Could Oracle Be Worth $1 Trillion by 2030?

As companies found new opportunities in artificial intelligence (AI), their valuations soared in recent years. There are seven companies right now with valuations of around $1 trillion or higher.

But with the economy continuing to grow and with AI potentially propelling stocks to greater heights, there could be many more stocks that join that list in the future.

One potentially underrated AI stock these days is Oracle (NYSE: ORCL). It has been picking up steam due to opportunities in AI, but it's still nowhere near the $1 trillion mark. Today, its valuation is $470 billion. Could it hit the $1 trillion milestone by the end of the decade?

Why Oracle could see stronger growth ahead

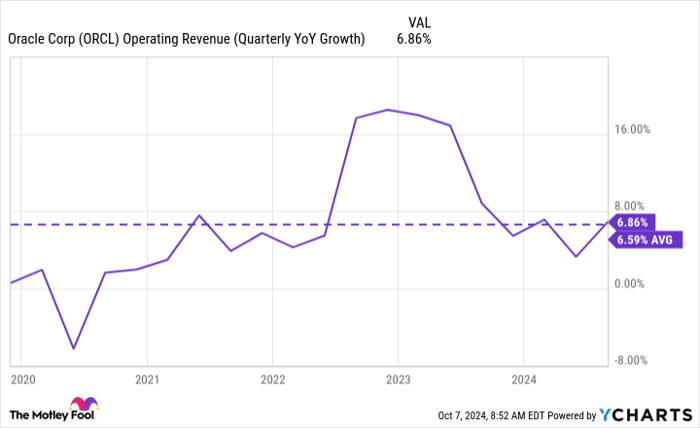

The big knock on Oracle is that it's a good and safe tech company known for its databases, but its quarterly growth rate has often been in the single digits -- even recently, as companies are spending more on AI.

ORCL operating revenue (quarterly YoY growth), data by YCharts; YoY = year over year.

Oracle needs to accelerate if it's going to attract the attention of growth investors, and if its valuation is to ultimately more than double to $1 trillion.

Companies investing in AI chips and new technologies will ultimately end up needing more infrastructure and database systems to house, support, and analyze all that data, which is where Oracle can play a key part.

It is also helping companies improve productivity with more than 50 role-based AI agents that are available in its Oracle Fusion Cloud Applications Suite. These agents can help automate processes for businesses across many areas of their operations.

The company is also bullish on an agreement it recently reached with Amazon, through which its latest technology and database software will be available on the cloud through Amazon Web Services, yet another growth opportunity.

Oracle is already seeing its efforts pay off in its pipeline as its remaining performance obligations for the first quarter of fiscal 2025 (which ended on Aug. 31) were $99 billion, up 53% year over year. That backlog will help boost the company's growth in upcoming quarters.

The path to a $1 trillion market cap

Shares of Oracle are up 61% this year, but for the company to be worth $1 trillion, the stock will need to rise by about 111%. Over a five-year period, it would have to average an annual increase of a little more than 16%, meaning it needs to vastly outperform the market's historical rate of around 10%.

Given the opportunities for Oracle and its important role in training AI models, it doesn't seem all that unlikely for the stock to outperform the market in the years ahead. It's just a question of how high its annual returns will actually end up -- a 16% average might be a bit optimistic to expect.

But the demand will no doubt be there for its services. According to estimates from tech research company Gartner, by 2026, 80% of enterprises will have either deployed generative AI applications or will have at least used generative AI application programming interfaces -- that would be up drastically from less than 5% last year.

Assuming AI remains a hot investment trend for the foreseeable future, it seems probable that Oracle should benefit and outperform the markets, likely leading to a valuation that eclipses $1 trillion. It's just a question of whether that happens before or after 2030.

Still a modestly priced buy

Oracle's stock has been a hot buy this year, but it's still modestly priced at a forward price-to-earnings multiple of 27. By comparison, the average stock in the Technology Select Sector SPDR Fund trades at 30 times its estimated future profits.

Overall, this is one of the better AI stocks you can add to your portfolio today -- there's little doubt in my mind that Oracle will ultimately join the $1 trillion club given its fantastic opportunities.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $782,682!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Oracle. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.