Prediction: This Artificial Intelligence (AI) Software Company Could Be the Next Palantir

For quite some time, the view surrounding Palantir Technologies (NYSE: PLTR) was stuck somewhere between a generational software developer or an "AI imposter," depending on whom you ask. One of the biggest reasons for this polarizing viewpoint is that many investors simply do not understand what Palantir actually does.

Juxtaposing industry buzzwords such as "AI" and "data-driven insights" will only get you so far. At some point, a business needs to prove that it's marketing tactics are bearing fruit. And, in fact, over the past year Palantir has witnessed a new wave of growth thanks to its lineup of data analytics software platforms.

The company has not only accelerated its top line, but it's also been consistently expanding profit margins and has transitioned from a cash-burning operation to a profitable enterprise. Recently, Palantir became a member of the S&P 500 and is working closely with some of the tech sector's largest incumbents, including Microsoft and Oracle.

Today, another company in this sector also merits a closer look: ServiceNow (NYSE: NOW). Ever heard of it? I'm going to detail how ServiceNow is quietly disrupting the world of enterprise software -- similar to what Palantir has done. Moreover, I'll explore how AI is playing a major role in the company's current growth trajectory and assess if now is a lucrative opportunity to scoop up shares.

What does ServiceNow do?

About a year ago, ServiceNow CEO Bill McDermott sat down for an interview with David Rubenstein -- a private equity investor and former policy advisor during President Jimmy Carter's administration.

When asked about what ServiceNow actually does, McDermott simply referred to the company as the "IT backbone" for businesses looking to build out digital infrastructure. While I appreciate the metaphor here, I'll admit that this explanation is still a little vague.

Let's look at an example to better understand the ServiceNow platform. From finance, sales and marketing, operations, human resources, and IT management, corporations have a separate department for just about everything. As a result, organizational workflows can be slow-moving, and employees can be left waiting for an optimal solution for hours or even days.

That's where ServiceNow comes in. The company offers a comprehensive suite of SaaS-based tools and services aimed to help streamline generic inefficiencies within organizations. This helps employees and team members better track the status of important issues or projects, ultimately driving higher productivity.

Image source: Getty Images.

How is AI a tailwind for ServiceNow?

Like many software companies, ServiceNow is looking to ride the AI wave. And on the surface, the company seems to be doing a good job. Since AI became the talk of the town, ServiceNow has signed some high-profile partnerships with Microsoft, IBM, and Nvidia, just to name a few. But as I alluded to, marketing strategic alliances and doing highly publicized interviews is only one part of the equation.

How is ServiceNow's business actually performing? Pretty solidly, if you ask me.

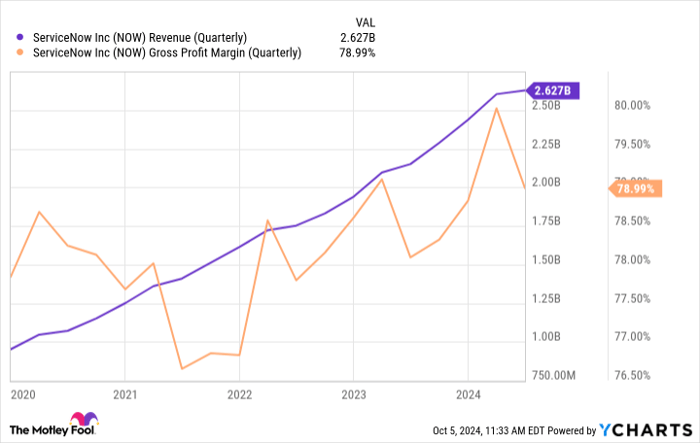

NOW Revenue (Quarterly) data by YCharts

As depicted in the chart, ServiceNow's revenue and gross profit margin have been rising significantly over the last several years. Diving a bit deeper here, look at the growth trends starting in 2023 -- roughly the period during which AI started to land on more radars.

Just over the last 20 months or so, ServiceNow's revenue line starts to witness a noticeably steeper slope, while profit margins simultaneously expand. What's even better is the combination of accelerating sales and wider margins is leading to consistent profitability -- both from a net income and free cash flow perspective.

Is ServiceNow stock a buy right now?

Although ServiceNow is consistently profitable, the magnitude of its net income and cash flow fluctuates quite a bit. Remember, ServiceNow is a growth company, so it is constantly reinvesting excess profits back into the business.

For this reason, using profit-based valuation metrics such as price-to-earnings (P/E) or price-to-free cash flow (P/FCF) aren't entirely useful. Instead, I am going to look at the ratio between enterprise value and revenue.

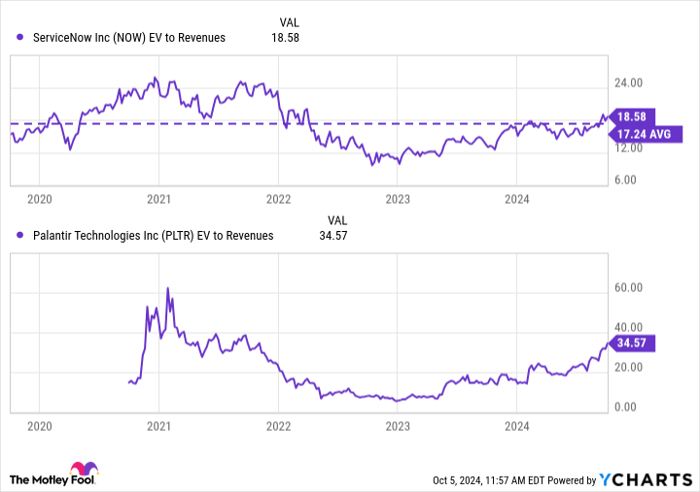

NOW EV to Revenues data by YCharts

Right now, ServiceNow trades at an EV-to-sales multiple of 18.6 -- essentially in line with its five-year average. But if you take a closer look at the overarching trends, there is a lot that can be gathered from these charts.

Following a brief pop in 2020, both ServiceNow's and Palantir's valuation multiples compressed pretty significantly between 2021 and 2023. Much of this was due to macro factors such as inflation and rising interest rates, and their toll on the enterprise software market as a whole.

However, as the AI dawn come into view around 2023, ServiceNow and Palantir started witnessing some valuation expansion. What's peculiar is that even with this valuation expansion, ServiceNow's EV-to-revenue is basically back to where it was several years ago.

When you consider the fact that ServiceNow is a much larger, profitable enterprise today compared to 2020, I think that there is an argument to be made that the stock is undervalued -- despite the gradual uptick in valuation over the last two years.

To me, the market is beginning to catch on to ServiceNow, more or less as it did with Palantir. However, I still think ServiceNow is not yet fully appreciated regarding how it is playing an integral role at the crossroads of AI and enterprise software.

For these reasons, I think now is a great time to buy ServiceNow stock, and I see the company following a very similar narrative and trajectory to that of Palantir as the AI narrative continues to take shape.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,579!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,710!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,239!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Adam Spatacco has positions in Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has positions in and recommends Microsoft, Nvidia, Oracle, Palantir Technologies, and ServiceNow. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.