With Its GLP-1 Drugs No Longer in a Shortage, Is Now the Time to Buy Eli Lilly Stock?

The popularity of GLP-1 weight loss drugs has soared, which had created a shortage among many of the drugs, including Eli Lilly's (NYSE: LLY) popular Mounjaro and Zepbound. However, the U.S. Food and Drug Administration (FDA) recently removed both drugs from its shortage list, indicating that supply can now keep up with current demand.

The drugs' removal from the shortage list is a positive for Eli Lilly in a couple of ways and could help the stock continue its strong run. Shares of Eli Lilly are up over 65% on the year. Let's take a closer look at the two drugs and how this news could impact the company.

Expanding production

Mounjaro and Zepbound are the trade names of GLP-1 drugs that both use tirzepatide as their active ingredient. The FDA first approved Mounjaro to help improve blood glucose levels in adults with type 2 diabetes. It later approved Zebound for weight loss in obese adults or overweight adults with at least one weight-related condition such as type 2 diabetes, high blood pressure, or high cholesterol.

While the drugs have clear indications from the FDA, their popularities have soared more from off-label use for general weight loss, not just among obese patients.

Mounjaro was Eli Lilly's best-selling drug in the second quarter with sales of $3.09 billion, a more than threefold increase compared to a year ago. Zebound, meanwhile, was the company's fourth-best-selling drug at $1.22 billion in sales in Q2. Another GLP-1 drug, Trulicity, which is also used to treat type 2 diabetes, was its third-best-selling drug, but saw its sales fall 31% to $1.25 billion as patients shifted to its newer GLP-1 drugs.

Image source: Getty Images.

The popularity of Mounjaro and Zepbound had left the company dealing with supply shortages for its active ingredient tirzepatide. The same also occurred to rival Novo Nordisk, which has seen supply shortages for semaglutide, the active ingredient in its GLP-1 drugs Ozempic and Wegovy.

These shortages have allowed a number of other companies to step in and sell generic compounding versions of these popular weight-loss drugs, as the FDA allows compounding drugs when a drug is on its drug shortage list.

Eli Lilly and Novo Nordisk have both complained about these low-cost alternatives and their effectiveness. While the drugs' removal from the shortage list could help lessen this competition, many compounders currently use semaglutide, not tirzepatide, and so they can continue to produce their versions as Ozempic and Wegovy remain on the list.

Meanwhile, companies like Hims & Hers Health (NYSE: HIMS) have long been creating personalized medications under the FDA compounding exemption and will look to continue to do this with GLP-1 drugs as well under the argument that they are not simply copies. This could lead to some legal battles down the road once the semaglutide shortage is over.

But for now, the big benefit to Eli Lilly is that it appears to have the manufacturing capacity in place to continue to meet the high demand for Mounjaro and Zepbound. This has been a big focus for the company, and it said during its latest earnings call that it expected to have 50% more doses of GLP-1 drugs in the second half of 2024 compared to the second half of 2023. It has a number of new facilities under construction that are nearing completion and should help ramp up production next year.

The company also just announced a new $4.5 billion investment to create an advanced manufacturing and drug development center at its Indiana facility. This is on top of a $5.3 billion expansion announced in May to help it manufacture the active pharmaceutical ingredients for its GLP-1 drugs.

Is Eli Lilly a buy?

While artificial intelligence (AI) has been one of the hottest investing trends, GLP-1 weight loss drugs are a close second. Demand for Eli Lilly's Mounjaro and Zepbound remains robust, and sell-side analysts tracking script data shows strong growth for both of these drugs.

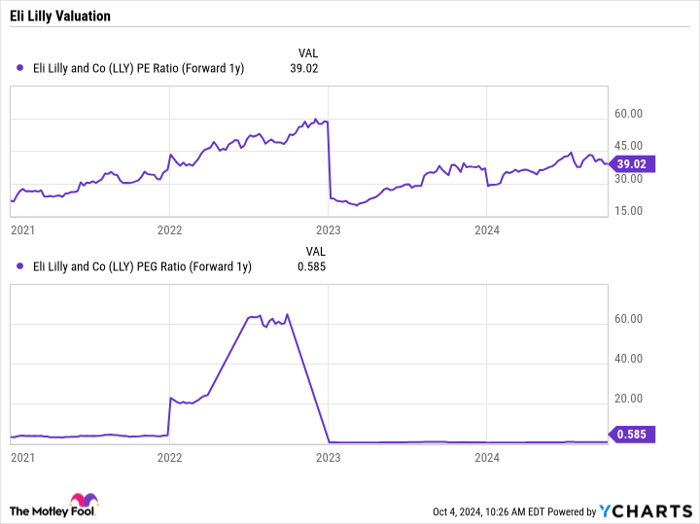

While the stock appears pricey on a forward price-to-earnings (P/E) basis, trading at 39 times next year's analyst estimates, it only has a price/earnings-to-growth ratio (PEG ratio) of 0.6 given its strong growth coming from GLP-1 drugs. PEGs under 1 are typically considered undervalued, so on that basis the stock is cheap.

LLY PE Ratio (Forward 1y) data by YCharts

With the healthcare company doing a nice job of expanding its manufacturing capabilities to meet the robust demand for Mounjaro and Zepbound, the stock looks like a buy at current levels.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Geoffrey Seiler has positions in Hims & Hers Health. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.