These 2 Simple Index Funds Could Turn $100 a Month Into $1 Million

Investing is a fascinating world, deep with layers of knowledge and understanding that can sometimes be intimidating. But successful investing doesn't have to be complex; it can be simple, perhaps even mindless. I say this because it's very possible to accumulate a million-dollar fortune, even if you start from nothing.

That doesn't mean finding the next Amazon or Nvidia in its early years. Instead, you need:

- Time

- Consistency

- Patience

Apply these three ingredients to these two simple index funds, and you'll almost certainly build substantial wealth throughout your lifetime.

Here's what you need to know.

How $100 a month becomes $1 million

You may have guessed already, but $100 doesn't grow to $1 million overnight, even if you set aside that much month after month. Like good barbecue, the best things take time, and you're going to take advantage of compounding to grow your fortune.

The math is simple. If you save $100 monthly for 45 years and generate a 10% annual return on your money, you'll end up with approximately $1,057,000. Why $100? Because it should be an attainable monthly savings goal for most people.

You can save more to speed things up, of course, so don't panic if you're older or feel you've fallen behind. It's never too late to tackle your wealth-building goals. The point is that letting compounding do most of the heavy lifting with your money helps keep the amount needed manageable for most people.

Jump aboard the S&P 500

The tricky part is compounding your money at 10% annually for decades. Yet there is a tried-and-true mechanism for doing so: the S&P 500.

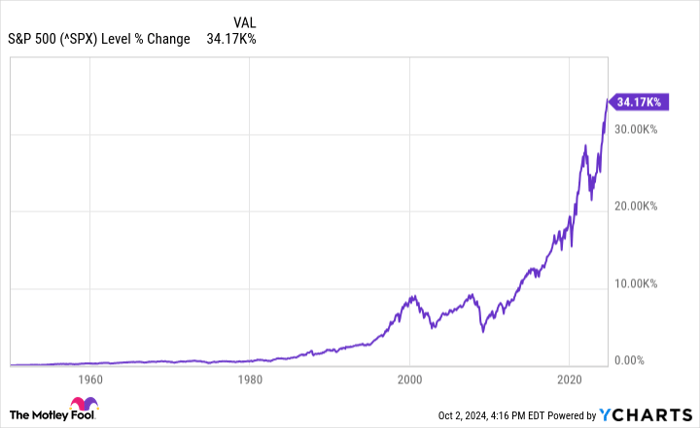

It's a stock market index that includes 500 of the largest U.S. stocks, carefully picked by a committee that uses a set of rules to ensure only quality companies make the cut. The index is market-cap weighted, so the bigger a company, the more it contributes to the index. Companies have churned in and out of the S&P 500 over time, but the index itself has proven to be a remarkably potent wealth-building machine:

Data by YCharts.

The trick with the S&P 500 is that it's not always a smooth ride. You can see above the index has trended upward over time, but there have been major ups and downs. However, the index's annual return averages out to about 10% over the long term. There's no guarantee the S&P 500 will continue in this manner, but its performance through history's recessions, wars, and even a global pandemic is reassuring, to say the least.

Consider these two fantastic index funds

The catch is you can't directly invest in the S&P 500. However, numerous index funds allow you to achieve the same goal. Investors have many choices, but two stand out: the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY).

World-class investor Warren Buffett built his legendary reputation on Wall Street by picking winning stocks for his company, Berkshire Hathaway. Of the dozens of stocks Berkshire Hathaway holds today, just two are index funds -- the two discussed here. There's no clear choice between them; both are popular and have nearly identical historical performances.

Their low expense ratios (fees paid to the fund management company) also make them attractive. The Vanguard S&P 500 ETF charges just 0.03% of your holdings annually, while the SPDR S&P 500 ETF Trust collects 0.0945%. That's just pennies on the $100 you invest every month. High fees will detract from your long-term returns, so it's always something to watch.

Ready, set, go

If you haven't already started, your priority should be doing so as early as possible. Determine whether you'll save your money in a brokerage or retirement account. Then, invest that $100 (or more) monthly, regardless of whether the S&P 500 is going up or down. In the end, it won't matter as much as you think. Focus on meeting or beating that $100 monthly target, and consider automating your contributions so they're out of sight and mind, effectively putting you savings strategy on autopilot.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Berkshire Hathaway, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.