2 Vanguard ETFs That Could Take Off As Rates Come Down

The Federal Reserve cut the fed funds rate by 50 basis points with additional cuts forecast over the next year or so. If this proves to be a sustained rate-cutting cycle, all sorts of stocks have the potential to benefit. In the current elevated interest rate environment, big tech and stocks involved with artificial intelligence are some of the few stocks to perform well. With rates falling, several other sectors will find opportunities to take advantage.

Two types of stocks investors will want to pay close attention to are real estate investment trusts (REITs) and small-cap stocks. The former will be more attractive as the debt that REITs hold will become less costly to finance. They also provide investors with a good source of dividend income, which can be in high demand as interest rates fall in saving accounts and other non-market categories. The latter, meanwhile, can rally due to lower financing costs, as small-cap stocks often need a lot of funding to grow their operations.

A couple of Vanguard exchange-traded funds (ETFs) that can give you exposure to these two investment sectors are the Vanguard Real Estate Index Fund ETF (NYSEMKT: VNQ) and the Vanguard Small-Cap Index Fund ETF (NYSEMKT: VB). Let's look at how these two ETFs can benefit.

1. Vanguard Real Estate Index Fund ETF

The Vanguard Real Estate Index Fund ETF holds a wide range of REITs in its portfolio, spanning multiple areas. It will give you exposure to office REITs, industrial REITs, hotel REITs, and many others. The broad diversification it offers means you don't have to worry about picking the right type of REIT to hold in your portfolio.

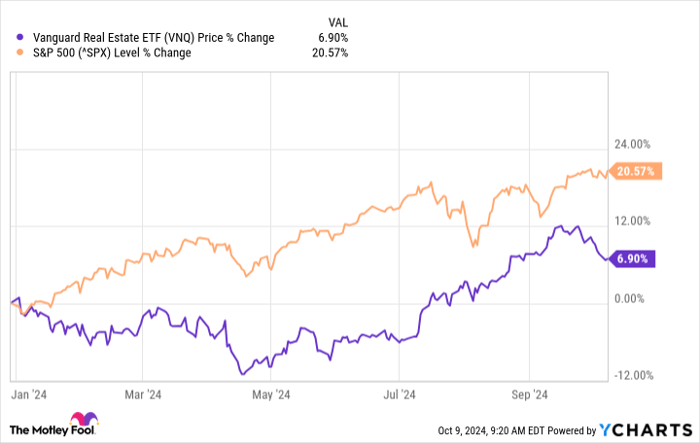

Data by YCharts.

It contains 155 stocks and charges a fairly low expense ratio of 0.13%. Some of the larger holdings in the ETF include Prologis, Public Storage, and Realty Income. The Vanguard fund has risen by around 7% this year, as it has widely underperformed the S&P 500 and its 20.6% returns over the same timeframe. The bulk of the fund's gains have come in the past few months as investors have been anticipating rate cuts and more favorable conditions for REITs.

Another attractive reason to hold this ETF right now is that it yields 3.7%, which is close to three times the S&P 500 average yield of 1.3%. As the fund rises in value, that yield could quickly come down, giving investors an incentive to buy before that happens. Whether you want to invest in REITs or just want to collect a lot of dividend income, this Vanguard fund can be a great investment to consider today.

2. Vanguard Small-Cap Index Fund ETF

Investing in small-cap stocks can seem risky. Investors may not be as familiar with these types of companies as they might be with bigger, more prominent names. The Vanguard Small-Cap Index Fund ETF, however, can keep that risk extremely low, as it contains 1,400 stocks. No one stock makes up even 1% of the fund's overall weight, so investors don't have to worry about the volatility that can come with investing in a small-cap stock.

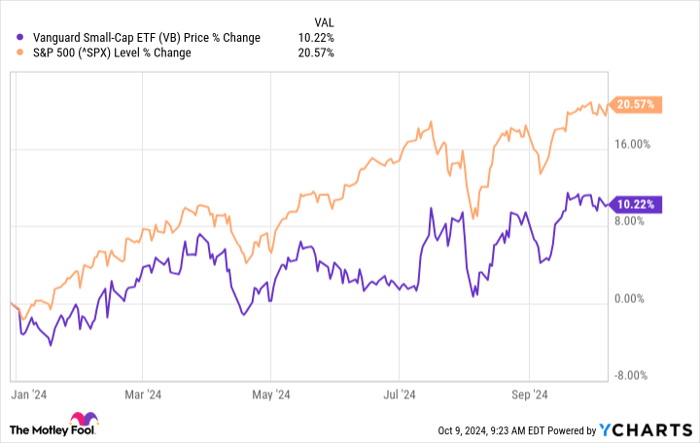

Data by YCharts.

Instead, investors have broad exposure to a wide range of different types of small-cap stocks, including Builders FirstSource, Deckers Outdoor, and Atmos Energy. Industrial stocks account for the largest slice of the fund's weight (22%), followed by consumer discretionary (16%) and financials (15%). The passively managed fund has a minuscule expense ratio of 0.05%, making it an ideal option for investors who don't want to see fees chip away at their overall returns.

The Vanguard Small-Cap Index Fund ETF has risen by 10% this year, but it could have a lot more upside as rates come down. At the very least, it can give you a good way to diversify your portfolio into growth stocks, which can have a lot of room to rise higher. This fund also provides investors with a modest dividend yield of 1.4%.

Should you invest $1,000 in Vanguard Real Estate ETF right now?

Before you buy stock in Vanguard Real Estate ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Real Estate ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Prologis, Realty Income, Vanguard Index Funds-Vanguard Small-Cap ETF, and Vanguard Real Estate ETF. The Motley Fool recommends the following options: long January 2026 $90 calls on Prologis. The Motley Fool has a disclosure policy.