Is AST SpaceMobile Stock a Buy Before Nov. 1?

On Sept. 12, 2024, AST SpaceMobile (NASDAQ: ASTS) took a bold leap into the future. That was the day it announced the launch of its first five operational satellites and, basically, the beginning of its ability to generate revenue from a space-based broadband network that works with regular cell phones.

The third quarter (ended Sept. 30) will be the first quarter in which the company provides an update on its progress with those five satellites. That news should come in early to mid-November.

What does AST SpaceMobile want to do?

AST SpaceMobile is looking to provide access to broadband and cellular services to people in remote locations. That could be in the middle of the ocean, the top of a mountain, or just in an area with minimal cell tower coverage. It's kind of similar to what Elon Musk's Starlink service, which is operated by the SpaceX company, is looking to do.

Image source: Getty Images.

There's a very important difference between Starlink and AST SpaceMobile. To use the Starlink service you need to buy dedicated equipment. To use AST SpaceMobile all you need is your cellphone and a subscription to the service. That vastly simplifies the process of using a space-based broadband mobile network.

The problem for AST SpaceMobile is that Starlink has a massive head start, given that it already has a substantial service offering. AST SpaceMobile has only proven its business concept with a single test satellite. But that is about to change, with the company having now launched five operational satellites. As AST gets set to report third-quarter 2024 earnings, investors are likely going to be far more interested in the progress with those satellites than they will be with the company's earnings figures.

The big questions and ongoing red ink

There are few important questions that need to be answered. For example, have the satellites been operating as expected? Have they been successfully tested? And when can these satellites start generating revenue for the company? When that happens, how much revenue should Wall Street expect to see on an ongoing basis? And, perhaps, is that a scalable number to use as more satellites get built and launched?

What most investors won't expect is a profit. In fact, it is highly likely that AST SpaceMobile will continue to bleed red ink for years to come. Why? Because five satellites are just a drop in the bucket, with management suggesting that at least 95 are needed for it to provide the full service that it envisions. So there are 90 more satellites to go and, extrapolating the company's math on the cost of the next 20, it has around $1.8 billion more to spend before it is done building out its full satellite network. Profits are unlikely to be on the horizon for a long time.

And yet there's an important sidebar here. AST SpaceMobile isn't trying to go it alone as it builds this service. It is partnering with major cellphone carriers, highlighted by agreements it has in place with AT&T and Verizon Communications. These and other partnerships should provide AST SpaceMobile with a customer pool to fish in and will give it access to deep-pocketed cellphone companies to help it afford to build out its satellite network.

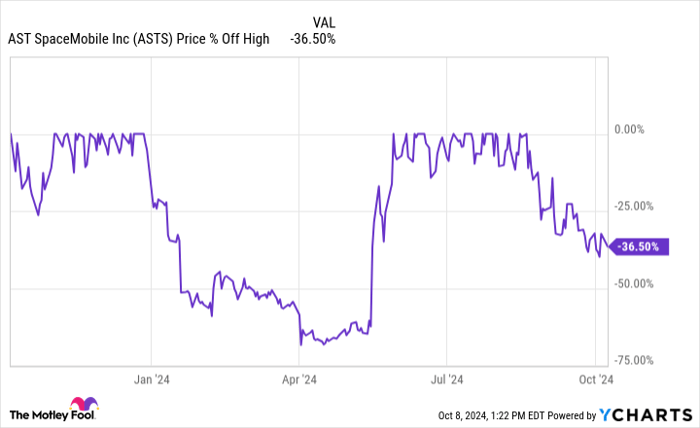

ASTS data by YCharts

AST SpaceMobile shares have rallied dramatically this year, but have pulled back about 33% from their most recent peak. Basically, it looks like investors got really excited about the satellite launch, and that enthusiasm has trailed off. However, this is an important turning point for the company since it is going from a proof of concept to an actual product. If you are an aggressive investor with a long-term growth approach, AST SpaceMobile could be worth the risk of buying before the operational update when it reports third-quarter earnings.

AST SpaceMobile needs a good update, not a great one

It seems unlikely that AST SpaceMobile is going to tell investors that it is done setting up the five satellite mobile broadband systems it just launched or that revenue is suddenly pouring in the door. It is far more likely to say that testing is going as well as hoped and then provide a date when a small-scale service will be operational. But that should be enough to keep long-term investors happy, since AST SpaceMobile is still building its service out. Indeed, good execution, even if it means just incremental steps forward, will likely be enough to signal that the long-term future remains bright for this upstart competitor to Starlink.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,579!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,710!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,239!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.