1 Growth ETF I Would Buy Hand Over Fist, and 1 I Would Be Cautious About

Growth stocks have been some of the most popular investments in the stock market in recent times. It's understandable why when you see the returns that many of them have generated.

Like any stock type, growth stocks come with risk. They offer investors a chance at market-beating returns, but many are also more volatile because their valuations are based on future potential. That's why exchange-traded funds (ETFs) focused on growth stocks can be a great option.

Growth ETFs give you exposure to growth stocks but typically have less risk because investments are spread across many companies. For those interested in growth ETFs, I've included one I strongly recommend and one I'd approach with caution.

The growth ETF I'm buying hand over fist

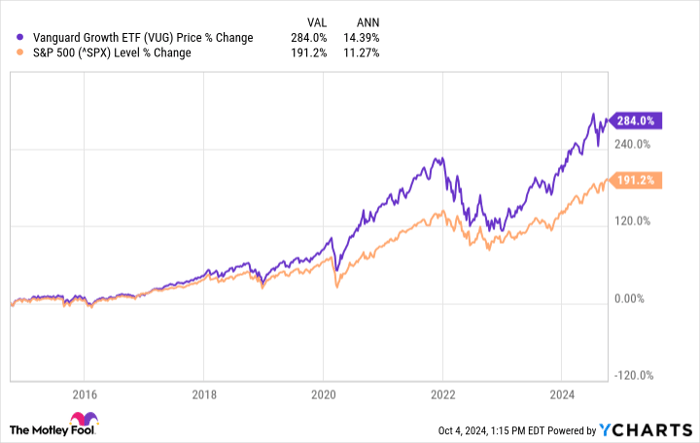

One of my favorite growth ETFs is the Vanguard Growth ETF (NYSEMKT: VUG) because it offers the best of both worlds. On one end, it has proven it can consistently outperform the broader market (based on the S&P 500). On the other end, it holds large-cap companies, so it's not as prone to volatility as younger growth stocks that may be more speculative.

VUG data by YCharts

A common misconception is that smaller companies are more likely to deliver higher returns, but this ETF and many of its holdings have proven that's not always the case. Companies like Apple and Microsoft are up over 300% and 200% in the past five years, respectively, and Nvidia has gone on a legendary run, up over 2,600% in that span.

The growth ETF I'm skeptical of investing in right now

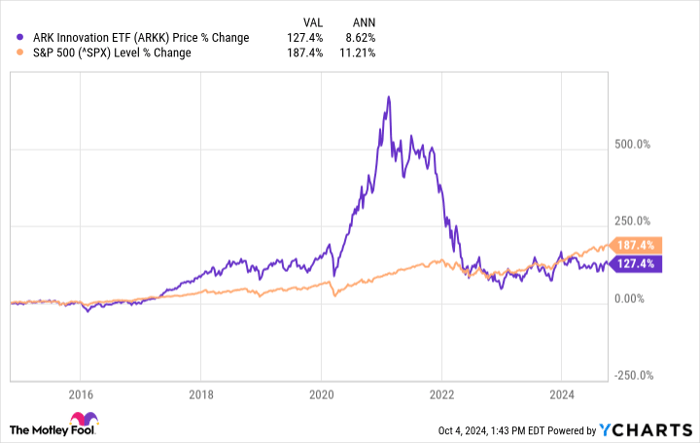

The Ark Innovation ETF (NYSEMKT: ARKK) is the flagship ETF from Cathie Wood's Ark Invest investment firm. Its popularity skyrocketed during the COVID-19 pandemic, riding the wave of the explosion of many high-profile growth stocks.

From March 2020 to February 2021, the ETF's price increased by over 300%. Unfortunately, it's now down over 70% since its February 2021 peak and trading around April 2020 prices. What a roller-coaster ride it has been.

ARKK data by YCharts

This ETF keys in on companies focusing on "disruptive innovation," which is par for the course for Wood, who's known for her big bets on finding The Next Big Thing. I appreciate the ETF's mission and what it's out to accomplish, but I'd be cautious as an investor looking for a growth ETF to add to their portfolio.

My cautiousness about the Ark Innovation ETF, compared to the Vanguard Growth ETF, is based on the companies leading the way for the ETF. Here are the top 10 holdings for each ETF:

| Vanguard Growth ETF's Top 10 Holdings | Ark Innovation ETF's Top 10 Holdings |

|---|---|

| Apple | Tesla |

| Microsoft | Roku |

| Nvidia | Coinbase |

| Amazon | Roblox |

| Meta Platforms | Palantir |

| Alphabet (Class A) | Block |

| Eli Lilly | Robinhood Markets |

| Alphabet (Class C) | CRISPR Therapeutics |

| Tesla | Shopify |

| Visa | UiPath |

Data sources: Vanguard and Ark Invest. Vanguard holdings as of Aug. 31. Ark Invest holdings as of Oct. 4.

By no means does my preference for the Vanguard Growth ETF mean I don't believe in the Ark Innovation ETF's holdings and what they can ultimately become; I just believe in and trust the Vanguard Growth ETF's top holdings much more.

For the most part, the Vanguard Growth ETF's top 10 holdings -- which make up almost 59% of the ETF -- are all market leaders with tried and true business models, solid financials, and a record of long-term growth. The Ark Innovation ETF's top holdings have a lot of potential, but a lot has to go right for them to reach the level of the Vanguard ETF's top companies.

Don't overlook the costs of each ETF

Companies aside, I'm not a fan of the Ark Innovation ETF's high expense ratio. At 0.75%, it's one of the more expensive ETFs you'll find on the market. It's noticeably more expensive than the Vanguard Growth ETF's 0.04% expense ratio.

Although the difference is "only" 0.71%, that could easily add up to thousands spent in fees over time. For perspective, if you invest $500 monthly and average 10% annual returns for 20 years, you'd pay just over $1,500 in fees with the Vanguard Growth ETF. With the Ark Innovation ETF, you would've paid close to $28,000 in fees.

It's one thing to have great growth in an ETF, but an underrated part of that is making sure you can keep as much of your gains to yourself as possible instead of paying them out in fees.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,363!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,938!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Block, CRISPR Therapeutics, Coinbase Global, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, Roblox, Roku, Shopify, Tesla, UiPath, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.