1 High-Yield Dividend Stock to Buy and 1 to Avoid

If you invest in dividend stocks, the one thing you will hate to see is a dividend cut. Unfortunately, they do happen and you'll likely deal with one in your portfolio sooner or later. How you choose to handle a dividend cutter can depend a great deal on the company's business and its future prospects.

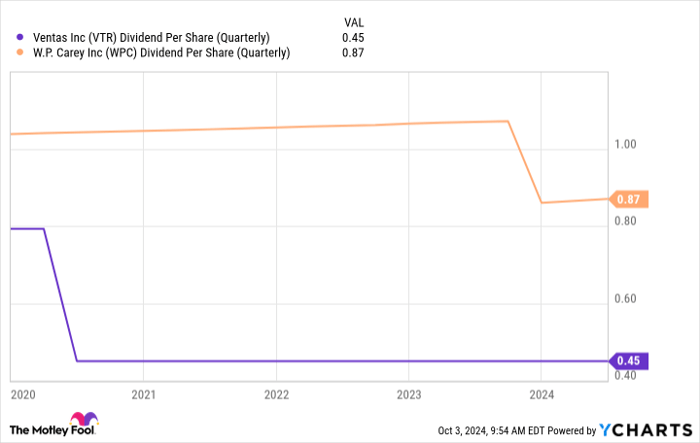

A good case study on both sides of this situation involves two dividend stocks I own that have cut their dividend. Right up front, I'll say that I'm so disappointed with my long-term investment in Ventas (NYSE: VTR) and so happy to keep owning W.P. Carey (NYSE: WPC). If you are looking at dividend stocks right now, W.P. Carey is the better choice.

Here's what you need to know and why I'm close to giving up on Ventas.

What happened to Ventas?

Ventas is a healthcare real estate investment trust (REIT) that owns senior housing assets, medical offices, and medical research facilities. It is one of the largest healthcare REITs and is generally well respected on Wall Street. That said, a significant portion of its senior housing portfolio is what is known in the industry as senior housing operating assets, or SHOPs. This means that Ventas owns the properties and runs them, too.

Image source: Getty Images.

Technically, it hires another company to operate the assets on its behalf. But this is still very different from leasing a property out because the performance of SHOP assets flows through to Ventas' top and bottom lines. When times are good this can turbocharge revenue and earnings. When times are bad it can lead to really troubling financial performance. The SHOP portfolio was why Ventas had to cut its dividend during the height of the coronavirus pandemic. With more move-outs and fewer move-ins, its cash flow was under a lot of pressure. And then it had to deal with tenants who leased senior housing who were feeling the same pinch.

The dividend cut made complete sense, which is why I decided to hold on to Ventas even after a dividend cut. But that was a long time ago now and Ventas has been talking up the growth opportunity ahead as occupancy levels increase. In fact, funds from operations (FFO) rose 7% year over year in the second quarter of 2024, led by 15.2% net operating income growth in the REIT's SHOP portfolio.

It looks like Ventas is out of the woods. Only Ventas still hasn't started to increase its dividend yet. Not even a token hike. The cut took place in the middle of 2020, so that's a very long time without even attempting to earn back the trust of dividend investors. I'm beginning to feel like Ventas' focus isn't where I want it to be, namely providing investors (like me!) with a reliable and growing income stream.

VTR Dividend Per Share (Quarterly) data by YCharts

What happened to W.P. Carey?

One of my biggest problems here is that REITs are specifically designed to pass income on to shareholders. So long as they pay out at least 90% of taxable earnings as dividends they avoid corporate-level taxation. That's actually a fairly low bar, since taxable income is impacted by noncash charges like depreciation (which is material for properties). Effectively, it is likely that Ventas could at least attempt to do a little more, just to signal to investors that it hasn't lost its way. Which is why right now most dividend investors will probably be better off with net lease REIT W.P. Carey. (A net lease requires tenants to pay most property-level operating costs.)

To be sure, Ventas' 2.8% dividend yield is well below that of W.P. Carey, which is offering a 5.6% yield. But there's a more fundamental issue here. W.P. Carey is among the most diversified REITs you can buy, with assets across the warehouse, industrial, and retail sectors, with a fairly large "other" category to round things out. It also has a substantial presence in Europe in addition to its North American portfolio. That said, management made the decision to exit office assets in late 2023.

The lingering impact of the pandemic on the office segment was the main driver of that choice. But because office made up 16% of the portfolio this change couldn't be enacted without a dividend reset. Not ideal, but understandable, just like it was understandable that Ventas cut its dividend in the face of COVID-19. And since W.P. Carey is a large and well-respected net lease REIT, it made sense to me to stick with the stock.

Here's where the most important difference between W.P. Carey and Ventas comes into play. The quarter after W.P. Carey reset its dividend it started to increase it again. It has increased the dividend every quarter since the reset, returning to the quarterly increase cadence that existed prior to the office exit. In other words, W.P. Carey is clearly telling dividend investors that they are important. Unlike Ventas, W.P. Carey is already working to earn back trust on Wall Street.

Buy W.P. Carey for more than the yield

Ventas is a generally well-run healthcare REIT, but W.P. Carey is a well-run REIT that also recognizes the importance of returning value to shareholders via regular dividend increases. I'm starting to look for an exit plan with Ventas at this point, but I have no intention of replacing W.P. Carey. And if you are looking at high-yield stocks, you might want to add W.P. Carey to your shortlist. Management clearly believes your dividends are important.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has positions in Ventas and W.P. Carey. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.