Can DocuSign Stock Double in Value Within the Next 2 Years?

DocuSign (NASDAQ: DOCU) is a stock that's taken a significant beating in recent years. The surge in demand it experienced during the early stages of the pandemic is long over and investors have become much more bearish on its future growth prospects, questioning just how attractive the company's opportunities truly will be in the long run, especially with loads of competition.

The company has been pivoting and working to diversify its operations so that it isn't only about e-signatures. It's a bold but possibly necessary strategy to help turn things around for the business. Contrarian investors are hopeful it will provide the catalyst DocuSign needs to generate much-needed growth and interest back into its brand. Can this stock, which is nowhere near the highs of more than $300 of 2021, possibly double in value within the next couple of years, as it expands its operations?

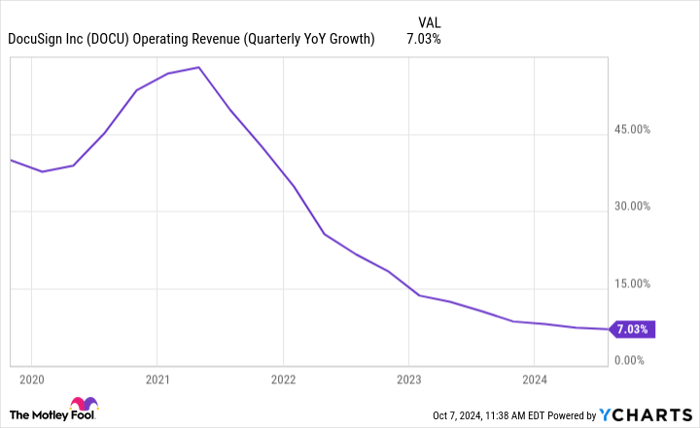

The problem with DocuSign is an obvious one: its growth rate is down big

DocuSign is facing considerable challenges, as there are many competing e-signature services. While DocuSign has built up a name for itself and it has generated $2.9 billion in revenue over the trailing 12 months, there's no question that business has slowed down significantly.

DOCU Operating Revenue (Quarterly YoY Growth) data by YCharts

A single-digit growth rate won't get growth investors too excited about the stock, hence the need for a bolder strategy. DocuSign is banking a wider array of services giving its financials a boost. It hopes that the complexity of reviewing and managing contracts will entice customers to use its intelligent agreement platform (IAM), which aims to streamline processes relating to agreements. DocuSign is still in the early stages of rolling out IAM to customers but management says it is "encouraged by the early results and customer feedback."

DocuSign's valuation remains low despite a big rally

Although DocuSign is down from the peak it hit a few years ago, its shares have risen by 50% over the past 12 months. A big part of the reason was that earlier this year, rumors of a potential acquisition led to excitement around DocuSign. But even with the increase in value, the stock still trades at a discount, with a price-to-earnings (P/E) multiple of around 14. By comparison, the average stock on the S&P 500 trades at 24 times its trailing earnings.

There is some risk with DocuSign stock which is why it comes at a steep discount, and where the stock goes will ultimately depend on the success of IAM. If the growth rate accelerates and gets back into double digits, that would likely rally the stock.

But for the stock to double in value and be a hot buy again, it would need to be commanding a P/E multiple that's likely twice as high as where it is now. And without solid data to back up and prove that IAM is the real deal and that it's winning over customers and resulting in a surge in sales, it might be a hard task to accomplish. Plus, many businesses are already using AI to automate processes, and whether there will be enough value added from IAM is the big question mark. Although management may be optimistic and happy with the feedback from customers right now, investors will want to see that translate into some tangible top-line growth.

Should you buy DocuSign stock today?

I'm not optimistic that DocuSign will be able to double in value in a few years or even in five years. The business faces a lot of competition and while AI can help it offer more services to customers, the same can be said for other comparable businesses offering enterprise solutions.

There isn't anything to suggest that DocuSign has a game-changing platform that is better than what other competitors might offer which will help it dominate the market. Between ChatGPT, Microsoft's Copilot, and many other companies offering services that can help with drafting up and analyzing contracts, I don't see it being an easy path for DocuSign to dramatically accelerate its growth rate due to the launch of IAM.

Investors are better off taking a wait-and-see approach with this stock as there's a real danger that DocuSign's growth rate may not get better...and it may even get worse with the growing number of AI services businesses have to choose from.

Should you invest $1,000 in Docusign right now?

Before you buy stock in Docusign, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Docusign wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Docusign and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.