Will IBM Be a Trillion-Dollar Stock by 2030?

International Business Machines (NYSE: IBM) may finally be ready for a comeback. The stock finally surpassed its all-time high from 2013 this year, and with its transformation into a cloud and artificial intelligence (AI) company, investors have taken an interest.

This has given IBM a market cap of around $205 billion. Given its trajectory, that figure will likely continue rising, so much so that some investors may speculate on whether it can become a trillion-dollar stock by 2030. While nobody knows for certain whether it can reach that level, it is likely worth taking a closer look to gauge the potential for such an occurrence.

The state of IBM

First, investors should realize that taking a $205 billion market cap to $1 trillion in six years will require an average stock price increase of 30% annually for the next six years.

In the previous decade, reaching such a goal did not appear likely. However, thanks to its metamorphosis, IBM has become a fundamentally different company over the last five years. The transformation began in earnest when Arvind Krishna, then the head of IBM's cloud and cognitive software division, spearheaded the $34 billion acquisition of Red Hat.

This purchase meant a massive increase in IBM's total debt. So large was that debt that a failure would have likely led to doubts about IBM's future.

Still, IBM seemed to believe enough in Krishna's vision that the company elevated him to the CEO role the following year, and it appears the gamble has paid off. Krishna went on to acquire numerous smaller cloud companies and spun off the managed infrastructure business into Kyndryl.

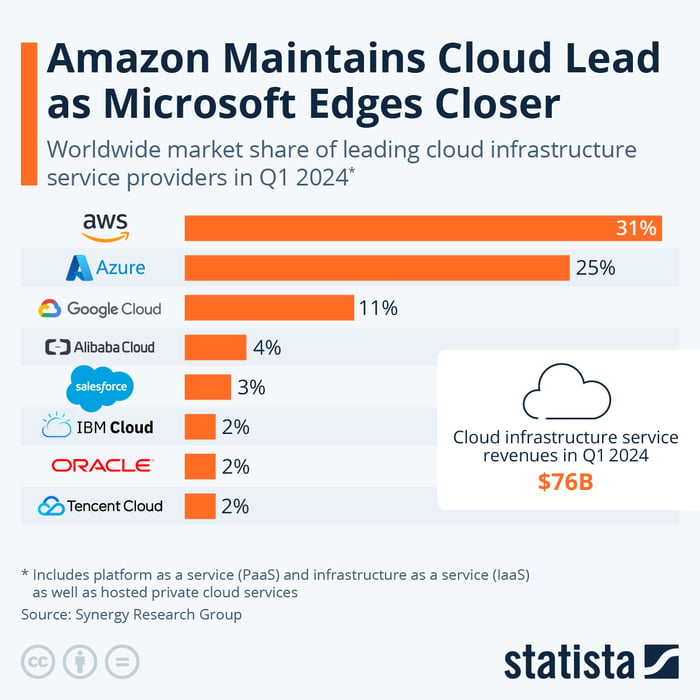

This has given IBM a 2% market share in the cloud infrastructure market, according to Synergy Research Group. While this may not sound significant, Grand View Research estimates the global cloud market will grow to $2.4 trillion by 2030. Hence, if it just maintains that percentage, that could mean a massive increase in revenue over that time.

Image source: Statista.

Additionally, IBM's more prominent role in the cloud has made the company a player in the emerging generative AI market with watsonx. In the year since the company launched watsonx, IBM's book of business in generative AI has grown to more than $2 billion. Grand View Research estimates that the market will reach $109 billion by 2030, a compound annual growth rate (CAGR) of 37%. This could bode well for IBM's generative AI platform if it can come close to matching this growth.

This is not to say that IBM has become only a cloud and AI company. Just over half of its revenue comes from its consulting and infrastructure segments. However, the largest segment remains software, which plays a critical role in the modern tech industry.

IBM's financials

Unfortunately, the company's overall growth rate may leave investors questioning whether it can reach a $1 trillion market cap in the next six years.

In the first half of 2024, revenue was just over $30 billion, and it rose just 2% from year-ago levels. Software, which made up 42% of overall revenue, increased by merely 6%. Consulting and infrastructure, which are nearly all of the remaining revenue, did not experience significant increases.

Still, its net income for the first two quarters of 2024 was $3.4 billion, a 37% yearly increase. An income tax benefit of $112 million (compared with a $543 million tax payment in the first half of 2023) gave IBM a critical break on income taxes, allowing the company's profit to rise significantly.

Unfortunately, that benefit is unlikely to repeat in future years. While IBM raised revenue growth guidance to mid-single-digits for the year, it may not be enough to inspire a rapid increase in the stock price.

Moreover, the stock price has risen by almost 60% over the last year, taking its stock price to its aforementioned record high. That brings its P/E ratio to the 25 range. While that might appear reasonable, IBM has not typically seen higher valuations except in times of falling profits. This may not bode well for its prospects for rapid growth.

Will IBM be a $1 trillion stock by 2030?

Given the current trajectory of IBM's financials, a $1 trillion market cap over the next six years appears unlikely.

Despite that modest prediction, IBM is back in action -- at least from a technical perspective. Thanks to its cloud presence and watsonx, it is again a major force in the tech industry, and that bodes well for the stock.

Nonetheless, even with revenue increases rising to the mid-single-digits, it may experience slower growth than some of its industry peers.

Additionally, the income tax benefit that ignited the 37% net income growth is a one-time event. With profitability likely to backslide once income tax payments resume, IBM is probably going to struggle to generate the profit growth needed to reach $1 trillion in the next six years. Big Blue's investors should set their sights a little lower.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Oracle, Salesforce, and Tencent. The Motley Fool recommends International Business Machines and Kyndryl and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.