Best Stock to Buy Right Now: Dollar General vs. Dollar Tree

It's been a tough year for investors in discount retailer Dollar General (NYSE: DG) and Dollar Tree (NASDAQ: DLTR), and as a result, both stocks are struggling mightily. The good news is that both stocks are trading at rock-bottom valuations, so if the businesses turn around, investors stand to gain.

Let's take a closer look at Dollar General and Dollar Tree to understand what's gone wrong. Let's also explore what the future holds for these two beaten-down stocks, to determine which has more potential for a turnaround.

Here's why Dollar General and Dollar Tree are struggling

Since investments are forward-looking, any time a business displays weak demand, its stock will sell off naturally. Dollar General's management recently revised its fiscal 2024 sales outlook from 6% to 6.7% to approximately 4.7% to 5.3% growth, compared to its fiscal 2023 net sales of $38.7 billion. On its most recent quarterly earnings call, management pointed to a decline in the average transaction, as its core customer "will continue to feel financial pressure for the duration of the year, and the promotional environment will remain elevated beyond what we had initially anticipated."

Additionally, Dollar General management halted its share repurchase program despite having $1.4 billion remaining, signaling to shareholders that its stock may be overvalued. As a result, Dollar General's stock is down 32% since reporting its fiscal second-quarter 2024 results, and down 38% for the year.

Dollar General's competitor, Dollar Tree, faces similar issues, resulting in weaker-than-expected demand. Dollar Tree's management revised its fiscal year 2024 sales outlook to $30.6 billion to $30.9 billion, a decline from its original projection of $31 billion to $32 billion. For comparison, Dollar Tree generated $30.6 billion in net sales for its fiscal 2023. On the company's most recent earnings call, Dollar Tree COO Mike Creeden also cited consumer pressures for the revised outlook, noting: "Inflation, interest rates, and other macro pressures have a more pronounced impact on the buying behavior of these customers."

Dollar Tree's Family Dollar stores are particularly struggling, with management pointing to weaker demand from its core lower-income customers. As a result, the company is closing underperforming Family Dollar stores. It also initiated a review of "strategic alternatives," including "a potential sale, spin-off, or other disposition of the business."

Due to stagnant sales growth and uncertainty around Family Dollar, Dollar Tree's stock is down 50% year-to-date. In contrast to Dollar General, Dollar Tree continued its share repurchase program in its latest quarter, spending $91 million to repurchase 750,000 shares at an average price of $120 per share. In hindsight, this doesn't look like the best use of capital, considering its stock is hovering around $70 per share.

A deeper look at the financials of Dollar General and Dollar Tree

While both Dollar General and Dollar Tree face similar challenges, a more in-depth look at each company's financials will give us an idea of which company is better suited for a turnaround.

Both discount retailers have a similar market capitalization, with Dollar General at $18.4 billion and Dollar Tree at $15.2 billion, helping the comparison. Dollar Tree has a better balance sheet, with $3.7 billion in net debt, compared to Dollar General's $7 billion in net debt. As a result, Dollar General paid $300 million over the trailing 12 months to service its debt, nearly three times what Dollar Tree paid.

DG Financial Debt (Quarterly) data by YCharts.

For its most recently reported quarter, Dollar General was more efficient at converting revenue into profit, with an operating margin of 5.39%, nearly double Dollar Tree's 2.75%. As a result of Dollar General's higher revenue and operating margin, its net income was naturally higher at $374.2 million, compared to $132.4 million.

Regarding capital allocation, Dollar General continues to expand its footprint. It opened 213 new stores in its fiscal Q2 2024, bringing its total store count to 20,345. Additionally, Dollar General pays a quarterly dividend of $0.59 per share, equating to a dividend yield of 2.8%, but it did suspend its share repurchase program, as previously mentioned.

Dollar Tree opened 104 net namesake locations but closed 116 net Family Dollar locations in its fiscal Q2 2024, reaching a total store count of 16,388 between the two brands. Dollar Tree doesn't pay a dividend, but it has brought its share count down by 1.3% in 2024, giving existing shareholders a larger ownership stake -- even if it wasn't the most price-efficient, given the decline in its stock price.

Here's what could turn Dollar General and Dollar Tree around

Both Dollar General and Dollar Tree management teams claimed that their customers are feeling macroeconomic pressure. The good news is that recent developments offer hope that the customers of these discount retailers may soon receive a reprieve. The Federal Reserve lowered interest rates by 50 basis points, to a key rate of 4.75% to 5.00%. The Consumer Price Index recently showed that consumer prices in August increased 2.5% year over year, the lowest inflation rate since early 2021. If their thesis is correct, sales could get a boost sooner rather than later.

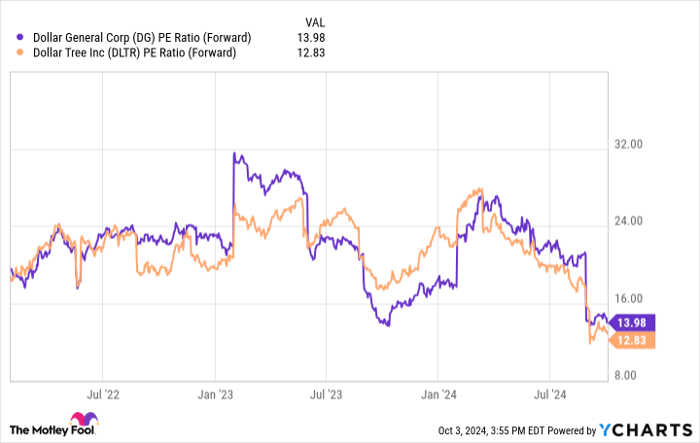

Arguably, valuations are the most favorable metric for Dollar General and Dollar Tree. Both stocks look incredibly cheap using the forward price-to-earnings ratio, which compares a company's stock price against its expected earnings over the next 12 months. Dollar General trades at only 14 times forward earnings, while Dollar Tree is even lower at 12.8 times forward earnings. With valuations at a three-year low, these discount retailers may be offering a bargain not just to their customers, but to investors as well.

DG PE Ratio (Forward) data by YCharts.

Is Dollar General or Dollar Tree the better stock to buy?

These two discount retailer stocks aren't for every investor, as significant growth may be difficult in the near term. That said, it's worth watching a stock any time it presents the opportunity to invest in a profitable business trading nearly 40% to 50% below recent highs. Between the two, Dollar General is the safer investment due to its revenue growth and steady dividend, compared to the uncertainty of Dollar Tree's Family Dollar brand. Keep an eye on Dollar General's debt, but if its customers are more resilient than expected, its stock could be, too.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,006!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,905!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $388,128!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Collin Brantmeyer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.