Here's How Far $100 Per Month Can Really Go Investing in the Stock Market

Investing in the stock market is one of the most accessible ways to build savings over time, and even small monthly contributions can help you build life-changing wealth.

Exactly how much you could earn investing will depend on where you buy and how much you can afford to invest. Building a robust portfolio of individual stocks could help you beat the market and earn higher-than-average returns, but this approach can be expensive and research-intensive.

Image source: Getty Images.

If you're a beginner, it may be wise to start with an investment like an index fund or exchange-traded fund (ETF). These investments are bundles of stocks grouped together into a single fund. In other words, buying just one fund will get you a stake in hundreds or even thousands of stocks at once.

Again, your returns will vary significantly, depending on where you invest. But if you have just $100 per month to put toward the stock market, here's approximately how far it could go in a few different scenarios.

Choosing the right investments

Historically, the stock market as a whole has earned an average rate of return of around 10% per year. This means that while you very likely won't earn 10% returns every single year, the annual ups and downs should average out to roughly 10% per year over decades.

Some stocks and funds will earn higher returns than this, especially if you hand-select stocks that are poised for significant growth. Some ETFs can also beat the market, such as funds that only contain growth stocks or stocks from a particular industry.

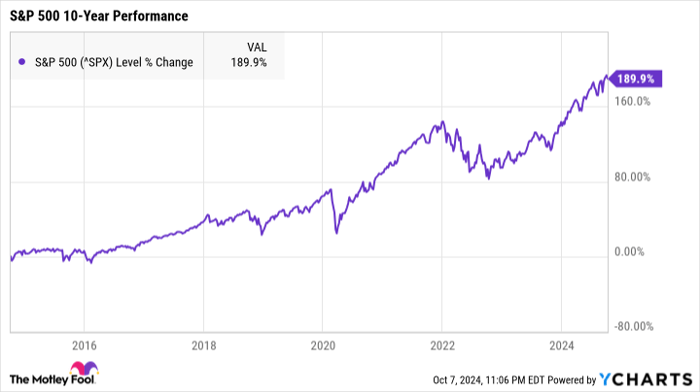

^SPX data by YCharts

Where exactly you choose to invest will depend on your goals, risk tolerance, and how much time and effort you're willing to put into your investment strategy.

Buying individual stocks can be the most lucrative approach. It requires significant research, however, as you'll need to study each company you're interested in owning to ensure it's a solid long-term investment. Then you'll need to do that a couple dozen more times, since you'll need at least 25 to 30 stocks for a well-diversified portfolio.

Index funds and ETFs are less customizable, and many may not be able to beat the market. However, they provide instant diversification and can be a much simpler, more straightforward way to get started in the stock market.

The path to lifelong wealth

For simplicity's sake, let's assume you're investing in a broad-market ETF, such as an S&P 500 ETF or total stock market ETF.

If you were to invest $100 per month, here's approximately how much you could earn over time, depending on whether you're earning a 10% average annual returns (in line with the market's historic average), a 9% average annual return, or an 11% average annual return:

| Number of Years | Total Portfolio Value: 9% Avg. Annual Return | Total Portfolio Value: 10% Avg. Annual Return | Total Portfolio Value: 11% Avg. Annual Return |

|---|---|---|---|

| 20 | $61,000 | $69,000 | $77,000 |

| 25 | $102,000 | $118,000 | $137,000 |

| 30 | $164,000 | $197,000 | $239,000 |

| 35 | $259,000 | $325,000 | $410,000 |

| 40 | $405,000 | $531,000 | $698,000 |

Data source: Author's calculations via investor.gov.

Time is an incredibly powerful tool when investing, and even if your investment earns below-average returns, you can still rack up hundreds of thousands of dollars in total savings if you give your money decades to grow.

No matter where you choose to invest or how much you can afford to contribute each month, getting started as early in life as possible is key. Even small amounts can go a long way, and the sooner you begin, the more you can potentially earn.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 793% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

The Motley Fool has a disclosure policy.