of a company that quickly pivoted to deploying generative AI before it was disrupted. By getting these tools into the hands of its users before other options became available, Adobe drastically reduced the risk of being replaced by another product.

This is key, as Adobe is the established player in this industry and needs to maintain its market dominance to maintain its premium price point.

Adobe's stock looks like a buy after its recent tumble

Adobe has long been the industry standard for what software companies want to be when they mature. It regularly posts nearly 90% gross profit margins and 30% net income margins.

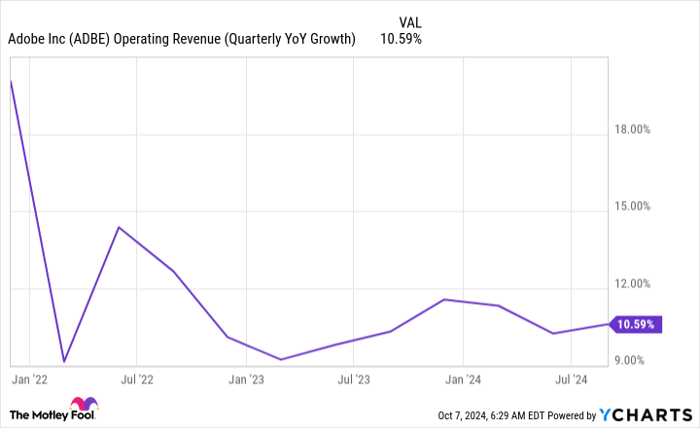

Although it's not growing nearly as fast as it used to, it consistently delivers double-digit revenue growth year over year.

ADBE Operating Revenue (Quarterly YOY Growth) data by YCharts

It generates a ton of free cash flow, which management uses to buy back stock. Over the past three years, Adobe reduced its outstanding shares by around 7%. While that's not a massive reduction, it's hard to make as big of a dent in the share count when the stock trades for a premium valuation.

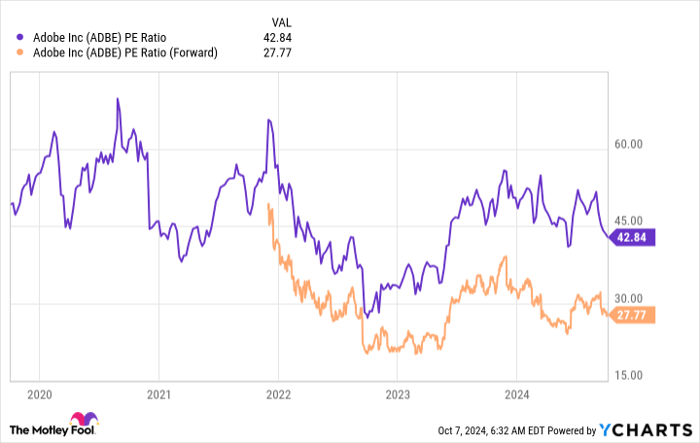

ADBE PE Ratio data by YCharts

Adobe's stock isn't cheap, at 43 times trailing earnings and 28 times forward earnings. Adobe has been executing at a high level for a long time, so it earns a premium valuation. However, 28 times forward earnings isn't that expensive compared to its consistent growth rate and execution history, especially when compared to some other stocks.

However, it was trading at a much higher price tag just last month based on Wall Street's reaction to its earnings report. So, what was in the report that was so bad?

It all had to do with its Q4 revenue guidance, which management projected would come in between $5.5 billion and $5.55 billion. However, Wall Street was expecting $5.61 billion, so the stock took a dive. This reaction isn't fair to Adobe, as it met all of management's projections.

Using the full-year revenue range guidance management gave in Q2 ($21.45 billion for fiscal year 2024) and comparing it to the revenue it generated in the first three quarters plus its Q4 guidance yields the exact same number. This is a case of Wall Street wanting Adobe to deliver more growth, but management does not agree with that assessment.

This is a ridiculous reason to sell off a stock, as investors knew what they were getting before these results were available. As a result, I don't think it's time to sell Adobe, and it may be time to take advantage of a historically attractive stock price. Adobe is still a top player in its space, even with generative AI affecting it, and I'm excited to see what other tools it will bring to market.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,579!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,710!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,239!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Keithen Drury has positions in Adobe. The Motley Fool has positions in and recommends Adobe. The Motley Fool has a disclosure policy.