Is Rivian Stock a Millionaire Maker?

I've written often about Rivian Automotive (NASDAQ: RIVN) in recent months. For investors who are hoping to pick the electric vehicle (EV) maker that could be the next Tesla, Rivian looks like the best bet. Based on the numbers, it's not hard to come up with scenarios where its shares soar by several times in value over the next few years.

But if you want to profit from Rivian stock, you would be smart to follow this time-tested investing strategy: patience.

3 Reasons I love this EV stock

The main thing I love about Rivian is how it's executing Tesla's proven playbook for growth. The first step is to produce a high-quality vehicle with no compromises, even if that prices out the mass market. Rivian achieved that with its R1T and R1S models. Yes, these vehicles start in the $70,000s, and in the luxury trims, they can climb above $100,000.

But Rivian's goal with them was to prove to consumers that it could make great vehicles that they could rely on. A recent Consumer Reports survey found that Rivian owners had the highest levels of customer satisfaction and loyalty among both EV-only brands and conventional automakers. That should tell you everything you need to know about Rivian's ability to sway people's opinions in a positive way.

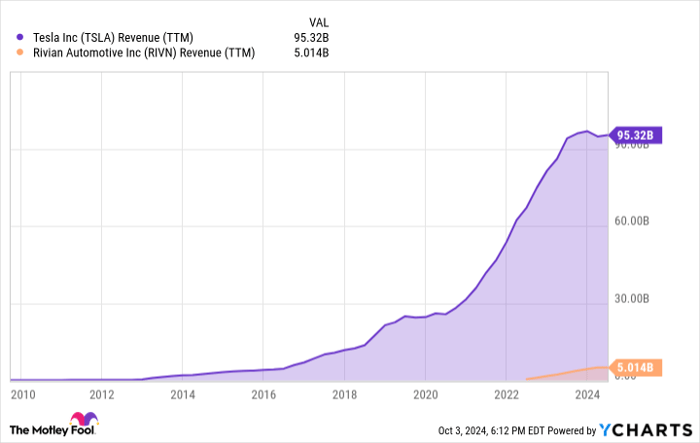

Step two in the old Tesla playbook is to release a vehicle that is priced to be accessible to the masses. This brings us to the second reason I love Rivian right now: Its biggest days of growth are just ahead. Earlier this year, the company announced plans to produce three new models. All three -- the R2, R3, and R3X -- are expected to be available for under $50,000. When Tesla launched its first mass-market models -- the Model 3 and Model Y -- it more than doubled its revenue base, then tripled it again. The same potential is available to Rivian with its new models.

The final reason I love Rivian right now is that it's about to achieve another major milestone: gross profitability. Last quarter, the company lost around $32,000 for every vehicle it sold. Over the next few months, however, the company could reduce that loss to zero, and potentially even post a profit. On its latest conference call, executives predicted "a modest gross profit" by the fourth quarter, adding that it expects to produce roughly 57,000 vehicles this year -- right around what it produced last year.

There have certainly been sales growth headwinds, but Rivian isn't alone in facing them. Tesla's sales numbers shrank in early 2024. But if you believe in the long-term potential of the EV market, Rivian -- which is doing everything necessary to become the next Tesla -- looks like a good bet.

TSLA Revenue (TTM) data by YCharts.

This is how you make money with Rivian

There's clearly huge potential for Rivian's stock price to rise over the next several years. But it won't always be easy to remain invested. As mentioned, Rivian is still losing money on every car it sells. Its current lineup is limited to just two high-priced luxury models. And its capital needs will be gigantic as it attempts to build out manufacturing facilities for its new mass-market models and ramp up their production -- models, it should be stressed, that only exist as prototypes today.

It's no wonder the stock has slumped over 90% from its initial public offering levels in 2021 -- and the risks remain very real. Yet, the current price may provide a good entry point for new investors today.

Today, Tesla shares are worth around $240 apiece. You might wish you had invested in it back in 2017, when shares were priced at just $20, right? Well, according to CEO Elon Musk, the company back then was about a month away from bankruptcy. It's hard to imagine now, but the market was very skeptical of the company's ability to sustainably and profitably scale up production of its Model 3 -- a model that looked to have great potential, but only on paper.

In 2017, Tesla's valuation was around 5 times sales. Rivian's current price-to-sales ratio is about 1.9. Could Rivian follow in Tesla's footsteps? I think the depressed valuation -- Rivian's market cap right now is just $11 billion -- is attractive enough to warrant the attention of investors.

Assuming a sales ramp similar to Tesla's, it's possible that Rivian is generating annual revenue of around $30 billion by 2030. Even at its depressed valuation multiple, that would imply a total valuation of nearly $60 billion -- more than 5 times its current value. So to be a millionaire market stock, you'll need to invest a hefty sum right off the bat.

But if Rivian can execute, expect its valuation multiple to rebound closer to Tesla's 5 times sales valuation. At that multiple, a $40,000 investment today could become $1 million or more over the next six years.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $782,682!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.