I Own 9 Vanguard ETFs. Here's Why I Own Each One.

The art of exchange-traded fund (ETF) investing often revolves around simplicity and cost-effectiveness. Many investors find success with a straightforward two-fund portfolio, combining broad market exposure through funds like Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF (NYSEMKT: VOO) with a bond fund like Vanguard Total Bond Market ETF (NASDAQ: BND). This approach aligns with Warren Buffett's recommendation for most lay investors to stick to an S&P 500 index fund and a bond fund in their core portfolio.

However, there are numerous ways to utilize Vanguard ETFs in various stock and bond portfolios. My personal investment strategy involves three distinct portfolios: a growth stock portfolio, a dividend growth stock portfolio for retirement income, and a blended portfolio encompassing growth, dividend growth, high-yield equities, real estate investment trusts (REITs), and various bond funds. Each portfolio is meticulously crafted to meet specific long-term financial objectives.

Image Source: Getty Images.

In the following sections, I'll explain how I leverage Vanguard ETFs to introduce a mix of stability, income, and growth to these three distinct portfolios.

Core market exposure

The Vanguard S&P 500 ETF (NYSEMKT: VOO) forms the cornerstone of my investment strategy within the blended portfolio. This fund offers comprehensive exposure to 500 of the largest U.S. companies, providing instant diversification across multiple sectors. Notably, it has consistently outperformed numerous actively managed funds over extended periods.

A significant advantage of this ETF is its remarkably low expense ratio of 0.03%, enhancing its cost-effectiveness. Since its inception in 2010, the fund has generated a noteworthy average annual return of approximately 14.7%, an exceptional performance for a large-cap-oriented, index-based ETF.

This combination of broad market representation, consistent outperformance, low costs, and strong historical returns makes the Vanguard S&P 500 ETF an ideal foundation for long-term investors seeking stable growth and diversification.

Growth potential

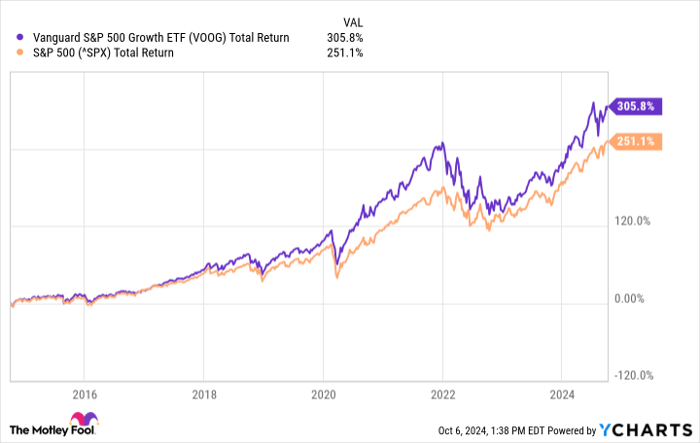

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) serves as a valuable complement to my core holdings in the growth-oriented portfolio. This fund specifically targets growth-oriented companies within the S&P 500, selecting stocks based on key factors such as sales growth, earnings growth, and momentum. By doing so, it offers investors the opportunity to potentially capture higher returns during bull markets.

Notably, the fund has demonstrated strong performance, outperforming the benchmark S&P 500 over the past 10-year period. With an average annual return of approximately 15% over the prior 10-year period, it has consistently delivered robust growth. Despite its focus on high-growth potential, the ETF maintains a remarkably low expense ratio of 0.10%, making it an attractive option for cost-conscious investors seeking enhanced growth exposure.

VOOG Total Return Level data by YCharts

This combination of targeted growth focus, historical outperformance, and low fees positions the Vanguard S&P 500 Growth ETF as an excellent choice for investors looking to amplify their portfolio's growth potential while maintaining a connection to the broader market.

International dividend exposure

The Vanguard International High Dividend Yield ETF (NASDAQ: VYMI) adds global diversification and income in my blended and growth portfolios. This fund concentrates on high-yielding stocks from developed and emerging markets outside the United States. Currently, it offers a dividend yield of approximately 4.3%, which is substantially higher than the S&P 500's average yield of 1.35%.

This ETF provides exposure to over 1,500 stocks across various countries and sectors, offering broad international representation. With an expense ratio of 0.22%, it stands out as a cost-effective option for an international, dividend-focused ETF.

This combination of high yield, extensive diversification, and reasonable fees makes the Vanguard International High Dividend Yield ETF an effective tool for investors seeking to add global income-generating assets to their portfolios while expanding their geographical exposure.

Technology sector focus

The Vanguard Information Technology ETF (NYSEMKT: VGT) allows me to capitalize on the growing importance of technology in our economy. I hold this ETF in my growth portfolio.

This fund provides exposure to companies involved in software, hardware, semiconductors, and IT services. The ETF has delivered strong performance, with an average annual return of about 20.6% over the past 10 years.

The fund's 0.10% expense ratio is also significantly lower than many actively managed technology funds. The Vanguard Information Technology ETF's top holdings include major industry players like Apple, Nvidia, and Microsoft.

This combination of focused technology exposure, historically strong returns, and low fees makes this ETF an attractive option for investors seeking to increase their portfolio's exposure to the ultra-high-growth technology sector.

Real estate investment

The Vanguard Real Estate ETF (NYSEMKT: VNQ) provides exposure to the real estate sector through a diversified portfolio of REITs. I hold this ETF in my retirement income portfolio. The fund offers potential for both capital appreciation and income generation. It currently yields around 3.7%, making it attractive for income-focused investors.

With an expense ratio of 0.13%, this ETF is among the most cost-effective in its category. It has delivered solid long-term performance, with an average annual return of about 7.3% over the past 10 years.

This combination of sector-specific exposure, income generation potential, low fees, and consistent historical performance makes the Vanguard Real Estate ETF a valuable option for investors seeking to add real estate to their portfolio mix, particularly for retirement income strategies.

Emerging markets growth

The Vanguard FTSE Emerging Markets ETF (NYSEMKT: VWO) adds exposure to high-growth potential economies like China, India, and Brazil. I own this fund in my growth portfolio. It invests in nearly 6,000 stocks across various emerging market countries. While emerging markets can be volatile, they offer the potential for higher long-term returns.

This ETF's expense ratio of 0.08% is exceptionally low for an emerging markets fund. It has delivered an average annual return of about 4.2% over the past 10 years.

This combination of broad emerging market exposure, growth potential, and very low fees makes the Vanguard FTSE Emerging Markets ETF an attractive option for investors seeking to diversify their portfolios with developing economies.

Small-cap potential

The Vanguard Small-Cap ETF (NYSEMKT: VB) provides exposure to smaller U.S. companies with high growth potential. I own this ETF in my growth portfolio.

Small-cap stocks have historically outperformed large-caps over long periods, albeit with higher volatility. They have also often benefited from interest rate cuts, though this trend hasn't been consistent throughout history. The fund offers diversification across over 1,400 small-cap stocks.

This ETF's expense ratio of 0.05% is among the lowest for small-cap funds. It has delivered an average annual return of about 9.6% over the past 10 years.

By offering broad exposure to the small-cap segment at a minimal cost, this ETF serves as an efficient tool for investors seeking to tap into the growth potential of smaller companies.

Its extensive diversification helps mitigate some of the risks associated with individual small-cap stocks, making it a compelling option for those looking to enhance their portfolio's growth prospects.

Core bond exposure

The Vanguard Total Bond Market ETF (NASDAQ: BND) serves as the foundation of my fixed-income allocation in all three portfolios. This fund provides broad exposure to U.S. investment-grade bonds, including government, corporate, and mortgage-backed securities. It offers stability and income, with a current yield of around 3.4%.

With an expense ratio of 0.03%, this ETF is extremely cost-effective for a bond fund. While bond returns have been poor in recent years due to low interest rates and other factors, the fund plays a crucial role in portfolio diversification and risk management for long-term investors.

By offering comprehensive coverage of the U.S. bond market at a minimal cost, this bond ETF provides an efficient way for investors to incorporate fixed-income exposure into their portfolios, helping to balance risk and potentially dampen overall portfolio volatility.

International bond diversification

The Vanguard Total International Bond ETF (NASDAQ: BNDX) complements my core bond holdings by providing exposure to investment-grade bonds from developed and emerging markets outside the U.S. across all three portfolios. This fund uses currency hedging to minimize the impact of exchange rate fluctuations on returns. It currently yields around 4.7%.

The fund's expense ratio of 0.07% is competitive for an international bond ETF. Adding international bonds to a portfolio can enhance diversification and potentially improve risk-adjusted returns.

This international bond ETF offers investors a straightforward way to access global bond markets, expanding the geographical diversification of their fixed-income holdings. Its currency hedging feature can help reduce volatility associated with foreign exchange movements, making it an attractive option for those seeking to broaden their bond exposure beyond domestic markets.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $782,682!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

George Budwell has positions in Apple, Microsoft, Nvidia, Vanguard Admiral Funds-Vanguard S&P 500 Growth ETF, Vanguard Charlotte Funds-Vanguard Total International Bond ETF, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard International Equity Index Funds-Vanguard Ftse Emerging Markets ETF, Vanguard International High Dividend Yield ETF, Vanguard Real Estate ETF, Vanguard S&P 500 ETF, Vanguard Total Bond Market ETF, and Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard International Equity Index Funds-Vanguard Ftse Emerging Markets ETF, Vanguard Real Estate ETF, Vanguard S&P 500 ETF, Vanguard Total Bond Market ETF, and Vanguard Total Stock Market ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.