The Smartest Buffett Stocks to Buy With $1,000 Right Now

When looking for new investment ideas, don't forget to take a look at Warren Buffett's portfolio. Buffett's investment strategy has beaten the market for decades at a time. And starting with his favorite stocks can instantly give your portfolio the leg up it needs.

Right now, two Buffett stocks in particular stand out as incredible values.

Take a risk on this proven blue chip stock

Buffett first bought shares of Visa (NYSE: V) back in 2011 for around $40 per share. Today, the company is worth more than $250 per share. But Buffett isn't selling, even after a recent antitrust lawsuit was filed by U.S. regulators last month.

As you likely already know, Visa operates one of the largest payment processing networks in the world. In this industry, scale matters. From the point of purchase to the financial institution backing the payment, payment networks must be vast to connect literally billions of nodes that must all work together seamlessly, instantly, with minimal error.

As of last quarter, Visa had more than 4 billion active credit and debit cards under its banner, which helped process more than $3 trillion in payments volume over the last 12 months. According to data compiled by Statista, Visa controls more of the market than its next three competitors combined.

In a nutshell, Visa operates in an industry that demands scale. And while lawsuits over the decades have attempted to derail the company's dominance, its huge market share is at least partially due to natural industry dynamics, not malintent. After a recent correction due to lawsuit fears, shares now trade at just 25 times forward earnings. That's about as cheap as it gets for a highly profitable company with ubiquitous brand awareness and a strong economic moat -- not to mention Buffett's direct backing.

There's some short-term risk here, but this looks like a great entry point for patient shareholders willing to look beyond near-term volatility.

V PE Ratio data by YCharts

Go for growth with this fintech superstar

Investors looking for maximum growth potential should pay attention to fintech stocks. These businesses combine the fast growth rates of technology companies with the huge addressable markets of financial companies. As a result, fintech stocks can grow far faster and far longer than most anticipate.

One of my favorite fintech stocks today is Nu Holdings (NYSE: NU). Buffett bought shares of Nu back in 2021, and his position is currently valued at around $1.4 billion.

Haven't heard of Nu? That's not a surprise. The company operates only in a handful of Latin American countries. It started in Brazil roughly a decade ago but has since expanded into Mexico and Colombia. It's achieved massive success by using a simple strategy: Offer financial services not through a physical bank branch, but directly to consumers through their smartphones.

When the company was launched in 2013, this was a novel idea, taking the market by storm. Today, more than half of Brazilian adults are Nu customers, demonstrating how well the company can tap new markets and grow with exceptional speed. The best news is that there are more than 600 million residents of Latin America, so Nu's growth runway should persist for years if not decades to come.

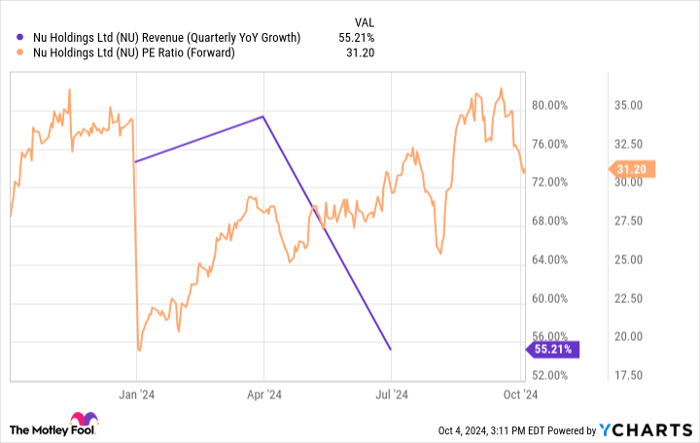

NU Revenue (Quarterly YoY Growth) data by YCharts

With a $60 billion market cap, Nu's biggest days of growth may be behind it. But amazingly, revenue growth rates are still averaging above 50% year over year. And the company is already profitable, with shares trading at just 31 times forward earnings. Buffett was an early investor in this fintech stock with impressive long-term growth potential. But at this valuation, it's not too late for you to jump in yourself.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Visa. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.