OpenAI Exodus: 1 Stock Set to Benefit

The OpenAI saga reads more like a novel than typical business history. The company has hired and fired its founder, shuffled through numerous executives, and is now making a dramatic shift to a for-profit company. Over a dozen key employees have left the company this year, including its chief technology officer (CTO) as of late September.

Even though the company has raised billions in capital to fund its artificial intelligence (AI) spending, the ground clearly looks shaky at the start-up. If the exodus ends up hurting OpenAI, there's one competitor that stands to benefit: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Does that make Alphabet stock a buy in Oct. 2024?

Stemming market-share losses

OpenAI is the owner of ChatGPT, the conversational and lifelike chatbot that set off the AI craze about two years ago. ChatGPT has started to replace search engines in some contexts, and OpenAI has partnered with Microsoft to power its Bing search engine, which has made a dent in Google's search-engine dominance.

On desktop computers -- where Microsoft owns the leading operating system with Windows -- estimates have Google's market share falling below 80%, compared to closer to 90% a few years ago. Most of these share losses have gone to Microsoft Bing following its partnership with OpenAI. On mobile devices, Google has virtually 100% market share due to its ownership of the Android operating system and the large licensing deals it makes with Apple.

Any issues for OpenAI due to the loss of key employees could be an opening for Google to recover some of its market-share losses. Alphabet's AI research labs have been able to come out with competing products to everything OpenAI has released. It recently rehired an important thought leader in the industry, and founder Sergey Brin has returned to the company and is working everyday on new AI tools.

OpenAI is losing important employees, while Alphabet is doing everything it can to retain its best talent. That could give Alphabet an advantage over OpenAI in the coming years.

Winning through vertical integration

The advantages don't stop there. Through multiple years of investment, Alphabet is now the only company that can come close to vertically integrating the AI supply chain. It has top researchers working with some of the most extensive data available, thanks to Google Search, YouTube, and Gmail. On top of this, it has even invested in its own computer chips called Tensor Processing Units (TPUs) for years.

One of the bottlenecks to building AI tools is computing power, and Alphabet is clearly in the lead when it comes to building its own chips. Only now are the likes of Meta Platforms and Microsoft trying to catch up.

Tying everything together is Google Cloud, Alphabet's cloud computing subsidiary that powers its internal services and third-party products. Underlying this cloud infrastructure are the TPUs and AI software Alphabet has cooked up in the last decade, which it now can sell to other companies. Google Cloud's revenue was over $10 billion last quarter.

Part of the reason Google Cloud has been so successful is the vertical integration across Alphabet's business. This advantage will only get larger in the years to come as AI usage grows and grows.

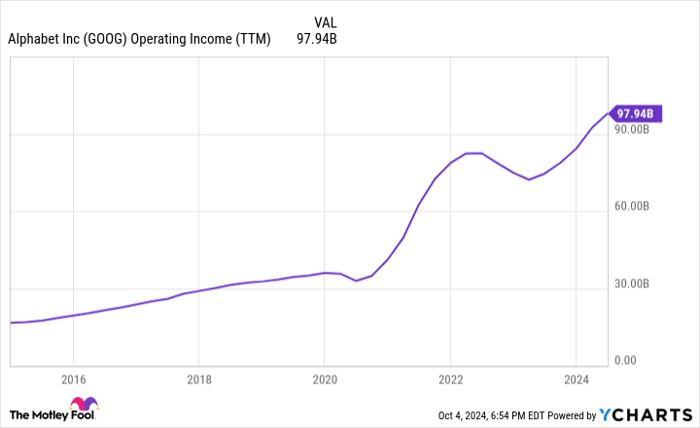

Data by YCharts.

Search and Cloud can drive the stock forward

AI has been the talk of the town for a few years now, but how does it lead to better business outcomes (meaning profits)? OpenAI is reportedly losing $5 billion this year on just $3.7 billion in revenue, which doesn't seem like a sustainable business model.

Meanwhile, Alphabet has clear ways to generate profits from AI. First, it has begun putting advertisements below its AI search results on Google, which will help Google Search revenue keep growing. Last quarter alone, the Google Search segment for Alphabet generated close to $50 billion in revenue and the majority of consolidated operating earnings.

Second is the aforementioned Google Cloud subsidiary. The cloud computing giant is finally generating a profit (over $1 billion last quarter) and has a long runway for reinvestment. Revenue should keep growing at a double-digit rate, and profit margins should keep expanding.

Add both of these ingredients together, and you have a straightforward recipe for Alphabet to generate earnings growth from its new AI tools. Alphabet shareholders should watch Google Search and Google Cloud closely as they're likely fuel the business over the next decade or more.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.