Is Nike Stock a Buy, Sell, or Hold in 2025?

Like sports-team fans in the middle of a disastrous season, Nike (NYSE: NKE) stock investors likely can't wait for its losing streak to end. Shares are down 24% this year, with an even steeper 52% decline from its all-time high stock price of $171.71 in November 2021.

Nike has struggled to navigate shifting consumer spending trends. This was apparent in the company's latest earnings report, which was highlighted by weak sales. On the other hand, it's hard to bet against this iconic global brand that still benefits from its category leadership position.

What should investors do with Nike stock as they head into 2025?

The case to buy or hold Nike stock now

The challenges facing Nike today have been several years in the making. Looking back to the pandemic era of record growth, when the company was benefiting from consumers flush with cash, retailers were too optimistic. Their wholesale orders created an inventory glut that's still working its way through the system today. Slowing demand, coupled with weak pricing, have hit earnings sharply.

The company's fiscal 2025 first-quarter results (for the period ended August 31) tell the story. Revenue was down by 10% year over year, while earnings per share (EPS) fell by 26% from the prior-year quarter. The company expects the weakness to continue into the second quarter.

As discouraging as the headline numbers may seem, there are also reasons to believe the worst of the situation is now in the rearview mirror. Notably, Nike has replaced its chief executive officer, bringing back longtime company veteran Elliott Hill, who retired in 2020 as president of global commercial and marketing operations. The move offers the company a chance to reset its strategy, led by an experienced insider with a track record of success.

Image source: Getty Images.

By this thinking, the biggest reason to buy Nike stock now is the potential for its new leadership team to make the necessary adjustments for the company to get back to its winning ways.

The good news is that Nike remains profitable with a rock-solid balance sheet supporting overall fundamentals. Despite the financial headwinds, the company has room to keep its 22-year history of consecutively increasing the annual dividend payout intact.

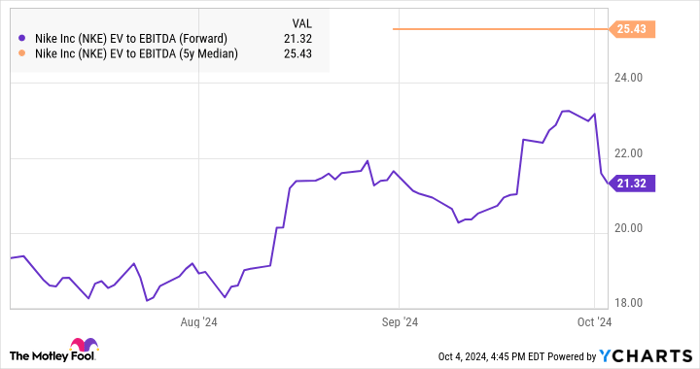

Nike shares yield 1.8% and are trading at 21 times the company's full-year consensus earnings before interest, taxes, depreciation, and amortization (EBITDA) estimate as an enterprise-value-to-forward-EBITDA ratio. Notably, this level is below the five-year average for the multiple closer to 25, suggesting the stock is relatively inexpensive.

Signs of rebounding growth with an improving earnings outlook into 2025 could mark the start of the comeback investors have been looking to see. Nike has room to capture a valuation expansion as a catalyst for the stock to rally.

NKE EV to EBITDA (Forward) data by YCharts.

The case to sell Nike stock now

Nike has its work cut out to rebuild investor confidence, which will take time to play out. The main risk to consider is the possibility that results continue to disappoint, requiring a deeper restructuring.

One area of concern is the quickly evolving competitive landscape. Beyond traditional rivals like Adidas, companies like Lululemon Athletica in athletic leisure apparel and On Holding, with its brand of high-performance running shoes, are all targeting many of the same growth opportunities. Nike's ability to consolidate market share could prove to be more difficult going forward.

Ultimately, investors who believe Nike faces a secular decline and will be unable to reclaim its peak sales and earnings have plenty of reason to sell the stock now, ahead of what could be even more downside.

Decision time for Nike stock

My prediction is that the number of uncertainties surrounding Nike will keep the shares volatile. The next several quarters will be critical to confirm whether a turnaround is underway.

Still, I believe a buy rating on Nike stock makes sense because there's a good chance shares will be trading higher by this time next year. A backdrop of favorable macroeconomic indicators, including a resilient labor market in the U.S. and an improving outlook in China as a key growth market, could be the key for the company to outperform a low bar of expectations.

For investors with long-term horizons, Nike can work within a diversified portfolio.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,363!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,938!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.